EXHIBIT 4.01

Schedule 3 (Audited Financial Statements) to this exhibit has been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby agrees to provide a copy of the omitted schedule to the SEC upon request

Freedom Finance SPC Ltd.

(Incorporated as a special purpose company under the legislation of the Astana International Financial Centre)

U.S.$1,000,000,000 Bond Programme

Freedom Finance SPC Ltd. (the “Company” or the “Issuer” or “FFSPC”) has established U.S.$1,000,000,000 bond programme (the “Programme”) valid until 31 December 2033, pursuant to which the Issuer may from time-to-time issue bonds (the “Securities” or the “Bonds”, and each a “Bond”) in accordance with the Acting Law of the Astana International Financial Centre (the “AIFC”). Each series of Bonds issued under the Programme is hereinafter referred to as “Tranche”. The Programme may be comprised of one or more Tranches. This document constitutes the prospectus of the Programme (the “Prospectus”) described herein and has been prepared by the Issuer pursuant to Section 1.3 of the AIFC Market Rules (AIFC Rules No. FR0003 of 2017). The Prospectus determines terms that are general to each Tranche. Terms of the Bonds not pointed out in this Prospectus will be specified in the relevant offer terms (the “Offer Terms”). Full information on the Issuer and the offer of the Bonds is only available based on this Prospectus and relevant Offer Terms. This Prospectus has been published on the website of the Astana International Exchange Ltd. (the “AIX”) at https://www.aix.kz via the AIX Regulatory Announcement Services and on the website of the Issuer at https://ffin.kz/freedombonds. The Offer Terms of each Tranche will be published on the AIX and the Issuer’s websites accordingly.

Application has been made for the Bonds issued under the Programme to be admitted to the Official List of the AIX and to be admitted to trading on the AIX. In order for Bonds to be admitted to the Official List of the AIX and to be admitted to trading by the AIX this Prospectus and the Offer Terms under each such Tranche will be delivered to the AIX for approval before the date of admission to the Official List of the Bonds of such Tranche.

AIX does not guarantee that the Bonds will be admitted to the Official List of the AIX. The AIX reserves the right to grant admission of the Bonds to the Official List of the AIX only where it is satisfied that such admission is in accordance with the Acting Law of the AIFC, including AIX Business Rules. The Issuer did not seek independent legal advice with respect to listing the Bonds on the AIX in accordance with this Prospectus.

AIX and its related companies and their respective directors, officers and employees do not accept responsibility for the content of this Prospectus including the accuracy or completeness of any information or statements included in it. Liability for the Prospectus lies with the issuer of the Prospectus and other persons such as Experts whose opinions are included in the Prospectus with their consent. Nor has AIX, its directors, officers or employees assessed the suitability of the securities to which the Prospectus relates for any particular investor or type of investor. If you do not understand the contents of this Prospectus or are unsure whether the Securities are suitable for your individual investment objectives and circumstances, you should consult an authorized financial advisor.

No representation or warranty, expressed or implied, is made by the Lead Manager as to the accuracy or completeness of the information set forth in this Prospectus, and nothing contained in this Prospectus is, or shall be relied upon as a promise or representation, whether as to the past or the future. The Lead Manager does not assume any responsibility for the accuracy or completeness of the information contained in this Prospectus.

Under no circumstances shall this Prospectus constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any jurisdiction outside AIFC or under any circumstances in which such offer, solicitation or sale is not authorized or would be unlawful. Recipients of this Prospectus who intend to subscribe for or purchase the Bonds are reminded that any subscription or purchase may only be made on the basis of the information contained in the Prospectus.

These Bonds constitute debt instruments. An investment in the Bonds involves risks. By subscribing to the Bonds, investors lend money to the Issuer who undertakes to pay interest on a regular basis as indicated in the relevant Offer Terms for each Tranche and to reimburse the principal within 15 (fifteen) calendar days

starting from the Maturity Date. In case of bankruptcy or default by the Issuer, investors may not recover the amounts they are entitled to and risk losing all or part of their investment. The Bonds are intended for investors who are capable of evaluating interest rates in light of their knowledge and financial experience. An investment decision must solely be based on the information contained in the present Prospectus. Before making any investment decision, investors must read the Prospectus in its entirety (and, in particular, Clause “Risk factors” in the Prospectus). Each potential class of investor must investigate carefully whether it is appropriate for them to invest in the Bonds, taking into account his or her knowledge and experience and must, if needed, obtain professional advice before making an investment in the Bonds.

SINCE THE BONDS ARE RECOGNISED AS BONDS OF FREEDOM HOLDING CORP. IN ACCORDANCE WITH THE U.S. TAX LAWS, IT IS IMPORTANT FOR THE U.S. AND NON-U.S. BONDHOLDERS TO READ THE FOLLOWING INFORMATION.

Under the U.S. tax laws, coupon interest payments on the Bonds will be deemed to be payable from a source in the United States. Coupon interest payments made to the non-U.S. Bondholder generally will be subject to U.S. withholding tax at the rate of 30% unless the non-U.S. Bondholder provides FFSPC on the Record Date of each coupon period (in accordance with clause 3.6. “Notices” of the Securities Notes section) with a properly executed IRS Form W-8BEN (for individuals) or W-8BEN-E (for legal entities which are not flow through entities for tax purposes) or other relevant IRS Form, establishing an exemption from, or reduction of the withholding tax. Prospective investors should carefully read clause 3.7 “Taxation” of the Securities Notes section. Each prospective investor should consult their own tax advisors regarding any reporting obligations they may have as a result of their acquisition, ownership or disposition of the Bonds.

Lead Manager

Freedom Finance Global PLC

The date of this Prospectus is 15 December 2023

CONTENTS

PROSPECTUS SUMMARY.. 3

1. Introduction.. 3

2. Key Information on the Issuer.. 3

2.1. The Issuer of the Bonds.. 3

2.2. Key financial information on the Issuer.. 3

2.3. Key risks that are specific to the Issuer/FRHC.. 3

3. Key Information on the Securities.. 4

3.1. Terms and conditions of the Securities.. 4

3.2. Information on trading of the Securities.. 4

3.3. Key risks specific to the Securities.. 4

4. Key information on the admission to trading.. 5

4.1. Conditions and timetable for investing in the Securities.. 5

4.2. The purpose of the Prospectus.. 5

REGISTRATION DOCUMENT.. 6

1. Information about the Issuer.. 6

1.1. General information.. 6

1.2. Investments.. 6

2. Operational and financial overview.. 6

2.1. Actual and proposed business activities.. 6

2.2. Risk factors.. 11

2.3. Production and sales trends.. 28

3. Articles of Association and organizational structure.. 28

3.1. Articles of Association.. 28

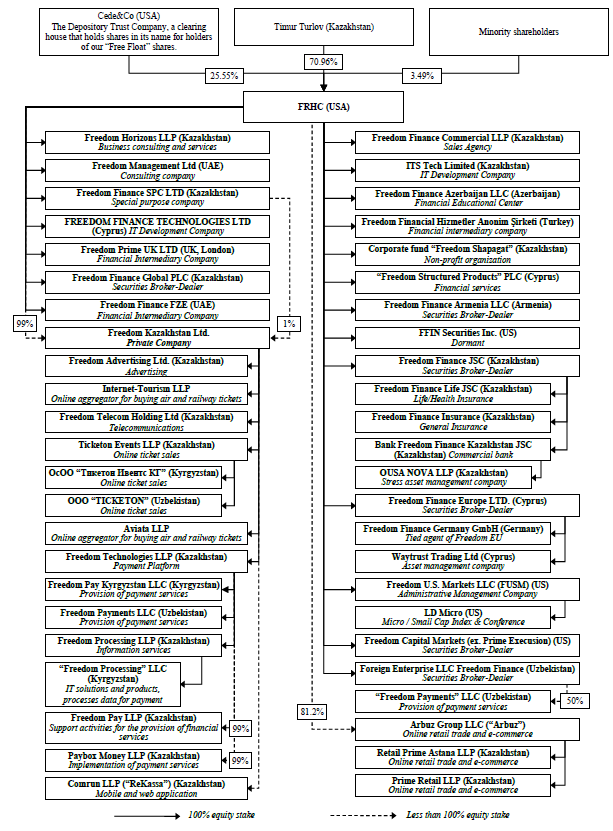

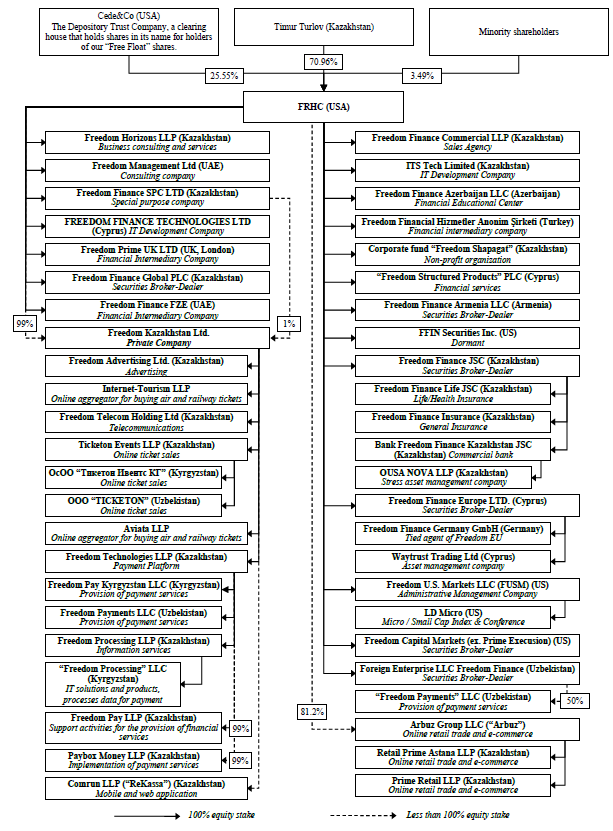

3.2. Group structure.. 31

4. Assets.. 32

4.1. Material contracts.. 32

5. Capital.. 32

5.1. Share capital.. 32

6. Management of the Issuer.. 32

6.1. Details relating to the Board of Directors and senior managers (“Key Persons”).. 32

6.2. Other information relating to Key Persons.. 34

7. Financial information about the Issuer.. 34

7.1. Historical financial information about the Issuer.. 34

8. Other information relating to the Issuer.. 35

8.1. Information about auditors.. 35

8.2. Connected Persons.. 35

8.3. Legal and other proceedings against the Issuer.. 35

9. Responsibility for the Content of the Prospectus.. 35

9.1. Responsibility Statement.. 35

9.2. Expert opinions included in the Prospectus.. 35

10. Documents on display.. 35

SECURITIES NOTES.. 37

1. Key information.. 37

1.1. Risk factors material to the Securities.. 37

1.2. Reasons for the offer.. 37

1.3. Creditworthiness of the Issuer.. 37

2. Information relating to the Securities offered/admitted to trading.. 37

2.1. General information relating to the Securities.. 37

3. Terms and conditions of the Offer.. 39

3.1 Payments.. 39

3.2 Penalty.. 39

3.3 Events of Default.. 40

3.4 Early redemption.. 40

3.5 Meetings of the Bondholders.. 40

3.6 Notices.. 41

3.7 Taxation.. 41

4. Other information.. 42

4.1. Audit and source of information including use of expert reports.. 42

5. Admission to listing and trading.. 42

GLOSSARY.. 43

SCHEDULE 1. RESPONSIBILITY STATEMENT.. 45

SCHEDULE 2: Form of Offer Terms template.. 46

SCHEDULE 3. AUDITED FINANCIAL STATEMENTS.. 48

PROSPECTUS SUMMARY

1. Introduction

The Prospectus Summary should be read as an introduction to Prospectus. Any decision to invest in Securities should be based on a consideration of the Prospectus as a whole by an investor. These Securities (Bonds) constitute debt instruments. An investment in the Bonds involves risks. By subscribing to the Bonds, investors lend money to the Issuer who undertakes to pay interest and to reimburse the principal within 15 (fifteen) calendar days of the Maturity Date. In case of bankruptcy or default by the Issuer, investors may not recover the amounts they are entitled to and risk losing all or part of their investment. Civil liability attaches only to those Persons who have tabled the summary including any translation thereof, but only where the summary is misleading, inaccurate or inconsistent, when read together with the other parts of the Prospectus, or where it does not provide, when read together with the other parts of the Prospectus, key information in order to aid investors when considering whether to invest in such Securities.

| | | | | |

| Issuer | Freedom Finance SPC Ltd., identification number 210540900127. Address: 16, Dostyk Street, Talan Towers offices, floor 26, Astana, Kazakhstan. Telephone: +7 701 958 01 27. E-mail: ffspc@ffin.kz. |

| Programme | U.S.$1,000,000,000 Programme valid until 31 December 2033. |

| Prospectus | This Prospectus was approved by the AIX on 15 December 2023. The Prospectus and Offer Terms of the first Tranche issued under the Programme were approved by the Special Resolution of the Issuer on 27 November 2023. The contact details of the AIX are:

Address: 55/19 Mangilik El str., Block C 3.4, Astana, Kazakhstan, Z05T3C4

Telephone: +7 (717) 223 53 66. |

2. Key Information on the Issuer

2.1. The Issuer of the Bonds

| | | | | |

| Issuer | Freedom Finance SPC Ltd., incorporated as a special purpose company of the Astana International Financial Centre under the identification number 210540900127. |

| Principal activities | The Issuer is a subsidiary of Freedom Holding Corp. (“FRHC”). The main activity of the FFSPC is raising funds through issuing and placing bonds for the sole purpose of financing loans in favor of the parent company Freedom Holding Corp.

FRHC is a public company incorporated under the laws of Nevada, USA. It conducts financial activities, retail brokerage, investment consulting, securities trading, investment banking, underwriting, commercial banking and insurance services through its subsidiaries. |

| Major shareholders | FRHC. Ultimate beneficiary owner is Timur Turlov (70.96%). |

| Director of FFSPC | Olga Baskakova acts as a Director and a Secretary of the FFSPC. |

| Board of Directors | 1.Yevgeniy Ler – Chairman of the Board. 2.Sergey Lukyanov – Member of the Board. 3.Madina Mantayeva – Member of the Board, Independent Director. |

| Auditors | Deloitte LLP. Address: 36 Al-Farabi ave., Almaty, Kazakhstan, 050000.

Telephone: + 7 7272 58 13 40, e-mail: info@deloitte.kz

|

2.2. Key financial information on the Issuer

The main activity of the FFSPC is raising funds through issuing and placing bonds for the sole purpose of financing loans in favor of the parent company Freedom Holding Corp. The independent auditor of the FFSPC, Deloitte LLP, issued unqualified independent auditor’s reports in respect of the FFSPC’s consolidated financial statements as at and for the year ended 31 March 2023 and a period from 21 May 2021 (inception date) to 31 March 2022.

| | | | | | | | | | | |

| Balance sheet, USD thousands | 31 March 2022 | 31 March 2023 | 30 September 2023 |

| Total Assets | 13,235 | 57,413 | 63,213 |

| | | | | | | | | | | |

| Total Liabilities | 13,521 | 60,113 | 66,023 |

| Total Equity | (286) | (2,700) | (2,810) |

| | | |

| Income statement, USD thousands | Period from 21 May 2021 (inception date) to 31 March 2022 | Year ended on 31 March 2023 | Six months ended on 30 September 2023 |

| Revenue | 259 | 2,011 | 2,013 |

| Profit (loss) for the year | (468) | (1,576) | (180) |

| | | |

| Cashflow statement, USD thousands | Period from 21 May 2021 (inception date) to 31 March 2022 | Year ended on 31 March 2023 | Six months ended on 30 September 2023 |

| Net cash flow from operating activities | (13,262) | (45,181) | (6,107) |

| Net cash flow from investing activities | - | - | - |

| Net cash flow from financial activities | 13,382 | 45,365 | 5,870 |

2.3. Key risks that are specific to the Issuer/FRHC

The Issuer is a newly organized subsidiary of FRHC. The main activity of the FFSPC is raising funds through issuing and placing bonds for the sole purpose of financing loans in favor of the parent company FRHC. The risks and uncertainties described in the risk factors below relate to the activities of the FRHC. For more details, please see clause “Risk factors” of the Registration Document section of the Prospectus.

1.Risks related to the Russia-Ukraine conflict.

2.Risks related to legal and regulatory matters.

3.Risk related to business and operations.

4.Risks related to information technology and cyber security.

5.Risks related to operations in emerging markets.

6.Taxation risks related to international operations.

7.Risks related to corporate structure and internal operations.

3. Key Information on the Securities

3.1. Terms and conditions of the Securities

| | | | | |

| The Issue | U.S.$1,000,000,000 Programme valid until 31 December 2033.

When counting the aggregate principal amount of the Programme, Bond issued in currencies other than U.S.$ will be included at the official exchange rate of the National Bank of the Republic of Kazakhstan as at the date of admission of the relevant Tranche to trading on the AIX. |

| Currency | Currency of each Tranche shall be specified in the relevant Offer Terms. |

| Number and Nominal Value of the Bonds | Number of Bonds and Nominal Value of each Tranche shall be specified in the relevant Offer Terms. |

| | | | | |

| Rights attached to the Securities | The Bondholders have the right to: •Receive coupon interest payments in the time and amount stipulated by the Prospectus and relevant Offer Terms of each Tranche. •Receive Nominal Value upon redemption in the time and amount stipulated by the Prospectus and relevant Offer Terms of each Tranche. •Freely transfer the Bonds. •Receive information concerning the Issuer’s operations. •Attend, participate in and vote at meetings of the Bondholders in accordance with the terms and conditions of the Bond specified in the Securities Note section of the Prospectus. •Require that the Bonds shall immediately become due and repayable at their Nominal Value together with accrued coupon interest if any of the events mentioned in clause 3.3 of Securities Notes occurs and continues for more than 30 (thirty) calendar days. |

| Ranking | The Issuer shall ensure that at all times the claims of the Bondholders against it under the Bonds rank at least pari passu with the claims of all its other unsecured creditors, save those whose claims are preferred by any bankruptcy, insolvency, liquidation or similar laws of general application, as well as per applicable AIFC rules and regulations. |

| Restrictions on the free transferability | The Bonds are freely transferable and, once admitted to the Official List of the AIX, shall be transferable only in whole in accordance with the applicable rules and regulations of the AIX amended from time to time. |

| Guarantees attached to the Securities | If applicable, the terms of guarantees attached to each Tranche will be specified in the relevant Offer Terms. |

3.2. Information on trading of the Securities

Trading information on each Tranche will be specified in the relevant Offer Terms.

3.3. Key risks specific to the Securities

1.The Bonds are subject to modification, waivers and substitution.

2.Delisting of the Bonds from the Official List of the AIX may subject gains and coupon interest payments on the Bonds to tax in the Republic of Kazakhstan.

3.The market price of the Bonds may be volatile.

4.If any Tranche issued under the Programme is guaranteed the guarantor might default on any payments related to the Bonds.

4. Key information on the admission to trading

4.1. Conditions and timetable for investing in the Securities

| | | | | |

| Admission to trading | Each Tranche issued under the Programme is expected to be admitted to trading on AIX. Details for admission of each Tranche will be provided in the relevant Offer Terms.

AIX is expected to be the main stock exchange for the Bonds issued under the Programme.

The Issuer, at its own discretion, may apply for listing of the Bonds on any other stock exchange subject to applicable rules and regulations of such other stock exchange and Offer Terms of the Bonds. |

| Plan for distribution | Subject to applicable laws and regulations the Bonds will be offered in or from AIFC to a wide range of investors. |

| Offering method | The offering of the Bonds will be made through the trading system of the AIX in accordance with the AIFC Market Rules, AIX Business Rules, AIX Central Securities Depository Business Rules and relevant AIX market notices. Trading methods will be specified in the Offer Terms for each Tranche. |

| | | | | |

| Offer period | The offer period including opening and closing dates shall be specified in the relevant Offer Terms of each Tranche. |

| Selling restrictions | The offering and sale of the Bonds is subject to applicable laws and regulations and the Bonds may not be sold to public in other jurisdictions outside AIFC, including without limitation the United Kingdom, the European Economic Area, other than in compliance with applicable laws and regulations. The Bonds have not and will not be registered under the U.S. Securities Act of 1933 or the securities laws of any state of the United States and may not be offered, sold or delivered within the United States or to, or for the account or benefit of, U.S. persons. |

| Notification process for investors | Prior to the start of the trading, AIX will publish a market notice specifying the first day of trading on its website:

https://aix.kz/news-announcements/aix-market-notices/

All other significant announcements will be made by the Issuer via the AIX Regulatory Announcement Service:

https://aix.kz/listings/continuous-disclosure-obligations/company-disclosures-2/ |

| Estimated expenses | Shall be specified in the relevant Offer Terms. |

4.2. The purpose of the Prospectus

This Prospectus has been produced in connection with the application for the Bonds to be admitted to the Official List of the AIX and trading on the AIX.

| | | | | |

| Reasons for the issuance/Use of proceeds | The proceeds received by the Issuer from the issue of the Bonds shall be transferred in the form of loans to the parent company Freedom Holding Corp., which intends to use the net proceeds from the sale of the Bonds for repayment or refinancing of debt, business expansion and general corporate purposes. |

| Estimated net amount of proceeds | Shall be specified in the relevant Offer Terms. |

| Lead Manager | Freedom Finance Global PLC, Astana, Esil district, Dostyk street, building 16, non-residential facility No.2, 010016, the Republic of Kazakhstan. |

| Conflict of interest | No person involved in the offering of the Bonds has any interest in the offering, which is material to the offering. |

REGISTRATION DOCUMENT

1. Information about the Issuer

1.1. General information

| | | | | |

| The full legal name of the Issuer | Freedom Finance SPC Ltd. |

| Legal form of the Issuer | Special purpose company. |

| The country of incorporation of the Issuer | •The Company was incorporated on 24 May 2021 as a special purpose company of the Astana International Financial Centre under the business identification number 210540900127 in accordance with the AIFC Special Purpose Company Rules (AIFC Rules No. GR0001 of 2017), as amended from time to time. •The contact details of the Issuer are: Address: 16, Dostyk Street, Talan Towers offices, floor 26, Astana, Kazakhstan. Telephone: +7 701 958 01 27. E-mail: ffspc@ffin.kz. |

1.2. Investments

The main activity of the FFSPC is raising funds through issuing and placing bonds for the sole purpose of financing loans in favour of the parent company FRHC. FFSPC does not have investment activities, the investments described below relate to the activities of the FRHC in Kazakhstan, Uzbekistan, Kyrgyzstan, Cyprus, Germany, the United Kingdom, United States, Greece, Spain, France, Poland, Armenia, Azerbaijan, Turkey and United Arab Emirates.

Investments made in the period ended 30 September 2023

Total investments exceeded U.S.$153.4 mln, mainly consisting of investments in fixed assets – U.S.$19.4 mln and purchase of available-for-sale securities, at fair value of U.S.$134 mln.

Investments made in the financial year ended 31 March 2023

Total investments exceeded U.S.$368.6 mln, mainly consisting of investments in fixed assets – U.S.$38.5 mln and purchase of available-for-sale securities, at fair value of U.S.$330.0 mln.

Investments made in the financial year ended 31 March 2022

Total investments exceeded U.S.$254.3 mln, mainly consisting of investments in fixed assets – U.S.$5.6 mln and purchase of available-for-sale securities, at fair value of U.S.$248.7 mln.

Investments made in the financial year ended 31 March 2021

Total investments exceeded U.S.$275.3 mln, mainly consisting of investments in fixed assets – U.S.$1.5 mln and purchase of available-for-sale securities, at fair value of U.S.$273.8 mln.

2. Operational and financial overview

2.1. Actual and proposed business activities:

The Issuer is a newly organized subsidiary of FRHC. The main activity of the FFSPC is raising funds through issuing and placing bonds for the sole purpose of financing loans in favor of the parent company FRHC. Described below is the actual and proposed business activities, including corporate history, description of business lines, revenue breakdown and information regarding the competition of FRHC.

For purposes of the Registration Document part of the Prospectus, references herein to the “we”. “our”, “us”, “our company”, “our business” and “Freedom” mean Freedom Holding Corp. together with its subsidiaries.

FRHC is a corporation organized in the United States under the laws of the State of Nevada that through its operating subsidiaries provides financial services including retail securities brokerage, research, investment counseling, securities trading, market making, retail banking, corporate investment banking, underwriting services, commercial banking, insurance products, a payment platform, a conference platform, and an online ticket sale platform. FRHC is headquartered in Almaty, Kazakhstan, with supporting administrative office locations in Cyprus and the United States. FRHC has a presence in Kazakhstan, Uzbekistan, Kyrgyzstan, Cyprus, Germany, the United Kingdom, United States, Greece, Spain, France, Poland, Armenia, Azerbaijan, Turkey and United Arab Emirates. FRHC also has subsidiaries in the United States which include a broker-dealer that is registered with the United States Securities and Exchange Commission (“SEC”) and the Financial Industry Regulatory Authority (“FINRA”). FRHC’s common stock trades on the Nasdaq Capital Market and the Kazakhstan Stock Exchange (KASE).

Through its subsidiaries, FRHC is a professional participant, with a license to provide one or more types of services, on a number of stock exchanges, including the Kazakhstan Stock Exchange (KASE), the Astana International Stock Exchange (AIX), the Republican Stock Exchange of Tashkent (UZSE) and the Uzbek Republican Currency Exchange (UZCE) and is a member of the New York Stock Exchange (NYSE) and the Nasdaq Stock Exchange (Nasdaq). FRHC also owns a 24.3% interest in the Ukrainian Exchange (UX). Freedom Finance Europe Limited provides FRHC’s clients with operational support and access to investment opportunities in the United States and European securities markets.

Corporate history of FRHC

Reverse Acquisition Transaction

FRHC was originally incorporated in the State of Utah in July 1981. In December 2004 FRHC redomiciled to the State of Nevada. In November 2015, FRHC entered into a reverse acquisition agreement with Timur Turlov changing the entity’s name from BMB Munai, Inc. to Freedom Holding Corp. and to acquire from him 100% ownership interests in FFIN Securities, Inc. (now a dormant company), Freedom Finance Europe Limited, and LLC Investment Company Freedom Finance and its wholly owned subsidiary, Freedom Finance JSC. These acquisitions closed in several stages from November 2015 to November 2017 as required audits and regulatory approvals were received.

Legacy Operations

FRHC’s legacy brokerage operations were acquired and developed by Timur Turlov. He acquired Beliy Gorod Ltd. in Moscow, Russia, in 2010 and renamed it LLC Investment Company Freedom Finance in 2011. In 2013 LLC Investment Company Freedom Finance acquired Freedom Finance JSC from unrelated third parties. In 2014, Freedom Finance JSC rolled out a branch office network of 14 offices across Kazakhstan and opened 20,000 customer brokerage accounts. Freedom Finance Europe Limited was organized in August 2013 and completed its regulatory licensing in May 2015.

In July 2014, Timur Turlov established Freedom Securities Trading Inc. (formerly FFIN Brokerage Services, Inc.) (“FST Belize”), a corporation registered in and licensed as a broker dealer in Belize, to provide brokerage services to customers seeking to purchase or trade securities in the international securities markets. FST Belize is 100% owned by Timur Turlov and is not part of FRHC’s group of companies.

Significant Recent Milestones

•On 26 September 2019 FRHC’s shares were approved for listing on Nasdaq and the shares began trading on Nasdaq on 15 October 2019.

•In December 2020 FRHC completed the acquisition of JSC Kassa Nova Bank, a Kazakhstan consumer bank with 10 branch offices across Kazakhstan, which were subsequently renamed Bank Freedom Finance Kazakhstan JSC.

•In December 2020 FRHC completed the acquisition of Freedom Capital Markets, a registered agency-only execution broker-dealer on the floor of the New York Stock Exchange, which represented our initial entry into the U.S. market.

•On 17 May 2022 FRHC completed the acquisition of two insurance companies, Freedom Finance Life JSC and Freedom Finance Insurance JSC. These two companies were 100% controlled by FRHC’s chief executive officer, chairman and majority shareholder, Timur Turlov.

•In February 2023 FRHC completed the divestiture of its Russian subsidiaries.

Business lines of FRHC

Securities Brokerage Services

We provide a comprehensive range of securities brokerage services to individuals, businesses and financial institutions seeking to diversify their investment portfolios to manage economic risks associated with political, regulatory, currency and banking uncertainties. Depending on the region, our brokerage services may include securities trading, margin lending, investment research, and investor education. Customers are provided online tools and retail locations to establish accounts and conduct securities trading on transaction-based pricing. We market our services through a number of channels, including telemarketing, training seminars and investment conferences, print and online advertising using social media, mobile app and search engine optimization activities.

Our securities brokerages also conduct proprietary investment activities, and facilitate repurchase and reverse repurchase agreements, both to support the funding of our proprietary investments and to act as an intermediary between third party purchasers and sellers.

Retail Brokerage

We offer full-service retail brokerage services covering a broad array of investment alternatives including exchange-traded and over-the-counter corporate equity and debt securities, money market instruments, exchange traded options and futures contracts, government bonds, and mutual funds. A substantial portion of our revenue is derived from commissions from customers through accounts with transaction-based pricing. Brokerage commissions are charged on investment products in accordance with a schedule we have formulated that aligns with local practices. We provide our brokerage customers with access to the U.S. stock markets, and a significant amount of our brokerage business relates to trading in U.S.-exchange listed and OTC securities by our brokerage customers. We use the services of third-party U.S.-registered securities broker dealer and clearing firms to execute substantially all of our trades in the U.S. market.

As of 31 March 2023, 31 March 2022, 31 March 2021 and 30 September 2023, respectively, we had approximately 370,000, 250,000, 170,000 and 433,947 total brokerage customer accounts, of which more than 56%, 58%, 71% and 57% had positive cash or asset account balances. As of 31 March 2023, we had approximately 52,000 active accounts, as compared to 53,000 and 32,000 active accounts as of 31 March 2022 and 2021, respectively. For six months ended September 30, 2023, we had approximately 67,158 active accounts. We define “active accounts” as those from which at least one transaction occurred in the quarter prior to the date of calculation.

Proprietary Trading and Investment Activities

In the normal course of our business, we take securities positions as a market maker and/or principal to facilitate customer transactions and for investment purposes. In market making activities and when trading for our own account, we expose our own capital to the risk of fluctuations in market value. Investment decisions are determined in accordance with internal policies and recommendations of our internal investment committees. The size of our securities positions varies substantially based upon economic and market conditions, allocations of capital, underwriting commitments and trading volume of an individual issuer’s securities. Also, the aggregate value of inventories of securities which we may carry is limited by the net capital and capital adequacy rules in effect in the jurisdictions where we conduct business.

Capital Markets/ Investment Banking Services

Our capital markets/investment banking business consists of investment banking professionals in Kazakhstan, Uzbekistan and the United States who provide strategic advisory services and capital markets products. Our investment banking team focuses on multiple sectors including consumer and business services, energy, financial institutions, real estate, technology, media and communications. Our investment banking activities are concentrated in Kazakhstan and Uzbekistan where commercial banks are currently focusing their financing activities on large enterprises or state-owned enterprises. In these countries, commercial lending sources also impose loan structures and debt covenants that preclude many companies from participating. This has created growing interest in and demand for our services. Our United States investment banking team has recently expanded its services to include

the full array of capital markets and investment banking services. To date our underwriting activities have included, among others, underwriting of debt and equity offerings on both a “best effort” and a firm commitment basis.

In the equity capital markets area, we provide capital raising solutions for corporate customers through initial public offerings and follow-on offerings, including listings of companies on stock exchanges. We focus on companies in growth industries and participate as market makers in our underwritten securities offerings after the initial placements of shares.

In the debt capital markets area, we offer a range of debt capital markets solutions for emerging growth and small market companies. We focus on structuring and distributing private and public debt for various purposes including buyouts, acquisitions, growth capital financings, and recapitalizations. In addition, we participate in bond financings for both sovereign and corporate issuers in the emerging markets.

Commercial Banking

We offer commercial banking services in Kazakhstan through our Bank Freedom Finance Kazakhstan JSC subsidiary. Prior to the divestment of our Russian subsidiaries, we also offered commercial banking services through a Russian banking subsidiary. We generate banking service fees by providing services that include lending operations, deposit services, money transfers, opening and maintaining correspondent accounts, renting safe deposit boxes, e-commerce money transfer services for legal entities, tender guarantees, and payment card services.

Freedom Box

Freedom Box is a package of payment acquiring services for individual entrepreneurs whereby the entrepreneurs do not need to bring documents to the bank in order obtain the package of services. The package includes an installment plan for clients purchasing the acquiring services, a free POS terminal, an overdraft facility and an entrepreneur’s card.

Insurance

On 17 May 2022, we acquired two insurance companies in Kazakhstan, a life insurance company Freedom Finance Life JSC, and a direct insurance carrier, excluding life, health and medical, Freedom Finance Insurance JSC. Prior to our acquiring these companies, each was wholly owned by our controlling shareholder, chairman and chief executive officer, Timur Turlov. We acquired these companies from him at the historical cost paid by him plus amounts he has contributed as additional paid in capital since his purchase. These companies were not initially acquired directly by us because at the time they were put on the market for sale by their prior owner they did not have audit reports conforming to U.S. GAAP standards and had not demonstrated sustained profitability. We do not consider the acquisition of these insurance companies to be material in the context of our group as a whole. The purchase price for Freedom Finance Insurance JSC was U.S.$12.4 million and the purchase price for Freedom Finance Life JSC was U.S.$12.1 million.

We believe incorporating the offerings of these insurance companies with our existing brokerage and banking product and service lines, along with our developing fintech ecosystem in Kazakhstan, will allow us to create a significant sustainable competitive advantage in Kazakhstan as an integrated, efficient and convenient single source for financial services.

Freedom Finance Life JSC

Freedom Finance Life JSC was established in 2014 and was acquired by Timur Turlov in 2019. Freedom Finance Life JSC provides a range of health and life insurance products to individuals and businesses, including life insurance, health insurance, annuity insurance, accident insurance, obligatory worker emergency insurance, travel insurance and reinsurance.

As of 31 March 2023, Freedom Finance Life JSC had 360,744 active contracts. As of 31 March 2023, Freedom Finance Life JSC had total assets of approximately U.S.$272 million and total liabilities of approximately U.S.$217 million. During the fiscal year ended 31 March 2023, Freedom Finance Life JSC experienced a 70% increase in gross insurance premiums written and recognized a net profit of approximately U.S.$25 million. As of 31 March 2023, Freedom Finance Life JSC’s market share in the Kazakhstan life insurance market was 8% based on gross

written premiums for life insurance, and it held an approximately 46% market share in the Kazakhstan voluntary life-related accident insurance market, in each case according to the National Bank of Kazakhstan.

Freedom Finance Insurance JSC

Freedom Finance Insurance JSC operates in the “general insurance” industry, was established in 2009 and was acquired by Timur Turlov in 2019. Freedom Finance Insurance JSC is the leader in online insurance in Kazakhstan and offers various general insurance products in property (including automobile), casualty, civil liability, personal insurance and reinsurance. In 2021 Freedom Finance Insurance JSC was recognized by online and print magazine Global Banking & Finance Review as the Best Online Insurance Company Kazakhstan, Best General Insurance Company Kazakhstan and Best Auto Insurance Company Kazakhstan.

Freedom Finance Insurance JSC distributes its products and services through different channels such as the internet, payment terminals and a call center. By utilizing its digital solutions, Freedom Finance Insurance JSC’s customers can purchase Freedom Finance Insurance JSC products within five minutes and have a personal account for managing policies.

On 31 March 2023, Freedom Finance Insurance JSC had 320,923 active contracts. As of 31 March 2023, Freedom Finance Insurance JSC had total assets of approximately U.S.$195 million and total liabilities of approximately U.S.$162 million. During the fiscal year ended 31 March 2023, Freedom Finance Insurance JSC experienced a 131% increase in written insurance premiums as compared to fiscal year ended 31 March 2022 and recognized net profit of approximately U.S.$7 million. On 31 March 2023, Freedom Finance Insurance JSC had a 7% share of the total Kazakhstan general insurance market based on total assets, according to the National Bank of Kazakhstan. It also held an approximately 3% market share of the Kazakhstan car owner’s liability insurance market.

On 27 August 2022, we acquired 100% of JSC Insurance Company “London-Almaty”, a Kazakhstan insurance company, and on 19 December 2022, this company was merged into Freedom Finance Insurance JSC.

Information Technology

FRHC’s business model places heavy reliance on information technology to offer customers a seamless digital experience, meet their diverse needs, and ensure stringent adherence to regulatory requirements and information security standards. To support sustainable growth of the Freedom ecosystem, our information technology is focused on continuous development that empowers business users with technology that accelerates the time-to-market for digital products while enhancing predictability. We seek to harmonize technology governance approaches across all of our companies and centralize key IT processes. Our IT strategy is designed to leverage technology as a key driver of success within our group. We are continuously adapting to the rapidly evolving digital landscape and aligning our technological capabilities with the changing needs of our customers and stakeholders. By fostering innovation, enhancing collaboration, and prioritizing business continuity and growth, we aim to establish a strong technological foundation that supports our strategic objectives.

Digital Ecosystem and Product Expansion

We have implemented a Technology Development and Ecosystem Growth strategy centered on building a robust technological infrastructure, fostering innovation, and enhancing user experiences. Under this strategy, our flagship technology product is our proprietary Tradernet software platform, complemented by other online technologies, enabling seamless access to multiple markets worldwide. Tradernet provides our customers with trading capabilities and access to monitoring multiple stock markets around the world simultaneously, including KASE, AIX, UX, MOEX, the SPB Exchange, NYSE, Nasdaq, ATHEX, ITX, the London Stock Exchange, the Chicago Mercantile Exchange, the Hong Kong Stock Exchange and Deutsche Börse and to execute trades electronically in these markets in multiple products from a single trading account. Additionally, Tradernet allows us to monitor and manage all aspects of our customers’ personal accounts, including non-trading orders, and to participate in our customer social network. We also use Tradernet for customer margin risk evaluation and for middle-office security transfer requests.

Operating under the “Freedom” brand, our comprehensive suite of digital products and services enables our customers to engage in electronic trading and to monitor their accounts. In addition to trading capabilities, we have expanded our digital solutions to include mortgages, auto loans, and insurance products. Through our online platform, customers can conveniently apply for and manage mortgages, track auto loans, and access a range of

insurance options. We prioritize delivering a seamless and integrated digital experience across all our products, ensuring user-friendly interfaces, robust security measures, and efficient workflows.

We have recently expanded our digital product portfolio with the acquisition of Ticketon Events LLP (“Ticketon”), the largest online ticket sales company in Kazakhstan, actively working to create an e-commerce infrastructure in the field of culture and sports. The acquisition of Ticketon, with 67% share in the Kazakhstan’s market of online ticket sales for cultural events, gave us greater access to key middle class that could join our clientele. Ticketon’s service focuses on promoting the cultural life of Kazakhstan and introducing modern promotion technologies. Ticketon offers convenient ways to buy tickets, expands sales channels for organizers and venues, and provides effective ticket promotion and distribution services. This acquisition further strengthens our digital offerings and enhances our ability to serve customers in the entertainment industry.

One of our key digital products is the Paybox payment platform, which we acquired as part of our acquisition of Paybox Technologies LLP (now called Freedom Pay LLP) and its subsidiaries in February 2023. The Paybox platform is a dynamic payment system services aggregation field project. By connecting to the Paybox platform digital payment aggregator, customers can accept payments from buyers using a wide range of payment methods, including bank cards, online banking, electronic money, and more. Freedom Pay LLP also develops customized solutions for banks, catering to their specific needs and expanding our network of partners. According to Global data (https://www.globaldata.com/) for calendar 2022, Freedom Pay’s share of electronic payments in the Kazakhstan market is 30%. This acquisition allowed our bank to become the largest acquiring bank in Kazakhstan enhances our product offering and expands our geographic footprint.

We are committed to further expanding our digital ecosystem going forward by integrating our online and mobile brokerage services, banking offerings, insurance products, payment processing systems, and online commercial ticketing services. Our strategic objective is to provide customers with a comprehensive and user-centric digital experience, offering them convenient access to a wide array of financial products and services through a single platform. By leveraging cutting-edge technology and fostering continuous innovation, we strive to enhance our digital offerings and meet the evolving needs of our diverse customer base.

Revenue breakdown by types and geographic markets

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended September 30, 2023 |

| STATEMENTS OF OPERATION (USD thousands) | Central Asia and Eastern Europe | | Europe, excluding Eastern Europe | | The United States | | Middle East/Caucasus | | Total |

| Fee and commission income | 157,612 | | 43,413 | | 8,268 | | 1,113 | | 210,406 |

| Net gain/(loss) on trading securities | 82,672 | | 435 | | (701) | | 181 | | 82,587 |

| Interest income | 336,046 | | 16,465 | | 1,851 | | 8,050 | | 362,412 |

| Insurance underwriting income | 102,865 | | — | | — | | — | | 102,865 |

| Net gain/(loss) on FX operations | 15,931 | | 307 | | (772) | | 139 | | 15,605 |

| Net gain/(loss) on derivative | (29,797) | | 570 | | — | | — | | (29,227) |

| Other income/(expense | 4,648 | | 1,705 | | 815 | | (25) | | 7,143 |

| TOTAL REVENUE, NET | 669,977 | | 62,895 | | 9,461 | | 9,458 | | 751,791 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended 31 March 2023 |

| STATEMENTS OF OPERATION (USD thousands) | Central Asia and Eastern Europe | | Europe, excluding Eastern Europe | | The United States | | Middle East/Caucasus | | Total |

| Fee and commission income | 106,982 | | 215,408 | | 4,825 | | — | | 327,215 |

| Net gain/(loss) on trading securities | 92,330 | | (22,693) | | 1,447 | | — | | 71,084 |

| Interest income | 257,285 | | 26,090 | | 11,289 | | 31 | | 294,695 |

| Insurance underwriting income | 115,371 | | — | | — | | — | | 115,371 |

| Net gain/(loss) on FX operation | 58,908 | | (2,287) | | (4,479) | | 12 | | 52,154 |

| Net gain/(loss) on derivative | (64,826) | | — | | — | | — | | (64,826) |

| TOTAL REVENUE, NE | 566,050 | | 216,518 | | 13,082 | | 43 | | 795,693 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year ended 31 March 2022 |

| STATEMENTS OF OPERATION (USD thousands) | Central Asia and Eastern Europe | | Europe, excluding Eastern Europe | | The United States | | Middle East/Caucasus | | Total |

| Fee and commission income | 23,652 | | 307,014 | | 4,545 | | — | | 335,211 |

| Net gain/(loss) on trading securities | 10,511 | | 142,195 | | 2,546 | | — | | 155,252 |

| Interest income | 107,075 | | 14,051 | | 483 | | — | | 121,609 |

| Insurance underwriting income | 72,981 | | — | | — | | — | | 72,981 |

| Net gain/(loss) on FX operations | 7,824 | | (5,598) | | 1,565 | | — | | 3,791 |

| Net gain/(loss) on derivative | 946 | | — | | — | | — | | 946 |

| TOTAL REVENUE, NET | 222,989 | | 457,662 | | 9,139 | | — | | 689,790 |

Regulatory oversight

We operate in highly regulated industries across several legal jurisdictions. The securities, banking, payment services and insurance business activities of our subsidiaries are subject to extensive regulation and oversight by the stock exchanges, central/national banks, governmental and self-regulatory authorities in the foreign jurisdictions where we conduct business activities. We expect that the regulatory environment will continue to raise standards and impose new regulations with which we will be required to comply in a timely manner.

We operate under various securities, banking and insurance licenses and must maintain our licenses in order to conduct our operations. As of 31 March 2023, we, through our subsidiaries, held: brokerage licenses in Kazakhstan issued by the Agency of the Republic of Kazakhstan for Regulation and Development of Financial Market (the “ARDFM”) and the Astana Financial Services Authority (the “AFSA”), in Cyprus issued by the Cyprus Securities and Exchange Commission (“CySEC”), in the United States issued by FINRA, in Armenia issued by the Central Bank of Armenia, and in Uzbekistan issued by the Ministry of Finance of the Republic of Uzbekistan; a foreign

currency operations license in Kazakhstan issued by the ARDFM; a banking license in Kazakhstan issued by the ARDFM; insurance licenses (general and life) in Kazakhstan issued by the ARDFM; and payment services licenses in Kazakhstan, Uzbekistan and Kyrgyzstan.

We spend considerable resources in our general efforts to comply with the various regulations to which we are subject, and we expect this burden to continue in the future.

Competition

We face intense competition in each of the markets where we offer our services. We compete with international, regional and local brokerage, banking, and financial services firms that offer an array of financial products and services. The brokerage and financial service firms which we currently regard as our principal competitors include: Halyk Finance, BCC Invest and First Heartland Securities in Kazakhstan; and eToro and Interactive Brokers in Europe. We consider Bank Freedom Finance Kazakhstan JSC’s principal banking competitors to be Halyk Bank, Kaspi Bank and Bank CenterCredit. In the United States, we expect to compete with, among others, Needham & Company, Craig-Hallum Capital Group and Oppenheimer & Co.

Many of the firms with which we compete are larger, provide additional and more diversified services and products, provide access to more international markets, and have greater technical, and financial resources. We leverage competitive advantages we have developed, including our extensive experience in providing investors in our core markets with access to the U.S. and European securities markets, our ability to deliver high quality analytical information and our focus on providing convenient, high tech user-friendly access to our services and the markets. We have also been an active participant in various privatization programs, which has allowed us to develop expertise and a prominent reputation in the public placement of securities of local issuers in the regions where we operate.

2.2. Risk factors

The Issuer is a newly organized subsidiary of FRHC. The main activity of the FFSPC is raising funds through issuing and placing bonds for the sole purpose of financing loans in favor of the parent company FRHC. The risks and uncertainties described in the risk factors below relate to the activities of the FRHC.

Risks Related to the Russia-Ukraine Conflict

Our business and operations may be materially adversely affected by the ongoing Russia-Ukraine conflict.

We have historically had significant operations in Russia. In view of the critical challenges for our business and operations resulting from the ongoing Russia-Ukraine conflict, and the responses of governments and multinational businesses to it, shortly after the onset of the Russia-Ukraine conflict we decided to divest our two Russian subsidiaries. On 19 October 2022, we announced that we had entered into an agreement to divest our Russian subsidiaries, and the divestiture of these subsidiaries was approved by the Central Bank of the Russian Federation on 10 February 2023, and was completed on 27 February 2023. Notwithstanding that we have completed the divestiture of our Russian subsidiaries, there can be no assurance that such divestiture will achieve its intended effects. In particular, we expect that the divestiture of our Russian subsidiaries will reduce our exposure to the current challenging geopolitical circumstances and will enable us to accelerate growth in other markets. However, these matters are subject to uncertainty and changes in circumstances. A failure by us to achieve the intended effects of the divestiture of our Russian subsidiaries could have a material adverse effect on our results of operations in future periods. In addition, we continue to provide brokerage services to Russian persons, including a number of former clients of our Russian subsidiaries, through their accounts at non-Russian companies within our group and indirectly through accounts held with our affiliate FST Belize. As a result, we continue to have significant exposure to Russia, which poses continuing challenges for our business and operations. These challenges, including the specific risks outlined below, may materially adversely affect our business, financial condition, results of operations and stock price.

Our business may be materially adversely impacted by negative macroeconomic and geopolitical developments in Russia and in other countries in which we operate or in which our clients are located.

Historically, a large portion of our brokerage business has been attributable to securities trading by individuals and qualifying institutions in Russia, through accounts held at our Russian subsidiaries, through accounts held at our

non-Russian subsidiaries and indirectly through accounts held with FST Belize. Although we have divested our Russian subsidiaries, we continue to generate a significant amount of fee and commission income from trading activity engaged in by Russian persons (including former clients of our former Russian subsidiaries) who are not subject to any sanctions or other legal restrictions through their accounts at our non-Russian subsidiaries, including indirectly through their accounts at FST Belize.

The Russia-Ukraine conflict and responses to it have materially and adversely impacted the macroeconomic climate in Russia and the surrounding region, resulting in significant currency rate volatility, the imposition of currency controls, capital flight, materially increased interest rates and inflation, and the withdrawal of or reduction of business by a number of Western businesses from the Russian market, any of which may lead to reduced investment confidence and investment spending by affected Russian persons. Should there be a large scale expansion of Russia-related sanctions to make them applicable to private sector financial institutions in Russia or to Russia’s banking system generally, this could negatively affect the Russian economy and investment climate and cause deterioration of the Russian financial markets. In addition, there is a risk that new international sanctions and new countersanctions measures may curtail the ability of our Russian brokerage customers to trade through non-Russian accounts or in non-Russian securities, or our ability to facilitate any trading through our non-Russian subsidiaries or FST Belize. For example, given Kazakhstan’s extensive historical business ties with Russia, we are exposed to the risk that secondary sanctions could be imposed on the financial sector in Kazakhstan. If investment spending by Russian persons through non-Russian trading accounts declines for any reason, this could result in a material reduction in our revenues.

The Russia-Ukraine conflict has also had, and may continue to have, adverse effects on our results of operations related to proprietary trading. For example, during year ended 31 March 2023 we sold 7,500,000 shares in the SPB Exchange that we owned and realized a loss from such sale in the amount of U.S.$73.4 million. We attribute this loss to a combination of factors, including heightened market uncertainty and increased volatility caused by the Russia-Ukraine conflict and its geopolitical consequences. Although neither FRHC nor any of its group companies is the subject of any sanctions imposed by the United States, the European Union or the United Kingdom, and we have divested our Russian subsidiaries, sanctions related to Russia could adversely impact our business. For example, we continue to provide brokerage services to a significant number of Russian persons through their non-Russian accounts with us or indirectly through accounts held with FST Belize, and sanctions could restrict our ability to continue to provide brokerage services to such Russian persons. Sanctions could also limit our ability to, or make it difficult for us to, enter into agreements with counterparties, who may refuse to work with us due to our significant Russian customer base.

Should there be an expansion of Russia-related sanctions, this could significantly increase the foregoing risks to our business. The impact of any such expansion would depend on the nature of such sanctions. Examples of additional sanctions measures that could affect our business include:

•expanding the scope of sanctioned activities or transactions;

•designating parties with whom we have or may have significant business relationships as “specially designated nationals” or “blocked” parties, meaning that all dealings with them by the U.S., EU and/or UK persons, or persons from other countries which impose economic sanctions, or involving items or technologies from these jurisdictions would be prohibited;

•expanding sanctions to cover entities that are less than 50% owned or controlled by a sanctioned party; or

•adopting corporate policies that prohibit or restrict business activities with us because we conduct business with Russian persons who are not subject to any sanctions.

Sanctions imposed on our founder and our Ukrainian subsidiary by Ukraine could have a material adverse effect on us.

On 19 October 2022, Timur Turlov, our Ukrainian subsidiary and our two Russian subsidiaries (which Russian subsidiaries have since been divested) were included on the National Security and Defense Council of Ukraine sanctions list, which included more than 2,500 companies and individuals. In connection with these sanctions, the operations of our Ukrainian subsidiary were suspended. We believe that the inclusion of Mr. Turlov and these subsidiaries on the list was due to perceived connections with Russia. While we believe the inclusion of Mr. Turlov and our Ukrainian subsidiary on the list is not justified and we have been actively appealing the decision, there can be no assurance as to when they will be removed from the list, if at all. While our Ukrainian subsidiary is not material in the context of our overall group, the inclusion of Mr. Turlov and our Ukrainian subsidiary on this list

could materially adversely affect our relationships with counterparties and regulators in other jurisdictions and as a result could restrict our ability to conduct our business and carry out our business strategy. In addition, because we have a significant number of Ukrainian brokerage customers that are served by our non-Ukrainian subsidiaries, the existing sanctions imposed by Ukraine, or any expansion of such sanctions could adversely affect our brokerage business.

Non-compliance with U.S., EU, UK, Russian or other sanctions programs could adversely impact our company.

We are committed to compliance with all applicable economic sanctions, including those related to the Russia-Ukraine conflict. U.S. economic sanctions include prohibitions (“primary” sanctions) that are generally administered and enforced by OFAC. With the exception of OFAC’s Iran and Cuba sanctions programs these prohibitions apply to U.S. persons, including companies organized under the laws of the United States and their overseas branches, but do not apply to non-U.S. subsidiaries of U.S. persons. U.S. economic sanctions also include “secondary” sanctions that make certain activities of non-U.S. companies sanctionable under U.S. statutes such as the Countering America’s Adversaries Through Sanctions Act (CAATSA). These sanctions are administered by OFAC and/or the U.S. Department of State. We require all of our group companies to fully comply with all U.S. primary sanctions that are applicable to them and/or to transactions in which they are involved and to refrain from participation in any conduct that is sanctionable under U.S. secondary sanctions.

Because FRHC is a U.S.-domiciled holding company that operates through its subsidiaries, we are obliged to comply with Ukraine-Russia conflict-related sanctions imposed by the United States, but those sanctions do not apply to the fully independent activities of our non-U.S. subsidiaries where there is no U.S. nexus. If, however, it was determined that FRHC facilitated activities of its subsidiaries that are prohibited under U.S. sanctions, FRHC could be subject to civil or criminal penalties under OFAC regulations. In addition, non-U.S. companies that cause U.S. companies to violate OFAC regulations may be subject to enforcement action and thereby the imposition of civil or criminal penalties. This could occur, for example, if one of our non-U.S. subsidiaries were to process a U.S. dollar transaction involving sanctioned securities through the U.S. financial system. The risk of noncompliance may arise in connection with international transactions conducted in U.S. dollars, transfers to or from U.S. bank accounts, or dealings with U.S. broker-dealers.

We maintain omnibus brokerage accounts for several institutional clients, including FST Belize and certain Russian institutions. The order flow from these accounts represents transactions of customers of the relevant institutions, which are executed by the relevant institutions through their omnibus accounts with us. While we have agreements with such customers in which they have agreed to comply with sanctions laws, and to grant us access to its customer records for purposes of compliance monitoring upon our request, we do not have direct access to such institutional customers’ own customer check systems and as a result we cannot provide assurance that the beneficial owners who are the beneficiaries of trades being carried out through such omnibus accounts are not sanctioned persons.

In the event that we believe or have reason to believe that our employees, agents or independent contractors have or may have caused us or any of our subsidiaries to violate applicable economic sanctions laws, we may be required to investigate or have outside counsel investigate the relevant facts and circumstances, which could be costly and require significant time and attention from senior management. Non-compliance with these laws may result in criminal or civil penalties, which could disrupt our business and result in a material adverse effect on our financial condition, results of operations, and cash flows and cause significant brand or reputational damage.

Sanctions are subject to rapid change, and it is also possible that new direct or indirect secondary sanctions could be imposed by the U.S. or other jurisdictions without warning in relation to the Russia-Ukraine conflict. The extent of current sanctions measures, not all of which are fully aligned across jurisdictions, further increases operational complexity for our business and increases the risk of making errors in managing day-to-day business activities within the rapidly evolving sanctions environment. In addition, certain transactions that may be prohibited by economic sanctions regulations of OFAC if undertaken by us or in the United States may be permissible if undertaken independently by a non-U.S. subsidiary where there is no U.S. nexus.

We are monitoring closely the developing sanctions environment, including Russian countersanctions, and utilizing dedicated corporate governance structures and in-house and outside advisors as and when required to ensure our continued compliance. However, we cannot assure that we can remain in compliance with all sanctions and countersanctions.

During year ended 31 March 2023 our subsidiaries Bank Freedom Finance Kazakhstan JSC and Freedom Finance Global PLC provided brokerage services to certain individuals and entities who are subject to sanctions imposed by OFAC, the European Union or the United Kingdom. These transactions did not involve any nexus with the United States, the European Union or the United Kingdom, as applicable. As of 31 March 2023, our customer liabilities relating to these individuals and entities in aggregate were U.S.$17.8 million, representing approximately 0.92% of our total customer liabilities as of such date.

For year ended 31 March 2023, the aggregate fee and commission income relating to transactions with these individuals and entities in aggregate was approximately U.S.$34,000, representing approximately 0.01% of our total fee and commission income for such fiscal year.

Risks Related to Legal and Regulatory Matters

We are subject to extensive regulation, and the failure to comply with laws and regulations could subject us to monetary penalties or sanctions.

Our business is subject to extensive government regulation, licensing and oversight in multiple jurisdictions. Laws, regulations and rules or other obligations to which we are subject include but are not limited to those concerning securities brokerage, commercial banking, insurance services, payment services, securities trading, investment banking, granting of credit, deposit taking, margin lending, foreign currency exchange, data protection and privacy, cross-border and domestic money transmission, cyber security, fraud detection, antitrust and competition, consumer protection, U.S. and non-U.S. sanctions regimes, anti-money laundering and counter-terrorist financing. Our Freedom Capital Markets subsidiary is a broker-dealer and investment adviser registered with the SEC and is primarily regulated by FINRA.

As we introduce new products and services and expand existing product and service offerings, we may become subject to additional regulations, restrictions, licensing requirements and related regulatory oversight.

Compliance with many of the regulations applicable to us involves a number of risks, particularly in areas where applicable regulations may be subject to varying interpretation. Many of the requirements imposed by these regulations are designed to ensure the integrity of the financial markets and to protect customers and other third parties who deal with us. New regulations may result in enhanced standards of duty on broker-dealers in their dealings with their clients. Consequently, these regulations often serve to limit our activities, including through net capital, customer protection and market conduct requirements, including those relating to principal trading.

We have implemented policies and procedures designed to ensure compliance with applicable laws and regulations. Notwithstanding these measures, it is possible that our employees, contractors, and agents could nevertheless breach such laws and regulations. We may be subject to legal claims from our customers and counterparties, as well as regulatory actions brought against us by the regulators, self-regulatory agencies and supervisory authorities that oversee and regulate the industries in which we operate.

From time to time, we have been, and in the future may be, subject to investigations, audits, inspections and subpoenas, as well as regulatory proceedings and fines and penalties brought by regulators. We are subject to regulation from numerous regulators, which include, but are not limited to, the AFSA, the ARDFM, CySEC and the SEC. We have received various inquiries and formal requests for information on various matters from certain regulators, with which we have cooperated and will continue to do so. If we are found to have violated any applicable laws, rules or regulations, formal administrative or judicial proceedings may be initiated against us that may result in censure, fine, civil or criminal penalties. For example, on November 25, 2022, our subsidiary Freedom Finance Global PLC, incorporated in the AIFC, entered into a settlement agreement with the AFSA which was the result of an on-site inspection by the AFSA of Freedom Finance Global PLC conducted between October and December 2021. Following such inspection, the AFSA communicated to Freedom Finance Global PLC a number of substantial findings and regulatory concerns related to matters of prudential, conduct-of-business, anti-money laundering and combatting financing of terrorism. In connection with the settlement agreement, Freedom Finance Global PLC was required to pay monetary penalties and carry out a remediation plan. In addition, on February 13, 2023, following an elective audit of Bank Freedom Finance Kazakhstan JSC commenced by the ARDFM in June 2022, the ARDFM issued an order providing that Bank Freedom Finance Kazakhstan JSC violated a number of banking laws and regulations. In connection with such order, Bank Freedom Finance Kazakhstan JSC was required to carry out a remediation plan. We could also experience negative publicity and reputational damage as a result of

future lawsuits, claims or regulatory actions. Any of the foregoing could, individually or in the aggregate, adversely affect our business, results of operations, financial condition and cash flows.

Financial services firms have been subject to increased regulatory scrutiny, increasing the risk of financial liability and reputational harm resulting from adverse regulatory actions.

Firms in the financial services industry have been operating in an onerous regulatory environment. The industry has experienced increased scrutiny from a variety of regulators, including the SEC and FINRA in the United States, U.S. state regulators and regulators in non-U.S. jurisdictions. Penalties and fines sought by regulatory authorities have increased substantially. We may be adversely affected by changes in the interpretation or enforcement of existing laws and rules by these governmental authorities. Each of the regulatory bodies with jurisdiction over us has regulatory powers dealing with many different aspects of financial services, including, but not limited to, the authority to fine us and to grant, cancel, restrict or otherwise impose conditions on the right to continue operating particular businesses. Increasingly, regulators have instituted a practice of “regulation by enforcement” where new interpretations of existing regulations are introduced by bringing enforcement actions against securities firms for activities that occurred in the past but were not then thought to be problematic. We also may be adversely affected as a result of new or revised legislation or regulations imposed by the SEC, other U.S. or non-U.S. governmental regulatory authorities or self-regulatory organizations (e.g., FINRA) that supervise the financial markets. Substantial legal liability or significant regulatory action taken against us could have a material adverse effect on our business prospects, including our cash position.

As a U.S. public company listed on Nasdaq, we have substantial regulatory reporting obligations.

We are subject to extensive corporate governance, reporting and accounting disclosure requirements under U.S. securities laws and regulations of the SEC. These laws, as well as the listing standards of Nasdaq, impose certain compliance requirements, costs and obligations on listed companies. This requires a significant commitment of resources and management oversight. The expenses associated with being a public company include auditing, accounting and legal fees and expenses, investor relations expenses, increased directors’ fees, registrar and transfer agent fees and listing fees, as well as other expenses.

Failure to comply with the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) or the Dodd-Frank Wall Street Reform and Consumer Protection Act could potentially subject us to sanctions or investigations by the SEC or other regulatory, exchange or market authorities, and related penalties, fines and litigation.

We are subject to risks related to anti-corruption laws in effect in the United States and the non-U.S. jurisdictions where we conduct business.

We are subject to the U.S. Foreign Corrupt Practices Act (“FCPA”) and similar non-U.S. anti-corruption laws that generally prohibit companies and their intermediaries from making improper payments or providing anything of value to influence foreign government officials for the purpose of obtaining or retaining business or obtaining an unfair advantage.

Recent years have seen a substantial increase in the global enforcement of anti-corruption laws, with more frequent voluntary self-disclosures by companies, aggressive investigations and enforcement proceedings, resulting in record fines and penalties, increased enforcement activity, and increases in criminal and civil proceedings brought against companies and individuals.

We operate through subsidiaries in Kazakhstan, Uzbekistan, Kyrgyzstan, Cyprus, Germany, the United Kingdom, United States, Greece, Spain, France, Poland, Armenia, Azerbaijan, Turkey and United Arab Emirates. Enforcement officials generally interpret anti-corruption laws to prohibit, among other things, improper payments to government officials such as those of the ARDFM, CySEC, FINRA, the Federal Financial Supervisory Authority of Germany (“BaFIN”), the Center for Coordination and Development of Securities Market of the Republic of Uzbekistan, which are the principal regulatory bodies that control and monitor our operations in the respective countries in which we operate. Our internal policies and those of our subsidiaries provide for training and compliance with all applicable anti-corruption laws and regulations. Despite our training and compliance programs, it is possible that our employees, agents or independent contractors may cause us or a subsidiary to violate applicable laws. In the event that we believe or have reason to believe that our employees, agents or independent contractors have or may have caused us or a subsidiary to violate applicable anti-corruption laws, we may be required to investigate or have

outside counsel investigate the relevant facts and circumstances, which can be costly and require significant time and attention from senior management. Non-compliance with these laws may result in criminal or civil penalties, which could result in a material adverse effect on our business, financial condition, result of operations and cash flows.

A failure by our subsidiaries to meet capital adequacy and liquidity requirements could affect our operations and financial condition.

As a condition to maintaining our licenses to conduct brokerage and banking activities, some of our subsidiaries must meet ongoing capital and liquidity standards, which are subject to evolving rules and qualitative judgments by government regulators regarding the adequacy of their capital and internal assessment of their capital needs. These net capital rules may limit the ability of each subsidiary to transfer capital to us. New regulatory capital, liquidity, and stress testing requirements may limit or otherwise restrict how each subsidiary utilizes its capital and may require us to increase our capital and/or liquidity or to limit our growth. Failure by our subsidiaries to meet minimum capital requirements could result in certain mandatory and additional discretionary actions by regulators that, if undertaken, could adversely affect the licenses of our subsidiaries, as well as our business, financial condition, results of operations, and cash flows.

The countries in which we operate have changing regulatory regimes, regulatory policies, and interpretations.

The countries in which we operate have differing, and sometimes conflicting, regulatory regimes governing the delivery of financial services in each country, the transfer of funds to and from such countries, and other aspects of the broker-dealer, finance, investment, banking, and insurance industries. In some jurisdictions where we operate, these provisions were promulgated during changing political circumstances, are continuing to change and may be relatively untested, particularly insofar as they apply to foreign investments by residents of various countries.

Therefore, there may exist little or no administrative or enforcement history or established practice that can aid us in evaluating how the regulatory regimes may impact our operations or our customers. It is possible that governmental policies will change or that new laws and regulations, administrative practices or policies, or interpretations of existing laws and regulations including those governing capital, liquidity, leverage, long-term debt, margin requirements, restrictions on leveraged lending or other business practices, reporting requirements and tax burdens will materially and adversely affect our activities in one or more of the countries where we operate. Further, since the history and practice of industry regulation is limited in a number of jurisdictions where we operate, our activities may be particularly vulnerable to the decisions and positions of individuals, who may change, be subject to external pressures, or administer policies inconsistently. Internal bureaucratic politics may have unpredictable and negative consequences. If we fail to develop and maintain good working relationships with local regulators, or a local regulator determines that we have violated local laws in a particular market it could negatively impact our businesses in that market and our reputation generally.

Our revenue and profitability could be affected by changes to rules and regulations that impact the business and financial sectors generally, including changes to the laws governing foreign ownership, electronic commerce, customer privacy and security of customer data. In addition, changes to laws, rules and regulations or changes in the enforcement of existing laws, rules or regulations, could:

•limit the lines of business we conduct;

•require us to reduce our ownership stake in a subsidiary;

•compel us to terminate certain lines of business in affected jurisdictions;

•require us to reduce our investment position in a particular instrument;

•result in material cost increases including our cost of capital;

•otherwise adversely affect our ability to compete effectively with other institutions that are not similarly impacted;

•require us to modify existing business practices;

•force us to relocate operations or personnel;