POULTON & YORDAN

ATTORNEYS AT LAW

RICHARD T. LUDLOW

January 19, 2016

H. Roger Schwall

Assistant Director

Official of Natural Resources

United States Securities and Exchange Commission

Division of Corporate Finance

Washington, D.C. 20549

|

|

Re:

|

BMB Munai, Inc.

|

|

|

Form 8-K

|

Response Dated December 23, 2015

File No.: 001-33034

Dear Mr. Schwall:

At the request of the management of BMB Munai, Inc., (the “Company” or “BMBM”) we are responding to comments raised by the staff (the “Staff”) at the Securities and Exchange Commission (the “Commission”) in your letter dated January 12, 2016.

We have incorporated the Staff’s comments into this letter in bold italics and the Company’s responses are set forth below.

Overview, page 5

|

1.

|

We note your response to our prior comment 2. Please expand your disclosure to identify the intermediary.

|

The Company proposes to amend the Form 8-K by removing in its entirety the third paragraph under the heading “Form 10-Item 1. Business”, “Overview” on page 5 of the Form 8-K and replacing it with the following:

| POULTON & YORDAN | TELEPHONE: 801-355-1341 | |

| 324 SOUTH 400 WEST, SUITE 250 | FAX: 801-355-2990 | |

| SALT LAKE CITY, UTAH 84101 | POST@POULTON-YORDAN.COM |

Mr. H. Roger Schwall

Securities and Exchange Commission

January 19, 2016

Page 2

“We believe the Freedom Companies serve an emerging capitalistic and investing segment of the economies of Russia and Kazakhstan that is interested in saving, investing, and diversifying risk through foreign investment. Under the existing regulatory regimes in Russia and Kazakhstan, Freedom RU and Freedom KZ are limited in their ability to grant their customers access to the U.S. securities markets. Currently, Freedom RU and Freedom KZ introduce their customers that want to execute securities transactions in U.S. securities to an intermediary in Cyprus, FFINRU Investments Limited, a Cyprus limited company (“FFINRU”). FFINRU is owned by Mr. Turlov and is operating pursuant to an informal interim licensing agreement. FFINRU introduces these customers to Lek Securities Corporation (“Lek”), New York, New York, and London, United Kingdom, founded in 1990, a licensed U.S. clearing broker-dealer and FINRA member that executes the customers’ orders and clears the transactions. At such time that Freedom CY activates its full license, which was issued in May 2015, customers using the services of the current Cyprus firm will be given the opportunity to open accounts through Freedom CY as well. We do not propose to acquire FFINRU.”

Completion of Acquisition or Disposition of Assets, page 3

|

2.

|

We note your proposed revised disclosure regarding the possible implications of being a “controlled company.” Please also disclose that Mr. Turlov currently has sole voting and operating control over the company.

|

The Company proposes to revise the disclosure set forth under “Item 2.01- Completion of Acquisition or Disposition of Assets” on page 3 of the Current Report on Form 8-K filed on November 23, 2015 (the “Form Original 8-K”) to add the following disclosure after the second paragraph of Item 2.01:

“Upon execution of the Acquisition Agreement, Mr. Turlov was issued 224,551,913 shares of BMBM’s common stock, which constituted approximately 80.1% of its outstanding common stock after giving effect to the acquisition of FFIN. As a result, Mr. Turlov currently has sole voting control of BMBM. Mr. Turlov’s ownership interest may increase to up to 95% of the outstanding common stock of BMBM if the acquisitions of the Freedom Companies are successfully completed. As the Chief Executive Officer, Mr. Turlov also has operating control over BMBM.

As a result of Mr. Turlov’s acquisition of greater than 50% of the voting power of BMBM, BMBM became a “controlled company” under the corporate governance standards of the New York Stock Exchange (“NYSE”) and the Nasdaq Stock Market (“NASDAQ”). Controlled companies are exempt from compliance with the listing standards of the NYSE and NASDAQ regarding majority board independence or the independence requirements relating to certain compensation and nominating committee decisions, and in the case of the NYSE, corporate governance committees. BMBM is not currently subject to the corporate governance standards of the NYSE or NASDAQ, but should it at some future date become subject to such standards while still being a controlled company, BMBM could be eligible to take advantage of the exemptions from compliance with such corporate governance standards.”

Mr. H. Roger Schwall

Securities and Exchange Commission

January 19, 2016

Page 3

The Company will include the risk factor proposed in our response to your prior Comment 1 in our letter dated December 23, 2015. The Company also proposes to add an additional risk factor disclosing substantially the following substance:

“Mr. Turlov has control over key decision making as a result of his ownership of a majority of our voting stock.

Mr. Turlov, our Chief Executive Officer and Chairman of our board of directors, beneficially owns approximately 80.1% of our outstanding common stock, which could increase to as much as 95%. Mr. Turlov currently has sole voting control of the Company and can control the outcome of matters submitted to stockholders for approval, including the election of directors and any merger, consolidation, or sale of all or substantially all of our assets. In addition, Mr.Turlov has the ability to control the management and affairs of BMBM as a result of his position as our CEO and his ability to control the election of our directors. Additionally, in the event that Mr. Turlov controls our Company at the time of his death, control may be transferred to a person or entity that he designates as his successor. As a board member and officer, Mr. Turlov owes a fiduciary duty to our stockholders and must act in good faith in a manner he reasonably believes to be in the best interests of our stockholders. As a stockholder, even a controlling stockholder, Mr. Turlov is entitled to vote his shares in his own interests, which may not always be in the interests of our stockholders generally.

Exhibits, page 50

|

3.

|

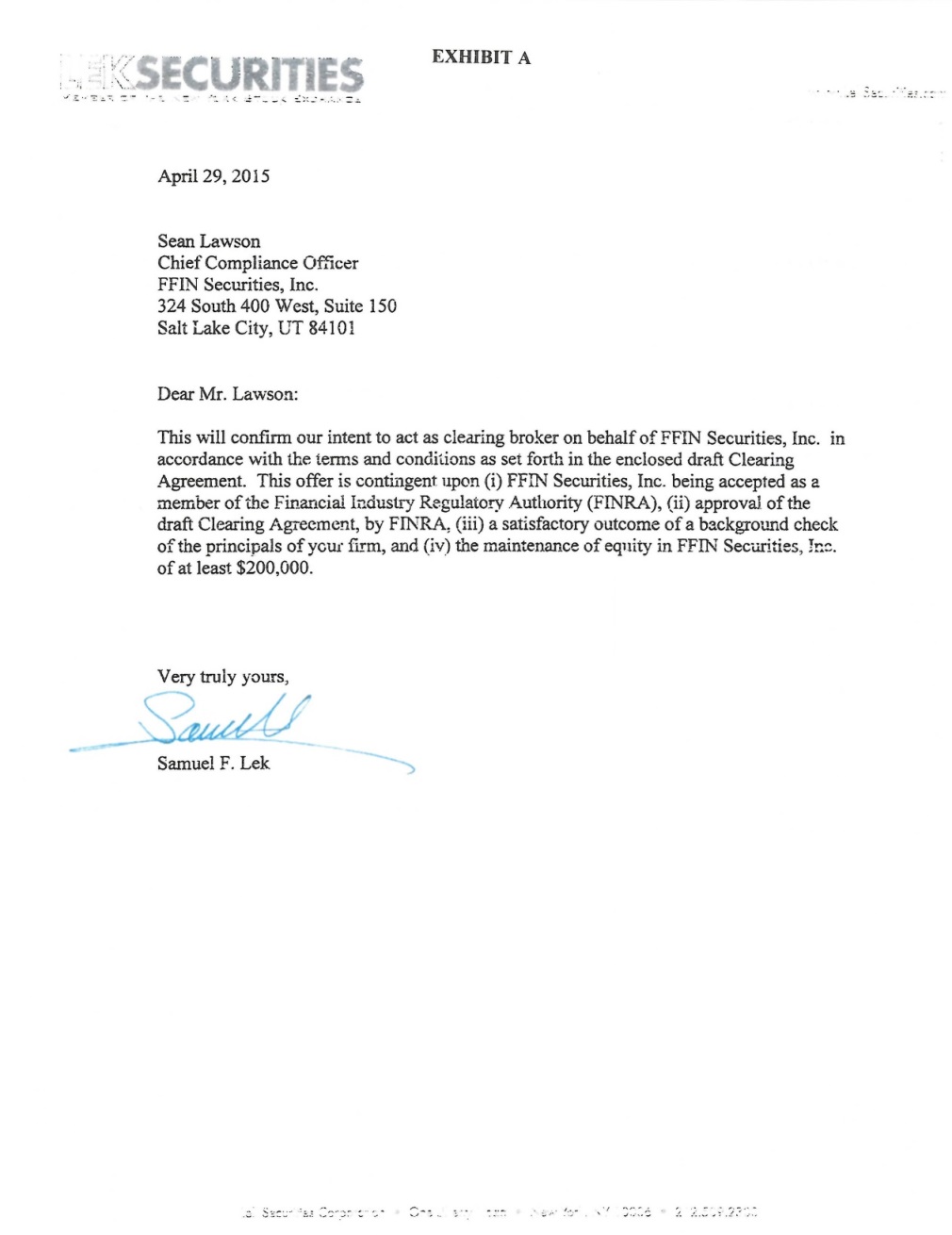

Provide us with the letter of intent and explain under what contractual arrangements Lek Securities Corporation will provide you with clearing services.

|

Attached hereto as Exhibit A, please find a letter dated April 29, 2015 confirming Lek Securities Corporation’s intent to act as a clearing broker on behalf of FFIN Securities, Inc. As you can see, entry into a definitive clearing agreement with Lek is subject to various conditions, including (i) FFIN Securities being accepted as a member of FINRA, and (ii) approval of the “draft Clearing Agreement” by FINRA.

Attached hereto as Exhibit B is the draft Clearing Agreement provided to FFIN Securities by Lek Securities for your review of the currently proposed contractual arrangements pursuant to which Lek Securities would provide clearing services to FFIN Securities. As noted above, any clearing agreement between Lek Securities and FFIN Securities must receive FINRA approval prior to execution and FFIN Securities must have bene accepted as a FINRA member prior to execution of a clearing agreement. There is no guarantee FINRA won’t require changes to the attached draft Clearing Agreement, or that FFIN Securities will be accepted as a member of FINRA, both of which are beyond the control of FFIN Securities and Lek Securities. If and when FFIN Securities is admitted as a member of FINRA and a definitive clearing agreement is approved by FINRA and entered into with Lek Securities, a copy of such clearing agreement will be filed with the Commission in accordance with the requirements of Item 601 of Regulation S-K.

Mr. H. Roger Schwall

Securities and Exchange Commission

January 19, 2016

Page 4

FFIN Securities, Inc.

Financial Statements for the Three and Six Months Ended September 30, 2015, page F-14

|

4.

|

We reissue prior comment 7 as a statement of operations and a statement of cash flows for the period from August 25, 2014 (inception) – September 30, 2014 should be presented to comply with Rule 8-03 of Regulation S-X.

|

The Company will amend the Form 8-K to provide a statement of operations and a statement of cash flows for the period from August 25, 2014 (inception) – September 30, 2014 in compliance with Rule 8-03 of Regulation S-X.

Thank you for your assistance in this matter. If you have any questions or require additional information, please contact me directly.

| Very truly yours,

POULTON & YORDAN

/s/ Richard T. Ludlow

Richard T. Ludlow

Attorney at Law

|

DRAFT

EXHIBIT B

CLEARING AGREEMENT

To: FFIN Securities, Inc.

This will confirm our agreement with you (hereinafter referred to as "you" or the "Introducing Broker" or FFIN Securities, Inc., or "FFIN") under the terms of which we will, upon submission to and approval of this Fully Disclosed Clearing Agreement (the "Agreement"), by the Financial Industry Regulatory Authority (“FINRA”) act as clearing agent (hereinafter sometimes referred to as "we", "Clearing Broker" or "Lek Securities Corporation" or “LSC”) for accounts which you will introduce to us and which will be carried by us on a fully disclosed basis.

The following are the terms and conditions which shall govern our relationship:

I. REPRESENTATIONS AND WARRANTIES

(a) Representations and Warranties of the Introducing Broker:

|

1.

|

FFIN is, and during the term of this Agreement will at all times be, duly registered and in good-standing as a Broker-Dealer with the Securities and Exchange Commission (the "SEC"), and a member in good-standing of FINRA.

|

|

2.

|

Introducing Broker is in compliance, and during the term of this Agreement will at all times be in compliance, with the registration, qualification, capital, financial reporting and other requirements of every self-regulatory organization (“SRO”) of which it is a member and of every governmental agency or authority to whose jurisdiction it is subject.

|

|

3.

|

Introducing broker will not introduce any accounts to LSC for which it is not itself the responsible broker dealer or act as an intermediary in obtaining clearing services from LSC.

|

(b) Representations and Warranties of Lek Securities Corporation:

|

1.

|

Lek Securities Corporation is, and during the terms of this Agreement will at all times be, duly registered and in good-standing as a Broker-Dealer with the SEC and as a member firm in good-standing of FINRA, which is Lek Securities Corporation's designated examining authority (“DEA”).

|

|

|

2.

|

Lek Securities Corporation is, and during the terms of this Agreement will at all times be in compliance with the registration, qualification, capital, financial reporting, customer protection and other requirements of every SRO of which it is a member and of every governmental agency or authority to whose jurisdiction it is subject; and capable in terms of its operations and financial condition to properly clear and carry fully disclosed accounts for the benefit of the Introducing Broker and its customers.

|

(c) Representations and Warranties of Each Party:

|

1.

|

Each of the parties to this Agreement agrees that it shall promptly notify the other should it become enjoined, suspended, prohibited or otherwise unable to engage in the securities business or any part of it, or its business or operations be limited or suspended or conditions imposed upon its further operation as a result of an administrative or judicial proceeding or action by the SEC or any SRO organization or government agency or authority having jurisdiction over either the Clearing Broker or Introducing Broker, or if any representation or warranty made by it in paragraphs (a) through (c) of this Part I is or becomes false, inaccurate or incorrect.

|

II. CUSTOMER ACCOUNTS

(a) General Procedures

As may be applicable under FINRA Rule 4311:

|

1.

|

It shall be the responsibility of Introducing Broker in connection with the opening, approving and monitoring of accounts, to obtain, verify and maintain original account documentation in accordance with the Securities Exchange Act of 1934 (the “Exchange Act”) Rule 17a-4 and any other applicable rules relating to retention of records, have knowledge of customers and each customer's investment objectives, to approve or reject new accounts, to review orders and/or accounts, to supervise orders and/or accounts, to furnish investment advice, to handle and supervise discretionary accounts, if any, or handle accounts for employees or officers of member organizations, SROs and other financial institutions, if any. The Introducing Broker may elect to use its own new account forms and supporting documents with the written approval of such forms by the Clearing Broker.

|

|

2.

|

It shall be the responsibility of Introducing Broker to ensure that cash and/or securities required for all transactions in accounts are available prior to or on the settlement date. For all margin accounts, after the initial transaction, it shall be Lek Securities Corporation's responsibility to monitor the adequacy of the margin and, upon two (2) hours prior written notice to Introducing Broker of any margin call, Lek Securities Corporation shall have the sole discretion as to the circumstances under which any and all securities in any under-margined account shall be liquidated. All unsecured debits resulting in Introducing Broker's accounts, either from liquidations, failure to deliver securities, or customer's failure to pay such debits shall be the responsibility of the Introducing Broker and shall be paid over to the Clearing Broker within two business days after written notice to Introducing Broker. Failure to comply with the provisions of this Section II may result in; (i) withholding of or an offset of such amount from the Introducing Broker's commission; and/or (ii) prohibiting Introducing Broker from executing trades. Introducing Broker has the responsibility for assuring that securities sold for any introduced accounts or any account of the Introducing Broker are available or delivered to Lek Securities Corporation on or before settlement date in "good delivery" form. If securities in introduced accounts are "restricted" or "control stock" as defined by the rules of the SEC, all orders executed for such securities must be in compliance with applicable law, rules and regulations.

|

Page 2 of 20

All transactions in any account are to be considered cash transactions until such time as Lek Securities Corporation receives from the Introducing Broker the appropriate forms of margin agreement, option information form, and other documentation as may from time to time be required. Lek Securities Corporation shall have control over all cash accounts, so as to fully comply with the liquidation requirements of accounts under Regulation "T" of the Board of Governors of the Federal Reserve Board and/or any other applicable law or regulation. Lek Securities Corporation agrees to notify the Introducing Broker immediately if any or all of the Securities in any introduced account or any account of the Introducing Broker are to be liquidated in accordance with Regulation T.

|

3.

|

It shall be Lek Securities Corporation's responsibility to maintain, in accordance with applicable law, books and records of each account, including the maintenance of stock records and/or other applicable records. However, it shall be the responsibility of Introducing Broker to supply Lek Securities Corporation with the information reasonably required by Lek Securities Corporation to discharge this responsibility.

|

|

4.

|

It shall be Lek Securities Corporation's responsibility to arrange for the receipt and delivery of funds and securities including the receipt and delivery of funds and/or securities to and from customers, the transfer of securities and/or accounts, payment of dividends and interest, handling of exchange and/or tender offers, rights, warrants and redemptions. Lek Securities Corporation shall also be responsible for the charging and collection of interest and for the payment of interest for those accounts to whom such interest is accorded. Lek Securities Corporation shall have the responsibility and control for the hypothecation, re-hypothecation and lending of customer securities in accordance with applicable law. Whenever Lek Securities Corporation has been instructed to act as custodian of the securities in any account of Introducing Broker or its customers, or to hold such securities in safekeeping, Lek Securities Corporation may, subject to segregation and record-keeping requirements, hold such securities in the name of Lek Securities Corporation or its nominee or in the names of nominees of any depository used by Lek Securities Corporation.

|

|

5.

|

It shall be Lek Securities Corporation's responsibility, in accordance with Exchange Act Rule 15c3-3 under the Securities Exchange Act of 1934 and other applicable law to safeguard the funds and securities of customers of the Introducing Broker.

|

|

6.

|

Lek Securities Corporation will prepare and send to the Introducing Broker's customers (and to Introducing Broker for its accounts) daily purchase and sale confirmations and periodic statements of account as required, in the name of and on behalf of the Introducing Broker. This may be in either electronic or hardcopy format.

|

|

7.

|

Introducing Broker shall be responsible for the acceptance and transmission of customer securities transactions, including the responsibility to accept or reject orders, establishing appropriate procedures for transmission of completed orders, and for the screening of orders prior to their transmission to Lek Securities Corporation for clearing and settlement.

|

Page 3 of 20

|

8.

|

Introducing Broker shall be responsible for all orders which it executes on behalf of introduced accounts or for its own account or if orders are executed by a designated third party. If the Introducing Broker designates Lek Securities Corporation as the executing broker, Lek Securities Corporation may record all verbal orders received and may use such recordings to determine responsibility for any errors or omissions.

|

|

9.

|

The Introducing Broker shall be responsible for the satisfactory completion of all over-the-counter orders executed by itself or its designated agent, but Lek Securities Corporation shall clear and settle all such trades.

|

(b) Additional Procedures

|

1.

|

To the extent that a particular function under FINRA Rule 4311 is allocated to either the Clearing Firm or Introducing Broker, the other party shall supply all appropriate data in its possession pertinent to the proper performance and supervision of that function. The parties agree to make available during normal business hours, whatever required books, records, or information may be needed by the other so as to complete inquiries by any SRO, or governmental agency or to fulfill its obligations under this Agreement. At the same time as Lek Securities Corporation dispatches confirmations, periodic statements of account, notices of any matter or any other communication or correspondence to a customer of Introducing Broker, Lek Securities Corporation shall furnish copies of same to Introducing Broker.

|

|

2.

|

Lek Securities Corporation and Introducing Broker are accountable for the actual performance of all functions performed or required to be performed by their respective agents, or employees and other associated persons as well as overall supervision of the functions and activities performed or required to be performed pursuant to this Clearing Agreement, FINRA Rule 4311 and all applicable law.

|

|

i

|

All inquiries concerning extensions of credit, maintenance of books and records, receipt and delivery of funds and securities, safeguarding of funds and securities and confirmations and periodic statements shall be directed to Lek Securities Corporation.

|

|

ii

|

All customer inquiries concerning the opening, approving or monitoring of accounts and the acceptance and execution of transactions shall be directed to the Introducing Broker.

|

|

iii

|

Any other inquiry shall be directed initially to the Introducing Broker.

|

|

iv

|

Copies of all written customer complaints received by Lek Securities Corporation regarding the functions allocated to either party will be furnished to Introducing Broker and its DEA. In addition, Lek Securities Corporation will confirm the receipt of such complaint to the customer and advise such customer that the complaint has been forwarded to the Introducing Broker and the specific DEA.

|

Page 4 of 20

|

3.

|

Each party agrees to defend, indemnify and hold the other party (the “Indemnifying Party”) harmless for any and all losses, costs, and expenses and any sums paid in settlement of any claim, including attorney’s fees, costs of experts and accounting fees that the other party may incur by reason of any actual or alleged failure to properly perform any obligation set forth in this Agreement, any gross negligence, willful misconduct, or error in performance or failure to perform in a proper and timely manner the functions set forth in this Agreement or any breach thereof. For the purpose of this indemnification clause a party shall include the party’s officers, directors, employees, agents, assigns and contractors, hereinafter each referred to as an “Indemnified Person”.

|

In case any proceeding (including any arbitration, regulatory, or governmental investigation) shall be instituted involving any Indemnified Person, such Indemnified Person will promptly notify the Indemnifying Party in writing and the Indemnified Person shall be permitted to retain its own counsel and control its legal defense, notwithstanding the Indemnifying Party’s duty to indemnify. It is understood that the Indemnifying Party shall not, in connection with any proceeding or related proceedings in the same jurisdiction, be liable for the fees and expenses of more than one law firm (in addition to local counsel) for all Indemnified Persons, and that all such fees and expenses shall be reimbursed as they are incurred.

The Indemnifying Party shall not be liable for any settlement of any proceeding affected without its written consent, which shall not be unreasonable withheld, but if settled with such consent, or if there shall be a final judgment for the plaintiff, the Indemnifying Party agrees to indemnify the Indemnified Person from and against any loss or liability by reason of such settlement or judgment. Notwithstanding the foregoing sentence, if at any time an Indemnified Person shall have requested the Indemnifying Party to reimburse the Indemnified Person for fees and expenses of counsel as contemplated in this Section, the Indemnifying Party agrees that it shall be liable for any settlement of any proceeding effected without its written consent if (i) such settlement is entered into more than 30 days after receipt by the Indemnifying Party of the aforesaid request, or (ii) the Indemnifying Party shall not have reimbursed the Indemnified Person in accordance with such request prior to the date of such settlement.

The Indemnifying Party shall not, without the prior written consent of the Indemnified Person, affect any settlement of any pending or threatened proceeding in respect of which any Indemnified Person is or could have been a party and indemnity could have been sought hereunder by such Indemnified Person, unless such settlement includes an unconditional release of such Indemnified Person from all liability on claims that are the subject matter of such proceeding. The Indemnifying Party duty to defend, indemnify and hold harmless shall remain in full effect even if the Indemnified Person or the Indemnifying Party prevails in litigation or is found not to have engaged in any wrongdoing or the action or proceeding is withdrawn.

Page 5 of 20

|

4.

|

Lek Securities Corporation shall have the right to debit Introducing Broker's commission accounts or clearing deposit account with any indebtedness to Lek Securities Corporation arising under this Agreement not paid by Introducing Broker within five (5) days of written demand for payment by Lek Securities Corporation. Such debit shall be reflected on the monthly commission statement rendered by Lek Securities Corp.

|

|

5.

|

Within thirty (30) days of the execution of the Agreement the Introducing Broker shall supply on its stationery, in a form acceptable to Lek Securities Corporation, a copy of the notice, sent to each of the Introducing Broker's customers and to be sent at the time of opening each new account, notifying such customer of the existence of this Agreement and the responsibility of Introducing Broker and Lek Securities Corporation to the customer, so as to fully comply with the notice provisions of FINRA Rule 4311.

|

|

6.

|

Solely for the purposes of the Securities Investors Protection Act and the SEC's financial responsibility rules and for no other purpose, the Introducing Broker's customers are customers of Lek Securities Corporation and not of the Introducing Broker.

|

|

7.

|

Lek Securities Corporation will issue periodic account statements directly to Introducing Broker’s customers. Such statements will disclose the nature of the relationship between the entities, and contain the name and telephone number of the responsible department at Lek Securities Corporation to whom a customer can direct inquiries regarding the maintenance of the customer’s account. The periodic statement will disclose that customer funds or securities are held by Lek Securities Corporation and not the Introducing Broker.

|

III. EXECUTION, CLEARING AND ASSOCIATED FEES

All commissions and fees are to be negotiated directly between the Introducing Broker and its customers. Lek Securities Corporation will not participate in such negotiations. Lek Securities Corporation shall be paid for services it performs pursuant to this Agreement in the amounts as set forth in Schedule A, attached hereto and made a part hereof.

(a) The fees in all cases shall include execution and clearing of all transactions in U.S. and overseas on which Lek Securities Corporation has a membership or can access foreign markets through other relationships with foreign broker or dealers. All orders are to be entered through the ROX® System, or such markets where the Introducing Broker shall direct its business, at its own expense, which shall be cleared by Lek Securities Corporation.

(b) The fees do not include exchange transaction fees, service charges, or other charges which the Introducing Broker may be required to pay by virtue of its membership, association or arrangement.

Page 6 of 20

(c) On over-the-counter orders executed by the Introducing Broker or its designated agent for out-of-town delivery, interest and draft charges shall be charged by Lek Securities Corporation to the Introducing Broker but only if the subject security is not eligible for processing through either the National Securities Clearing Corporation ("NSCC") or Depository Trust Company ("DTC") and such contra broker or dealer is not, and its clearing agent or correspondent is not, a participant in either NSCC or DTC or an interfacing agency of either of them.

(d) Lek Securities Corporation will provide to Introducing Broker daily and monthly statements of charges for execution and clearing services performed by Lek Securities Corporation for Introducing Broker.

(e) Lek Securities Corporation shall by the fifteenth business day of each calendar month pay over to the Introducing Broker all commissions, interest or other monies received or collected by Lek Securities Corp. for or on its behalf during the previous calendar month less any deductions pursuant to this Agreement. Lek Securities Corporation may make periodic payments to Introducing Broker against such commissions in advance of the monthly settlement date. Lek Securities Corporation may offset from such remittances any monies due from the Introducing Broker to Lek Securities Corporation.

IV. CLEARING DEPOSIT

(a) The Introducing Broker shall provide a Clearing Deposit of $100,000.00 in cash (upon which Lek Securities Corporation shall pay interest at prevailing rates) or marginable securities. The deposit with Lek Securities is for the purpose of establishing a collateral account which the Introducing Broker agrees to maintain a minimum balance of $100,000.00 at all times. The deposits are subject to periodic review and may be adjusted at the sole discretion of Lek Securities Corporation based upon such review and after providing five (5) business days written notice to the Introducing Broker. The Deposits do not represent an ownership interest or any investment by the Introducing Broker in Lek Securities Corporation. If Lek Securities Corporation should require an increase in the deposit there should be a stated reason, such as, change in business mix or profile. Additionally, FFIN should be given a reasonable amount of time to meet the new deposit or make sufficient arrangements at another clearing house with no termination fees.

(b) Forthwith upon request of Clearing Broker, Introducing Broker will pay any margin requirement based on DTCC’s “Value-At-Risk Volatility” calculation pertaining to Introducing Broker’s customers; insofar the margin requirement exceeds the Clearing Deposit. This margin requirement is a measure of volatility risk for unsettled positions and is performed daily by the DTCC. All payments required to be made pursuant to this section will be paid by Introducing Broker on same day as margin call by means of an electronic wire transfer.

(c) Within thirty (30) days after the termination of this Agreement, Lek Securities Corporation shall refund to the Introducing Broker the Clearing Deposit plus any accrued interest thereon less any unpaid charges, costs and expenses and a reasonable reserve, if any, for any known or expected additional costs, expenses or charges arising out of the clearing relationship. Any withholding under this subparagraph (c) shall be explained in writing to Introducing Broker. Lek Securities Corporation may withhold such a reserve related to any open dispute or balances owed, after the Introducing Broker has been notified in writing previously of such amount or amounts and has had an opportunity within a period during the thirty days subsequent to termination to remedy such dispute or make any necessary or negotiated payment.

Page 7 of 20

V. NSCC ILLIQUID CHARGES

(a) The parties recognize that the NSCC may demand excessive margin for securities that are not listed on a national securities exchange and that the imposition of these margin requirements may place an extreme drain on LSC’s liquidity. Accordingly, Introducing Broker agrees to reasonably limit its trading in these securities so as not to create an illiquid charge in excess of $1,000,000.

(b) If Introducing Broker nevertheless creates a greater charge, Introducing Broker understands and agrees that this will cause LSC to incur significant costs that are difficult to measure as such larger charges will expose LSC to liquidity drains that will cause substantial risk to LSC’s business. Although the cost of being forced to accept this risk is difficult to measure, it is nevertheless clear that the requirement for LSC to assume this risk entitles LSC to compensation. Accordingly, it is agreed between the parties that if for any reason Introducing Broker creates an illiquid charge in excess of one million dollars, Introducing Broker will owe compensation to LSC as follows:

(c) For each day that the illiquid charge attributable to Introducing Broker’s trading activity at NSCC is greater than $1,000,000, Introducing Broker will pay compensation to LSC equal to 25 basis points (0.25%) of the illiquid charge assessed by NSCC for each day that the charges is assessed for as long as it is assessed. This provision is in addition to interest charges imposed by LSC on all margins that LSC is required to post at NSCC and other clearing houses on account of Introducing Broker’s trading activity. It is Introducing Broker’s responsibility to be aware of illiquid charges and to the extent these charges cannot be accurately predicted, Introducing Broker assumes the risk of the unpredictability of the charge.

VI. PROPRIETARY ACCOUNTS OF BROKER ("PAB")

Pursuant to the SEC’s No-Action Letter (the "No-Action" Letter), dated November 3, 1998, relating to the net capital treatment of assets in proprietary accounts of introducing brokers ("PAB"), the Introducing Broker may treat assets in its PAB as allowable assets for its net capital computation provided that it and Lek Securities Corporation agree to comply with certain procedures and perform certain calculations, and that notification of this agreement is made to the Introducing Broker's DEA within two days of execution of the agreement.

(a) Lek Securities Corporation will perform a separate computation for PAB assets ("PAB Reserve Computation") of the Introducing Broker in accordance with the customer reserve computation set forth in Exchange Act Rule 15c3-3 ("Customer Reserve Formula") with certain modifications as outlined in the No-Action Letter.

Page 8 of 20

|

1.

|

Any credit (including a credit applied to reduce a debit) that is included in the customer reserve formula cannot be a credit in the PAB reserve computation;

|

|

2.

|

Note E(3) to Exchange Act Rule 15c3-3a which reduces debit balances by 1% under the basic method and subparagraph (a) (1) (ii) (A) of the net capital rule which reduces debit balances by 3% under the alternative rule will not apply; and

|

|

3.

|

Note E(1) to Exchange Act Rule 15c3-3a nor NYSE Interpretation 04 to Item 10 of Exchange Act Rule 15c3-3a regarding securities concentration charges is applicable to the PAB reserve computation.

|

(b) The PAB reserve computation will include all the proprietary accounts of the Introducing Broker. All PAB assets will be kept separate and distinct from customer assets under the Customer Reserve Computation set forth in Exchange Act Rule 15c3-3.

(c) The PAB Reserve Computation will be prepared within the same time frames as those prescribed by Exchange Act Rule 15c3-3 for the Customer Reserve Formula.

(d) Lek Securities Corporation will establish and maintain a separate "Special Reserve account for the Exclusive Benefit of PAB Customers" with a bank in conformity with the standards of Exchange Act Rule 15c3-3 (I) ("PAB Reserve account"). Cash and/or qualified securities as defined in such rule will be maintained in the PAB Reserve account in an amount equal to the PAB reserve requirement.

(e) A PAB reserve deposit requirement can be satisfied by excess debits in the customer reserve formula of the same date. However, a customer reserve deposit requirement cannot be satisfied with excess debits from the PAB reserve computation of the same date.

(f) Introducing Broker must notify its DEA in writing that it has entered into a PAB Agreement with Lek Securities Corporation, within two (2) days of executing such agreement.

(g) Commissions receivable and other receivables of the Introducing Broker from Lek Securities Corporation (excluding clearing deposits) that are otherwise allowable assets under the net capital rule are not to be included in the PAB Reserve Computation provided the amounts have been clearly identified as receivable on the books and records of the Introducing Broker and as payables on the books of the clearing broker.

(h) The proprietary account of an introducing broker that is a guaranteed subsidiary of the clearing broker, or who guarantees Lek Securities Corporation, is to be excluded from the PAB reserve computation.

(i) Upon discovery that any deposit to the PAB Reserve Bank account did not satisfy the deposit requirements, Lek Securities Corp. must immediately notify its DEA and the Commission by facsimile or by telegram. In addition, notification to its introducing brokers is to be made. Unless a corrective plan is found acceptable by the Commission and the DEA, Lek Securities must provide immediate written notification to its introducing brokers that PAB assets held by LSC will not be deemed allowable assets for net capital purposes. The letter should also state that if the introducing broker wishes to continue to count its PAB assets as allowable, it has until the last business day of the month following the month in which the notification was made to transfer all PAB assets to another clearing broker. However, if the deposit deficiency is remedied before the time at which introducing broker must transfer its PAB assets to another clearing broker, the introducing broker may choose to keep its assets at Lek Securities Corporation.

Page 9 of 20

VII. COMPLIANCE

(a) All transactions hereunder are subject to the Constitution, Rules, by-laws, regulations and customs, and any amendments thereto of the market or stock exchange and any clearing facility where executed, and also the SEC, applicable SROs and any state and Federal laws or regulations applicable thereto, and shall be complied with by the party whose function is subject thereto.

(b) In the event of any dispute that may arise, Introducing Broker and Lek Securities Corporation agree to arbitrate the dispute through the medium of the FINRA Dispute Resolution System in New York City, New York, and in accordance with the rules of arbitration of FINRA and the laws of the State of New York.

(c) Each party has the sole responsibility for supervision of the activities of its officers, directors, registered representatives and employees, including, but not limited to those responsibilities outlined in Section I hereof.

(d) Introducing Broker has the exclusive responsibility in connection with all matters involving the investment objectives of its customers and the suitability of the investments they make, and the frequency of their transactions.

(e) Each party will have full responsibility for its own compliance with state securities laws and other state laws applicable to its activities.

(f) Introducing Broker and Lek Securities Corporation shall each be responsible for customary compilation, preparation and filing of their own regulatory reports including all Financial and Operational Combined Uniform Single (“FOCUS”) reports which may be required by the SEC or their respective memberships on any exchanges, associations or SROs.

(g) Introducing Broker shall provide Lek Securities Corporation with copies of all FOCUS reports. Introducing Broker shall comply with this requirement by including Lek Securities Corporation as an electronic destination for FOCUS filings sent electronically to the FINRA. These reports will be not be made public record and will be kept in strict confidence.

(h) Lek Securities Corporation will provide Introducing Broker, at the time of execution of this Agreement and annually thereafter, a list of all reports (e.g., exception-type reports) that it offers to Introducing Brokers. The Introducing Broker agrees to promptly notify Lek Securities Corporation, in writing, of the specific reports that it elects to receive. Additionally, Lek Securities Corporation agrees:

Page 10 of 20

|

1.

|

Pursuant to Exchange Rule 440, to retain and preserve copies of the specific reports requested by and/or supplied to the Introducing Broker or have the capability to (a) recreate copies of reports furnished, or (b) provide the report format and data elements provided in the original reports; and (ii) to give written notice, on an annual basis, within thirty (30) days of July 1st of each year, to the Chief Executive Officer and Compliance Officer of the Introducing Broker of the list of reports offered and those reports actually chosen or supplied to the Introducing Broker as of the date of the notice. A copy of this notice will also be provided to the Introducing Broker's DEA.

|

(i) Introducing Broker shall not be allowed to issue negotiable instruments to its customers for which Lek Securities Corporation is the maker or drawer under FINRA Rule 4311.

VIII. Anti-Money Laundering and OFAC Reporting and Regulatory Obligations

(a) LSC and Introducing Broker each recognizes its respective responsibility to comply, and represents and warrants that it is in compliance, and during the term of the Agreement will remain in compliance, with any applicable federal, state, or foreign anti-money laundering laws and regulations, including the Bank Secrecy Act ("BSA") as amended by the Uniting (and) Strengthening America (by) Providing Appropriate Tools Required (to) Intercept (and) Obstruct Terrorism Act of 2001 (the “PATRIOT Act”); federal, state, and foreign criminal and civil statutes relating to money laundering; rules and regulations of the U.S. Treasury Department, the SEC, state regulatory authorities, and any relevant securities exchange or association or regulatory or SRO, including as applicable FINRA, as well as the sanctions and embargo programs administered by the Office of Foreign Assets Control ("OFAC"). LSC and Introducing Broker each shall establish an anti-money laundering program consistent with all requirements under the PATRIOT Act and its implementing regulations and applicable related SRO rules, including: internal policies, procedures and controls that can be reasonably expected to detect and cause the reporting of suspicious transactions and to otherwise achieve compliance with the BSA and its implementing regulations; independent testing for compliance; ongoing training for appropriate personnel; and the designation of an anti-money laundering compliance officer. Both LSC and Introducing Broker should be in compliance with Exchange Act Rule 17a-8 with respect to financial recordkeeping and reporting of currency and foreign transactions. LSC and Introducing Broker each shall file reports of any financial interest in or signature authority, or other authority over any financial accounts, including bank, securities, or other types of financial accounts in a foreign country, if the aggregate value of these financial accounts exceeds $10,000 at any time during the calendar year, on a Form TD 90-22.1 ("FBAR").

(b) Except for such measures as are specifically allocated by this Agreement to LSC, and LSC’s responsibility to comply with Section 312 of the PATRIOT Act with respect to verifying Introducing Broker itself, Introducing Broker shall be initially and primarily responsible through a principal executive officer or a person designated for undertaking all measures necessary to comply with the requirements of, among others, any applicable anti-money laundering legal and regulatory rules and reporting and record keeping requirements with respect to the accounts including, but not limited to, the following:

Page 11 of 20

|

1.

|

The BSA, including any amendments thereto under the PATRIOT Act, and its implementing regulations, which now require, or which may, in the future, require, among other things:

|

|

i

|

Filing reports of any transaction over $10,000 in currency, including multiple transactions occurring during the course of the same day, on a Currency Transaction Report, Form 4789 ("CTR");

|

|

ii

|

Filing reports of any transportation of more than $10,000 in currency or monetary instruments into or outside of the United States, on a Report of International Transportation of Currency or Monetary Instruments, Form 4790 ("CMIR");

|

|

iii

|

Filing reports of any suspicious activity, on a Suspicious Activity Report ("SAR-SF");

|

|

iv

|

Recordkeeping, including, but not limited to, collection and maintenance of records regarding funds transfers of $3,000 or more and the transmission of certain information with such funds transfers. To the extent that Introducing Broker conducts funds transfers for itself or on behalf of an account through Lek Securities Corporation, Lek Securities will maintain records sufficient to satisfy the requirements under the Federal Funds Transfer Rules.

|

|

v

|

Establishing a customer identification program, which, at a minimum, requires Introducing Broker to verify the identity of any customer seeking to open an account to the extent reasonable and practicable, maintain records of the information used to verify such customer's identity, and consult lists of known or suspected terrorists or terrorist organizations provided by the Financial Crimes Enforcement Network ("FinCEN") to determine whether the prospective customer appears on any such list. To assist Introducing Broker in this process, LSC will utilize vendor databases for the purpose of screening Customers to determine whether a Customer appears on any list of known or suspected terrorists or terrorist organizations provided by FinCEN. Lek Securities Corporation will similarly screen Customers to determine whether a Customer appears on the OFAC List, and will ensure, through a contractual arrangement with its bank, that all wire transfers are screened against the OFAC List. LSC will present any adverse information, where relevant, to Introducing Broker. At or prior to the opening of any new account, and as otherwise requested by LSC, Introducing Broker agrees to obtain sufficient information from its Customer, including obtaining a copy of the passport or other government issued identification document of any non-U.S. individual, to permit LSC to perform such functions. Introducing Broker recognizes that when LSC provides these services, LSC does not thereby assume sole responsibility for OFAC or other reporting or relieve Introducing Broker of any responsibility for such reporting.

|

Page 12 of 20

|

vi

|

Notwithstanding Clearing Broker’s responsibility to comply with section 311 of the PATRIOT Act, conducting special measures imposed by the Secretary of the Treasury by order, rule, regulation or as otherwise required, including additional due diligence for certain customers, accounts or transactions within or involving jurisdictions identified as a primary money laundering concern, additional record keeping and reporting of certain financial transactions and the obtaining and retaining of information relating to the beneficial ownership of certain types of accounts;

|

|

vii

|

Providing information to FinCEN under Section 314(a) of the PATRIOT Act in connection with a mandatory request for information from FinCEN on behalf of a federal law enforcement agency investigating terrorist activity or money laundering. To the extent Introducing Broker is unable to search its own records for the requested information or to retrieve responsive information, and LSC is able to do so, LSC will assist Introducing Broker in responding to any such requests (Nothing in this paragraph vii will limit LSC’s responsibility to itself respond to FinCEN requests);

|

|

viii

|

Performing, if applicable, due diligence and enhanced due diligence policies, procedures and controls for private banking customers, including ascertaining the identity of the nominal and beneficial owners of the account and the source of funds deposited into the account;

|

|

ix

|

Conducting enhanced scrutiny of any accounts, including private banking accounts, requested or maintained by or on behalf of a senior non-U.S. political figure, any member of the figure's immediate family, or any close associate of the figure, as those terms are defined in the PATRIOT Act and its implementing regulations, and in the Interagency Guidance issued by the U.S. Treasury Department in January 2001;

|

|

x

|

Complying with procedures with respect to Introducing Broker accounts as defined by the PATRIOT Act and its implementing regulations, including:

|

|

(1)

|

Due diligence and enhanced due diligence policies, procedures and controls for such accounts;

|

|

(2)

|

A prohibition on establishing, maintaining, administering or managing such accounts in the United States for, or on behalf of, a prohibited "foreign shell bank," as defined in the PATRIOT Act and its implementing regulations;

|

Page 13 of 20

|

(3)

|

For any of Introducing Broker account’s established, maintained, administered, or managed for a non-U.S. bank, (i.e., a "foreign bank" as defined by the PATRIOT Act and its implementing regulations), Introducing Broker will take reasonable steps to ensure that such account is not used directly or indirectly to service foreign shell banks, and will obtain a completed Certification/Recertification Regarding Introducing Broker’s accounts for Foreign Banks ascertaining whether the customer is a prohibited "foreign shell bank" or is indirectly servicing a prohibited "foreign shell bank." Such certification/recertification shall also indicate ownership of the foreign bank and the name and address of a person that resides in the United States and is authorized to accept service of legal process for records regarding such account. Introducing Broker will forward to LSC a copy of any such completed certification/recertification; and

|

|

(4)

|

Prompt notification to LSC upon receipt of written notice requiring the Introducing Broker to terminate a correspondent relationship with a non-U. S. bank where the non-U.S. bank has failed to comply with a summons or subpoena or failed to initiate proceedings in a United States court contesting the same.

|

|

xi

|

Any future anti-money laundering regulations that may impose obligations on Introducing Broker.

|

|

xii

|

Rules of the SEC and the SRO’s relating to anti-money laundering requirements, including but not limited to those relating to the establishment of anti-money laundering programs and the reporting and record keeping requirements of the BSA and its implementing regulations.

|

|

xiii

|

Applicable state reporting and record keeping requirements with regard to certain currency transactions, transportation of currency or monetary instruments, or reports of suspicious activity.

|

|

xiv

|

The federal statutes, regulations, executive orders and other programs administered by OFAC which prohibit, among other things, the engagement in transactions with and the provision of services to certain sanctioned or embargoed foreign countries and other individuals, entities or organizations designated by OFAC on its website (http://www.ustreas.gov/ofac).

|

(c) Introducing Broker recognizes that LSC is relying on Introducing Broker's performance of the procedures specified by its customer identification program with respect to each account. Introducing Broker hereby certifies to LSC that it has implemented an anti-money laundering program, and that it will perform the specified requirements of its customer identification program with respect to each account. Introducing Broker shall renew such certification annually and as otherwise requested by LSC, in a manner specified by LSC.

(d) Introducing Broker shall reasonably furnish LSC with such information, documents and certifications/re-certifications, including customer identification documentation and copies of passports, as are requested by LSC, to permit LSC to satisfy its own obligations under the PATRIOT Act and implementing regulations there under. Clearing Firm reserves the right, to the extent permitted by law, to reject any transaction, or any funds transfer, check or other payment, that raises money laundering, terrorist financing or OFAC concerns, and to freeze or block any assets in any account pursuant to the sanctions and embargo programs administered by OFAC, or as otherwise required by law.

Page 14 of 20

(e) LSC will also provide Introducing Broker data or exception reports to assist Introducing Broker in complying with applicable federal, state, or foreign anti-money laundering laws and regulations. However, Introducing Broker understands that the preparation and/or possession by LSC of surveillance records or data, including exception reports, on behalf of, or for the use of Introducing Broker, shall neither obligate LSC to review such material nor make LSC responsible to know its contents. Where LSC undertakes to review such materials for its own benefit, such activity does not relieve Introducing Broker of the obligation to review such materials or to take appropriate action with respect to any unusual activity that LSC may bring to Introducing Broker's attention.

(f) LSC requires that, to the extent permitted by law, Introducing Broker provide LSC, at the time of filing, with copies of reports or other communications with regard to the accounts filed with the U.S. Treasury Department, the Internal Revenue Service, the U.S. Customs Service or any regulatory body or organization relating to currency transactions, the transfer of currency or monetary instruments into or outside of the United States and suspicious activity, including, but not limited to, Forms CTR, CMIR and SAR-SF. To the extent permitted by law, upon Introducing Broker's request, LSC shall provide Introducing Broker with copies of any such reports it files related to any account. Further, to the extent permitted by law, LSC and Introducing Broker will consult with each other concerning any potentially suspicious transaction conducted or attempted by, at, or through LSC or Introducing Broker involving an account for the purpose of sharing information and determining which party shall file the SAR-SF, if necessary. Upon filing a SAR-SF with respect to any such account, Introducing Broker will inform LSC of any measures Introducing Broker has taken with respect to the account as a result of the activity that is the subject matter of the SAR-SF. LSC reserves the right to make and file such reports where it deems it appropriate in its own interest; and Introducing Broker recognizes that when LSC does so, LSC does not thereby assume sole responsibility for, or relieve Introducing Broker of, any future reporting responsibility, nor does LSC’s filing relieve Introducing Broker of its own responsibility for such reporting where Introducing Broker has not provided LSC with all relevant facts. Furthermore, to the extent that LSC is required to prepare or file any reports or records by any entity that regulates it, Introducing Broker shall reasonably cooperate in providing LSC with any information needed in order to prepare such reports or records.

(g) Introducing Broker, at the written request of LSC, agrees to file a notice pursuant to Section 314 of the PATRIOT Act and the implementing regulations relating to the voluntary sharing of information between Introducing Broker and LSC. Upon filing such notice, Introducing Broker shall forward a copy of the filed notice to LSC. Introducing Broker agrees to comply with all requirements concerning the use, disclosure, and security of information shared pursuant to Section 314 of the PATRIOT Act and its implementing regulations.

Page 15 of 20

(h) In addition to the grounds for termination stated in the Agreement, LSC may take appropriate steps, including but not limited to the immediate termination of the Agreement and/or the liquidation of an account or any portion thereof, upon the failure of Introducing Broker to close the account of a prohibited "foreign shell bank"; or upon failure by Introducing Broker to close an account Introducing Broker maintains for a non-U.S. bank, where Introducing Broker is unable to obtain a required certification or re-certification, or to otherwise obtain or update information concerning the non-U.S. bank, as required by sections 313 and 319 of the PATRIOT Act; or upon notification that Introducing Broker has failed to terminate a correspondent relationship with a non-U.S. bank where the non-U.S. bank has failed to comply with a summons or subpoena, or has failed to initiate proceedings in a United States court contesting same. Introducing Broker shall have five (5) business days to remedy any breach under this subparagraph (h).

(i) Introducing Broker agrees to allow LSC to conduct a background check on its firm and principals and authorized officers.

IX. TERM, MODIFICATION, EXCLUSIVITY AND CANCELLATION

(a) This Agreement, including all Schedules attached hereto, supersedes all other agreements between the parties with respect to the transactions contemplated herein and may not be modified, amended, or assigned except in writing which shall be signed by representatives of both parties. Such modification or amendment shall take effect as of the date of execution of such modification or amendment unless otherwise agreed and this Agreement as modified or amended shall remain in full force and effect.

(b) The term of this agreement shall be two years commencing on the date hereof and terminating on the second anniversary of the date hereof, where after either party may terminate this Agreement without cause by notification in writing which shall take effect no less than sixty (60) days after such notice. If not so terminated, the agreement will be deemed to have been automatically renewed for an additional term of two years.

(c) In consideration of LSC accepting Introducing Broker and agreeing to provide the services as contemplated by this agreement, Introducing Broker agrees that it will not enter into a clearing arrangement with another broker dealer and that it will use LSC as its exclusive clearing broker for a period of two years from the date hereof. LSC and Introducing Broker will employ their best efforts to expeditiously transfer all of Introducing Broker’s accounts from Introducing Broker’s current clearing firm to LSC and the parties agree that this process should be completed within three months from the date hereof. Notwithstanding the foregoing, nothing in this clause shall prevent Introducing Broker from employing the services of another clearing firm for services LSC is unable or unwilling to provide in a commercially reasonable manner, or if this agreement is terminated by LSC. In the event that Lek Securities Corporation shall adjust its business practices or the Introducing Brokers business practices in a way as to materially affect the viability or the business line of the Introducing Broker, than the Introducing Broker may terminate this Agreement at any time, without incurring any termination fee. The termination fee shall be one half of the minimum monthly amount that LSC would have earned if Introducing Broker had not exclusively used LSC until the scheduled termination date. Any termination fee due LSC will be subordinate to any claims by customers of Introducing Broker or by SIPC. Any termination of this Agreement by Lek Securities Corporation shall grant Introducing Broker a commercially reasonable amount of time to facilitate an orderly transition to a new clearing firm.

Page 16 of 20

(d) Either party to this Agreement may terminate for cause by notification in writing to the other party if the other party breaches any material representation, undertaking, duty or obligation made hereunder, in which case the termination notice shall describe those breaches for which notice of termination is given and such termination shall be effective immediately. The responsibilities and obligations of each party to the other under this Agreement to indemnify and hold harmless under this Agreement, as well as Sections X, XI and XII shall survive the termination of this Agreement. Lek Securities Corporation shall cooperate fully with the Introducing Broker through its best efforts to promptly transfer the accounts of the Introducing Broker as directed by the Introducing Broker. This Agreement shall remain in full force and effect as to all accounts awaiting transfer; however, this shall not relieve either party of the obligation to complete the transfer of such accounts.

(e) In the event of termination of this Agreement, the Introducing Broker shall have the obligation to notify all accounts of the termination. Such notice shall be in a form acceptable to Lek Securities Corporation, and FINRA

X. CONFIDENTIALITY

All agreements, documents, papers, fee schedules and information (including identity of customers and all transactions) supplied by either party concerning the other party's business or customers shall be treated by the receiving party as confidential, during the term of this Agreement and thereafter. To the extent such documents are retained by the receiving party, they shall be kept in a safe place and shall be made available to third parties only as authorized by the other party in writing or pursuant to any order or subpoena of a court, regulatory agency, or DEA having appropriate jurisdiction. The receiving party shall give the other party prompt notice of the receipt by the receiving party of any such order or subpoena, which notice shall be given prior to the receiving party's compliance therewith. Such documents shall be made available by the receiving party for inspection and examination by the other party's and the receiving party's auditors, by properly authorized agents or employees of any regulatory bodies or commissions or by such other persons as the other party may authorize in writing. The restrictions contained in this section shall not apply to any records or documents which the receiving party is required by law or regulation to make available to any regulatory agency or SRO having appropriate authority.

XI. LIMITATION OF LIABILITY AND PROPRIETARY SOFTWARE

In the event that any communications network, data processing system, or computer system used by Lek Securities Corporation, or by the Introducing Broker, not owned by Lek Securities Corporation, is rendered inoperable, Lek Securities Corporation shall not be liable to the Introducing Broker or its customer for any loss, liability, claim, damage or expense resulting, either directly or indirectly, therefrom, unless such loss, liability, claim, damage or expense is on account of the gross negligence or willful misconduct of Lek Securities Corporation. Moreover, Lek Securities Corporation shall not be liable for any loss caused directly or indirectly by government restrictions, exchange or market rulings, suspension of trading, war, strikes or other conditions beyond the control of Lek Securities Corporation. Lek Securities Corporation shall be liable only in the event of its own gross negligence or willful misconduct. All software provided to the Introducing Broker by Lek Securities Corporation, whether owned or licensed to Lek Securities Corporation, shall remain the property of its respective owner. Introducing Broker shall exercise due care to ensure that such software will not be misappropriated or misused by any employee or authorized user. Introducing Broker agrees that software will be used only for its intended purpose. Lek Securities Corporation makes no representation or warranties with respect to the applicability, quality or utility of such software. No provision of this Agreement shall grant to Introducing Broker an ownership right to any such software. Introducing Broker shall promptly remove from in computer network all copies of any software supplied to it pursuant to this Agreement.

Page 17 of 20

XII. THE ROXâ SYSTEM

(a) The parties acknowledge that from time to time, Introducing Broker will use Lek Securities Corporation’s proprietary and copyrighted order management system, the ROX System, as part of the Introducing Broker’s trading and other operations. The Introducing Broker acknowledges that any securities orders executed away from LSC must also be entered into the ROX System for recording purposes; however, the specific terms regarding the ROX System, its services and the responsibilities of the parties are set forth in a separate agreement, with the costs associated with the Introducing Broker’s use of the ROX System set forth in the attached Schedule A.

XIII. RIGHT TO COMPETE

Nothing in this Agreement shall be deemed to restrict LSC or its affiliates, in any way or manner, from competing with Introducing Broker in any or all aspects of Introducing Broker’s business or from offering substantially similar products, services, technology solutions or software as that offered by Introducing Broker.

XIV. COMMUNICATION

(a) Introducing Broker will review, upon first receipt, all confirmations, statements, notices and other communications, no matter how delivered (whether in writing, verbally, by email, or otherwise) and agrees that all information contained therein shall be conclusively binding unless objected to in writing or by electronic mail within forty-eight (48) hours of first receipt.

(b) LSC will send communications electronically, by email or electronic mail attachment or in the form of an available download from LSC’s Web Site www.LekSecurities.com. Introducing Broker agrees to accept such electronic communications in lieu of paper documents and agrees that such electronic communications shall have the same legal force and effect as if sent or delivered in hard copy by hand delivery.

Page 18 of 20

XV. NOTICES

All notices, requests, claims, demands and other communications hereunder shall be in writing and shall be given or made (and shall be deemed to have been duly given or made upon receipt) by delivery in person, by an internationally recognized overnight courier service, by telecopy or registered or certified mail (postage prepaid, return receipt requested) to the respective parties at the following addresses (or at such other address for a party as shall be specified in a notice given in accordance with this Section:

(a) If to the Clearing Broker:

Lek Securities Corporation

One Liberty Plaza, 52nd Floor

New York, New York 10006

Attention: Samuel F. Lek

Phone: (212) 509-2300

Email: SamL@LekSecurities.com

(b) If to the Introducing Broker:

FFIN Securities, Inc.

324 South 400 West, Suite 150

Salt Lake City, UT 84101

Attention: Sean Lawson

Phone: 801-869-4810

Email: sean.lawson@ffin.us

XVI. MISCELLANEOUS

(a) Assignment. Neither party may assign this agreement without the prior written consent of the other party.

(b) Counterparts. This agreement may be signed in counterparts, each of which will be an original, but all of which, together, will constitute one and the same instrument. A signature delivered via facsimile or portable document format shall be afforded treatment as an original signature.

(c) Severability. If a court of competent jurisdiction declares any provision of this agreement to be invalid, unlawful or unenforceable as drafted, the parties intend that such provision be amended and construed in a manner designed to effectuate the purposes of the provision to the fullest extent permitted by law. If such provision cannot be so amended and construed, it shall be severed, and the remaining provisions shall remain unimpaired and in full force and effect to the fullest extent permitted by law.

(d) Controlling Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York, without regard to conflict of law principals.

Page19 of 20

(e) Breach. No consent by either party to, or waiver of, a breach of this Agreement by the other party, whether express or implied, shall constitute a consent to, waiver of, or excuse for any other different, continuing, or subsequent breach.

(f) Singular and Plural. All items herein that are in the singular shall include the plural, and the plural shall include the singular.

(g) Section Headings. The section headings in this Agreement are inserted for convenience of reference only and are not intended to limit the applicability or affect the meaning of any of its provisions.

(h) Citations. Reference to the rules or regulations of the SEC, FINRA, Exchange or any other regulatory or self-regulatory organization are current citations. Any changes in the citations (whether or not there are any changes in the text of such rules or regulations) shall be automatically incorporated herein.

LEK SECURITIES CORPORATION

By: —————————————————

Samuel F. Lek

Chief Executive Officer

ACKNOWLEDGED AND AGREED:

FFIN Securities, Inc.

By: —————————————————

Sean Lawson

Chief Compliance Officer

Dated: _____________________________, 2015

Page 20 of 20