|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

|

|

|

|

|

|

INFORMATION STATEMENT

|

|

|

|

|

|

|

|

SCHEDULE 14C INFORMATION

(Rule 14c-101)

|

|

|

|

|

|

|

|

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

Check

the appropriate box:

|

|

|

|

|

|

|

[X]

|

Preliminary

Information Statement

|

|

|

[

]

|

Confidential,

For Us of the Commission Only (as permitted by Rule

14c-5(d)(2))

|

|

[

]

|

Definitive

Information Statement

|

|

|

|

BMB MUNAI, INC.

|

|

|

|

(Name

of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

[X]

|

No fee

required

|

|

|

[

]

|

Fee

computed on table below per Exchange Act Rules 14c-5(g) and

0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction

applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computer per

Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

|

[

]

|

Fee

paid previously with preliminary materials.

|

|

|

[

]

|

Check

box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Dated

Filed:

|

|

BMB MUNAI, INC.

Office 1704, 4B Building

“Nurly Tau” BC

17 Al Farabi Ave.

Almaty, Kazakhstan 050059

Telephone: +7 727 311 10 64

Dear Stockholders:

This

notice and accompanying Information Statement are being furnished

to the holders of shares of common stock, par value $0.001, of BMB

Munai, Inc. a Nevada corporation, in connection with the approval

of the actions described below (collectively, the “Corporate

Actions”) taken with the unanimous approval of our board of

directors (the “Board”) and by the written consent of

Timur Turlov, our CEO, Chairman, and the holder of a majority of

the voting power of our issued and outstanding capital stock (the

“Consenting Shareholder”):

1.

Effect a reverse

stock split of the outstanding shares of our common stock, par

value $0.001, at the ratio of one-share-for-twenty-five-shares

(1:25) (the “Reverse Stock Split”).

2.

Amend our Articles

of Incorporation, as amended, to change our name to “Freedom

Holding Corp.” or such other name as the Board may deem

appropriate (the “Corporate Name Change”).

3.

Adopt the Freedom

Holding Corp. 2018 Equity Incentive Plan (the “2018 Equity

Incentive Plan”).

These

Corporate Actions were unanimously approved by the Board on July

28, 2017. On the same date, the Consenting Shareholder, who holds

approximately 88.6% of our issued and outstanding common stock,

executed a written consent approving the Corporate Actions. In

accordance with Rule 14c-2 promulgated under the Securities

Exchange Act of 1934, as amended, (the “Exchange Act”)

the Corporate Actions will become effective no sooner than 20 days

after we mail this notice and the accompanying Information

Statement to our stockholders.

The

written consent that we received from the Consenting Shareholder

constitutes the only stockholder approval required for the

Corporate Actions under Nevada law and our Articles of

Incorporation, as amended and our By-Laws, as amended through July

8, 2010. As a result, no further action by any other stockholder is

required to approve the Corporate Actions and we have not and will

not be soliciting your approval of the Corporate Actions. Nevada

Revised Statutes 78.320 provides that

in no instance where action is authorized by written consent need a

meeting of stockholders be called or notice given.

Notwithstanding the foregoing, the record holders of our

common stock of record as of the close of business on August

2, 2017, (the “Record

Date”) are being provided this notice of the Corporate

Actions.

The accompanying Information Statement is for information purposes

only – Please read it carefully.

NO VOTE OR OTHER ACTION OF THE COMPANY’S STOCKHOLDERS IS

REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT. WE ARE NOT

ASKING FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A

PROXY.

|

|

|

By

Order of the Board of Directors

|

|

|

|

BMB

Munai, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

/s/

TimurTurlov

|

|

|

|

Timur

Turlov

|

|

|

|

Chief

Executive Officer and Chairman of the Board of

Directors

|

August

__, 2017

BMB MUNAI, INC.

INFORMATION STATEMENT REGARDING ACTION TAKEN BY WRITTEN CONSENT OF

THE MAJORITY STOCKHOLDER IN LIEU OF A SPECIAL

MEETING

WE ARE NOT ASKING YOU FOR A PROXY,

AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

GENERAL INFORMATION

This Information Statement is being furnished to

the stockholders of BMB Munai, Inc. (“BMBM”,

“our”, “us”, or “we”) to notify

you that on July 28, 2017, our board of directors (the

“Board”) unanimously approved, and Timur Turlov, who

holds approximately 88.6% of our issued and outstanding common

stock, and is also our CEO and Chairman of our Board (the

“Consenting Shareholder”) executed a written consent to

approve the actions described below (collectively, the

“Corporate Actions”):

1.

Effect a reverse

stock split of the outstanding shares of our common stock, par

value $0.001, at the ratio of one-share-for-twenty-five-shares

(1:25) (the “Reverse Stock Split”).

2.

Amend our Articles

of Incorporation, as amended, (the “Articles”) to

change our name to “Freedom Holding Corp.” or such

other name as the Board may deem appropriate (the “Corporate

Name Change”)

3.

Adopt the Freedom

Holding Corp. 2018 Equity Incentive Plan (the “2018 Equity

Incentive Plan”).

In accordance with Section 78.320 of the Nevada

Revised Statutes (“NRS”), unless otherwise provided by

the articles of incorporation or bylaws of a Nevada corporation,

any action required or permitted to be taken at a meeting of the

stockholders may be taken without a meeting if, before or after the

action, a written consent thereto is signed by stockholders holding

at least a majority of the voting power. Our Articles of

Incorporation, as amended (the “Articles”) provide that any action that may be taken at a

meeting of our stockholders may be taken without a meeting, if a

consent or consents in writing setting forth the action so taken,

shall be signed by the holder or holders of outstanding stock

having not less than the minimum number of votes that would be

necessary to authorize or take such action at a meeting at which

all shares entitled to vote thereon were present and voted.

Utilizing the written consent of the holders of a majority in

interest of our voting securities eliminates the costs involved in

holding a special meeting of stockholders.

NRS

78.320 provides that in no instance where action is authorized by

written consent need a meeting of stockholders be called or notice

given.

This Information Statement is first being mailed

on or about August __, 2017 to stockholders of record of BMBM as of

August 2, 2017, (the “Record Date”), and is being

delivered to inform you of the Corporate Actions before they take

effect in accordance with Rule 14c-2 of the Exchange Act. No

appraisal rights are afforded to our stockholders under Nevada law

or our Articles and our By-Laws, as amended through July 8,

2010, (the “By-Laws”), as

a result of the Corporate Actions being taken.

We

will bear the entire cost of furnishing this Information Statement.

We may also reimburse brokerage firms, banks and other agents for

the cost of forwarding copies of this Information Statement to

beneficial owners.

THE REVERSE STOCK SPLIT

The

Board and the Consenting Shareholder have approved the Reverse

Stock Split, as described in more detail below. The Board and the

Consenting Shareholder considered, among other things, the

following factors in determining the ratio of the Reverse Stock

Split:

●

the

need for additional common stock to satisfy our contractual

obligations under the Share Exchange and Acquisition Agreement,

dated November 23, 2015, between BMBM and Timur Turlov

(“Acquisition Agreement”) in connection with the

acquisition of LLC Investment Company Freedom Finance

(“Freedom RU”) and to acquire FFINEU Investments

Limited (“Freedom CY”);

●

the

initial listing requirements of any market or exchange we may

consider applying to be listed upon;

●

the

historical trading price and trading volume of our common

stock;

●

the

prevailing trading price and trading volume of our common stock and

the anticipated impact of the Reverse Stock Split on the trading

market for our common stock; and

●

maximizing

the anticipated benefits to our stockholders.

The

Reverse Stock Split will reduce the number of shares of our common

stock that is currently issued and outstanding. It will not,

however, reduce the number of authorized shares of our common

stock, which will continue to be 500,000,000 shares following the

Reverse Stock Split.

Background and Reasons for the Reverse Stock Split; Potential

Consequences of the Reverse Stock Split

You are urged to read carefully the entire document and the other

documents to which this information statement refers in order to

fully understand the acquisition and the related transactions. See

“Where You Can Find Additional Information” beginning

on page 27.

Summary

of the Acquisition Agreement and Acquisitions

We are

currently authorized to issue 500,000,000 shares of common stock.

As disclosed in a Current Report on Form 8-K filed with the

Securities and Exchange Commission (the “Commission”)

on November 23, 2015, as amended by the Current Report on Form

8-K/A-1 filed on March 2, 2016, (collectively referred to herein as

the “Current Report as amended”), on November 23, 2015,

BMBM and Mr. Turlov entered into the Acquisition Agreement. Under

Nevada corporate law and our Articles and By-Laws, approval of and

entry into the Acquisition Agreement was within the authority of

the Board, and did not require shareholder approval. Pursuant to

the Acquisition Agreement, we agreed to issue sufficient shares of

BMBM to Mr. Turlov such that after giving effect to the

acquisitions contemplated in the Acquisition Agreement, Mr. Turlov

would own up to 95% of our issued and outstanding common stock,

which together with the number of shares of common stock issued and

outstanding as of November 23, 2015, would exceed our total

authorized common stock.

The

transactions contemplated in the Acquisition Agreement were

negotiated at arm’s-length. Prior to entering the Acquisition

Agreement there was no relationship between BMBM and Mr. Turlov.

Following the November 23, 2015 closing, Mr. Turlov was appointed

as BMBM’s Chief Executive Officer and Chairman of the Board.

He continues to hold those positions through the date of this

Information Statement.

The

Acquisition Agreement provides for the acquisition by BMBM of all

of the outstanding equity interests of three entities wholly owned

by Mr. Turlov in exchange for what will constitute 95% of our

outstanding common stock after giving effect to the transactions

contemplated in the Acquisition Agreement. The entities we have

acquired or will acquire pursuant to the Acquisition Agreement

include FFIN Securities, Inc., a Nevada corporation

(“FFIN”), Freedom RU and Freedom CY. Freedom RU is

engaged in the securities brokerage and financial services business

in Russia. Freedom RU has several wholly-owned subsidiaries,

including JSC Freedom Finance, a Kazakhstan joint stock company

(“Freedom KZ”), LLC FFIN Bank, a Russian limited

liability company, (“FFIN Bank”), LLC First Stock

Store, a Russian limited liability company, (“FSS”) and

Branch Office of LLC Freedom Finance Company in Kazakhstan, a

Kazakhstan limited liability company (“KZ Branch”).

Freedom KZ is engaged in the securities brokerage and financial

services business in Kazakhstan. FFIN Bank is engaged in the

banking business in Russia. FSS provides an online securities

marketplace to retail brokerage customers in Russia. KZ Branch

serves as the representative office of Freedom RU in Kazakhstan.

Unless otherwise specifically indicated or as is otherwise

contextually required, references herein to the “Freedom

Companies” includes Freedom RU and its wholly owned

subsidiaries, Freedom KZ, FFIN Bank, FSS and KZ Branch. Freedom CY

engages in the securities brokerage and financial services business

in Cyprus. The Acquisition Agreement provides for the acquisitions

of FFIN, Freedom RU and Freedom CY in a single, unified transaction

with one or more separate closings. For additional information

regarding the Acquisition Agreement, BMBM, FFIN, Freedom RU and

Freedom CY see “Description of the Acquisitions”

beginning on page 10 of this Information Statement and

“Description of the Business of BMBM, Freedom RU and Freedom

CY” beginning on page 11 of this Information

Statement.

Potential Impact on the Market Price of and the Market for our

Common Stock

In

approving the Reverse Stock Split, the Board and the Consenting

Shareholder also considered the possibility that the Reverse Stock

Split could increase the market price of our common stock to

enhance our ability to meet the initial listing requirements of a

national securities exchange, and make our common stock more

attractive to a broader range of institutional and other investors.

In addition to potentially increasing the market price of our

common stock, the Reverse Stock Split could also reduce certain of

our costs and may facilitate trading or reduce other costs, as

discussed below.

We

believe that the Reverse Stock Split may enhance our ability to

obtain a listing on the New York Stock Exchange MKT (the

“NYSE MKT”) or one of the NASDAQ markets

(“NASDAQ”). One of the NYSE MKT and NASDAQ listing

requirements is that the bid price of our common stock is at a

specified minimum price per share. Reducing the number of

outstanding shares of our common stock could, absent other factors,

increase the per share market price of our common stock, although

we do not anticipate our minimum bid price would, following the

Reverse Stock Split, exceed or remain over the minimum bid price

requirement of any such stock exchange solely as a result of the

Reverse Stock Split.

Additionally,

we believe an increase in price that could accompany the Reverse

Stock Split would make our common stock more attractive to a

broader range of institutional and other investors, as we have been

advised that the current market price of our common stock may

affect its acceptability to certain institutional investors,

professional investors and other members of the investing public.

Many brokerage houses and institutional investors have internal

policies and practices that either prohibit them from investing in

low-priced stocks or tend to discourage individual brokers from

recommending low-priced stocks to their customers. In addition,

some of those policies and practices may function to make the

processing of trades in low-priced stocks economically unattractive

to brokers. Moreover, because brokers’ commissions on

low-priced stocks generally represent a higher percentage of the

stock price than commissions on higher-priced stocks, the current

average price per share of common stock can result in individual

stockholders paying transaction costs representing a higher

percentage of their total share value than would be the case if the

share price were substantially higher. We believe that the Reverse

Stock Split could make our common stock a more attractive and

cost-effective investment for many investors, which will enhance

the liquidity of the holders of our common stock.

Reducing

the number of outstanding shares of our common stock through the

Reverse Stock Split is intended, absent other factors, to increase

the per share market price of our common stock. However, other

factors, such as our financial results, market conditions and the

market perception of our business may adversely affect the market

price of our common stock. As a result, there can be no assurance

that the Reverse Stock Split will result in the intended benefits

described above, that the market price of our common stock will

increase (proportionately to the reduction in the number of shares

of our common stock after the Reverse Stock Split or otherwise)

following the Reverse Stock Split or that the market price of our

common stock will not decrease in the future. Accordingly, the

total market capitalization of our common stock after the Reverse

Stock Split could be lower or higher than the total market

capitalization before the Reverse Stock Split.

Accordingly,

for these reasons, the Board and the Consenting Shareholder believe

that effecting the Reverse Stock Split is in the best interests of

the Company and its stockholders.

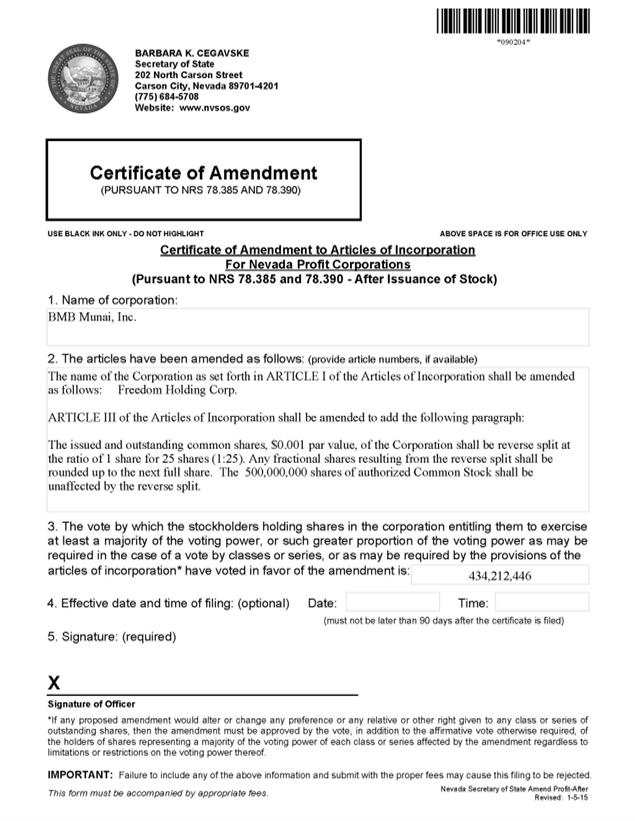

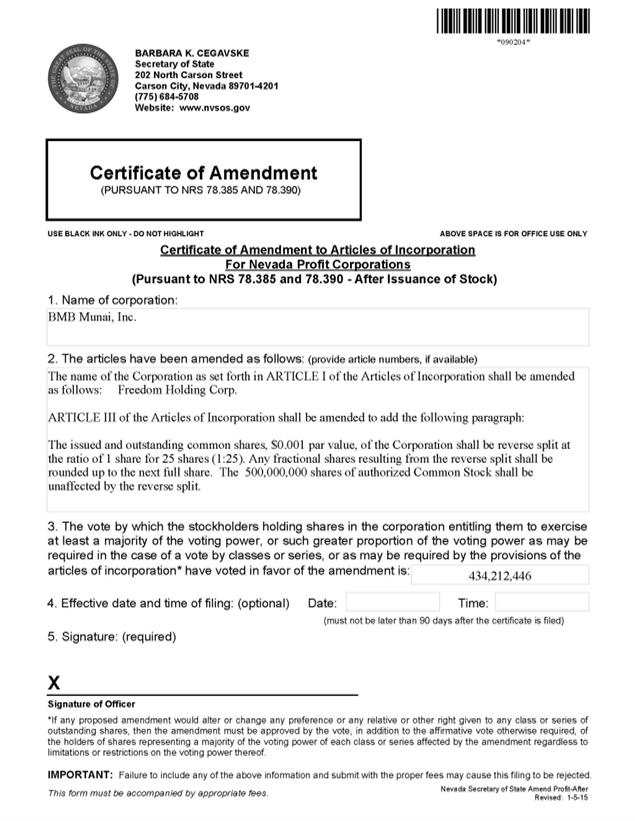

Procedure for Implementing the Reverse Stock Split

The effective date of the Reverse Stock Split will

be the date of the filing of a Certificate of Amendment to our

Articles of Incorporation (the “Amendment”) with the

Secretary of State of the State of Nevada (the “Split

Effective Date”). A copy

of the Amendment is attached as Annex A to this Information

Statement. The exact timing of the filing of the Amendment will be

determined by the Board, but in no event shall such Amendment be

filed until at least 20 days after the mailing of this Information

Statement to our stockholders. Moreover, effectuation of the

Reverse Stock Split on the OTC Pink Market by FINRA may or may not

coincide with the Split Effective Date.

Effect of the Reverse Stock Split on Holders of Outstanding Common

Stock

Based

on the one-share-for-twenty-five-shares (1:25) ratio of the Reverse

Stock Split, twenty-five shares of our currently issued and

outstanding common stock will be combined into one new share of our

common stock. Based on the 490,000,000 shares of common stock

issued and outstanding as of July 28, 2017, immediately following

the Reverse Stock Split the Company would have approximately

19,600,000 shares of common stock issued and outstanding (without

giving effect to rounding for fractional shares). Fractional shares

will not be issued. Instead, we will issue a full share of

post-Reverse Stock Split common stock to any stockholder who would

have been entitled to receive a fractional share of common stock as

a result of the Reverse Stock Split.

The

Reverse Stock Split will affect all holders of our common stock

uniformly and will not affect any stockholder’s percentage

ownership interest in BMBM, except to the extent the Reverse Stock

Split would result in fractional shares, as described above. In

addition, the Reverse Stock Split will not affect any

stockholder’s proportionate voting power, except to the

extent the Reverse Stock Split would result in fractional shares,

as described above.

The

Reverse Stock Split will result in some stockholders owning

“odd lots” of less than 100 shares of common stock. Odd

lot shares may be more difficult to sell, and brokerage commissions

and other costs of transactions in odd lots are generally somewhat

higher than the costs of transactions in “round lots”

of even multiples of 100 shares.

Because

the total number of authorized shares of common stock is not being

reduced from 500,000,000 in the Reverse Stock Split, the ability of

the Board to issue authorized and unissued shares without further

stockholder action will be significantly increased. Other than as

described in this Information Statement, we currently have no firm

commitments or arrangements to issue these additional authorized

shares. The issuance in the future of such additional authorized

shares may have the effect of diluting the earnings per share and

book value per share, as well as the stock ownership and voting

rights, of the currently outstanding shares of our common

stock.

The

additional shares of common stock that will become available for

issuance following the Reverse Stock Split could also be used by us

to oppose a hostile takeover attempt or delay or prevent changes in

control or of our management. For example, without further

stockholder approval, the Board could sell shares of common stock

in a private transaction to purchasers who would oppose a takeover

or favor the current Board.

The Reverse Stock Split is not being effected in response to any

effort of which we are aware to accumulate shares of our common

stock or obtain control, nor is it part of a plan by management to

recommend a series of similar amendments to our Board and

shareholders. The Board does not intend to use the Reverse Stock

Split as a part of or as a first step in a “going

private” transaction pursuant to Rule 13e-3 under the

Exchange Act.

After

the Split Effective Date, our common stock will have a new

Committee on Uniform Securities Identification Procedures

(“CUSIP”) number. CUSIP numbers are used to identify

equity securities. After the Reverse Stock Split, we will continue

to be subject to the periodic reporting and other requirements of

the Exchange Act. We expect that our common stock will continue to

be quoted on the OTC Pink Market or other applicable tiers of the

OTC markets, subject to any decision of our Board to seek listing

of our securities on a stock exchange and approval by such exchange

of the listing.

No Exchange of Stock Certificates Required

The

reduction in the number of our issued and outstanding shares of

common stock as a result of the Reverse Stock Split will occur

automatically without any additional action on the part of our

shareholders.

Upon

the reverse split becoming effective, stockholders (at their option

and at their expense) may exchange their stock certificates

representing pre-reverse split common shares for new certificates

representing post-reverse split common shares but, stockholders are

not required to exchange their stock certificates as a result of

the Reverse Stock Split. No new certificates will be issued to a

stockholder until such stockholder has surrendered such

stockholder's outstanding certificate(s) together with the properly

completed and executed letter of transmittal.

We

intend to treat stockholders holding shares of our common stock in

“street name” (that is, through a bank, broker or other

nominee) in the same manner as registered stockholders whose shares

of our common stock are registered in their names. Banks, brokers

or other nominees will be instructed to effect the reverse stock

split for their beneficial holders holding shares of our common

stock in “street name”; however, these banks, brokers

or other nominees may apply their own specific procedures for

processing the Reverse Stock Split. If you hold your shares of our

common stock with a bank, broker or other nominee, and you have any

questions in this regard, we encourage you to contact your

nominee.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATES AND SHOULD

NOT SUBMIT ANY CERTIFICATES UNLESS REQUESTED TO DO SO.

Effect of the Reverse Stock Split on Employee Plans, Options,

Restricted Stock Awards and Units, Warrants, and Convertible or

Exchangeable Securities

Proportionate

adjustments are generally required to be made to the number of

shares reserved for future issuance under our 2009 Equity Incentive

Plan, as well as the per share exercise price and the number of

shares issuable upon the exercise or conversion of all outstanding

options or convertible securities entitling the holders to purchase

or convert into shares of common stock. This would result in

approximately the same aggregate price being required to be paid

under such options or convertible securities upon exercise or

conversion, and approximately the same value of shares of common

stock being delivered upon such exercise or conversion, immediately

following the Reverse Stock Split as was the case immediately

preceding the Reverse Stock Split. The number of shares deliverable

upon settlement or vesting of restricted stock awards will be

similarly adjusted, subject to our treatment of fractional shares.

The number of shares reserved for issuance pursuant to these

securities will be proportionately adjusted, subject to our

treatment of fractional shares. There are currently no awards

outstanding under the 2009 Equity Incentive Plan. Further, as

discussed below, the Board has resolved that the 2009 Equity

Incentive Plan shall terminate as of the effective date of the

Freedom Holding Corp. 2018 Equity Incentive Plan.

The

Board will determine the date the Freedom Holding Corp. 2018 Equity

Incentive Plan shall become effective (the “Plan Effective

Date”), which in no event shall occur prior to the Split

Effective Date. Therefore, the 5,000,000 shares authorized for

issuance under the Freedom Holding Corp. 2018 Equity Incentive Plan

will not be subject to proportionate adjustment.

Accounting Matters

This

proposed Amendment will not affect the par value of our common

stock. As a result, as of the Split Effective Date, the stated

capital attributable to common stock and the additional paid-in

capital account on our balance sheet will not change due to the

Reverse Stock Split. Reported per share net income or loss will be

higher because there will be fewer shares of common stock

outstanding.

Certain Federal Income Tax Consequences of the Reverse Stock

Split

The

following summary describes certain material U.S. federal income

tax consequences of the Reverse Stock Split to holders of our

common stock.

Unless

otherwise specifically indicated herein, this summary addresses the

tax consequences only to a beneficial owner of our common stock

that is a citizen or individual resident of the United States, a

corporation organized in or under the laws of the United States or

any state thereof or the District of Columbia or otherwise subject

to U.S. federal income taxation on a net income basis in respect of

our common stock (a “U.S. holder”). A trust may also be

a U.S. holder if (1) a U.S. court is able to exercise primary

supervision over administration of such trust and one or more U.S.

persons have the authority to control all substantial decisions of

the trust or (2) it has a valid election in place to be treated as

a U.S. person. An estate whose income is subject to U.S. federal

income taxation regardless of its source may also be a U.S.

holder.

This

summary does not address all of the tax consequences that may be

relevant to any particular investor, including tax considerations

that arise from rules of general application to all taxpayers or to

certain classes of taxpayers or that are generally assumed to be

known by investors. This summary also does not address the tax

consequences to (i) persons that may be subject to special

treatment under U.S. federal income tax law, such as banks,

insurance companies, thrift institutions, regulated investment

companies, real estate investment trusts, tax-exempt organizations,

U.S. expatriates, persons subject to the alternative minimum tax,

traders in securities that elect to mark to market and dealers in

securities or currencies, (ii) persons that hold our common stock

as part of a position in a “straddle” or as part of a

“hedging,” “conversion” or other integrated

investment transaction for federal income tax purposes, (iii)

persons that do not hold our common stock as “capital

assets” (generally, property held for investment), or (iv)

persons who are not a U.S. holder. If a partnership (or other

entity classified as a partnership for U.S. federal income tax

purposes) is the beneficial owner of our common stock, the U.S.

federal income tax treatment of a partner in the partnership will

generally depend on the status of the partner and the activities of

the partnership. Partnerships that hold our common stock, and

partners in such partnerships, should consult their own tax

advisors regarding the U.S. federal income tax consequences of the

Reverse Stock Split.

This

summary is based on the provisions of the Internal Revenue Code of

1986, as amended, U.S. Treasury regulations, administrative rulings

and judicial authority, all as in effect as of the date of this

Information Statement. Subsequent developments in U.S. federal

income tax law, including changes in law or differing

interpretations, which may be applied retroactively, could have a

material effect on the U.S. federal income tax consequences of the

Reverse Stock Split.

PLEASE CONSULT YOUR OWN TAX ADVISOR REGARDING THE U.S. FEDERAL,

STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE

REVERSE STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE

INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING

JURISDICTION.

The

Reverse Stock Split should be treated as a recapitalization for

U.S. federal income tax purposes. Therefore, a stockholder

generally will not recognize gain or loss on the reverse stock

split, except for a stockholder receiving an additional share of

common stock in lieu of a fractional share (as described below).

The aggregate tax basis of the post-split shares received will be

equal to the aggregate tax basis of the pre-split shares exchanged

therefore, excluding the basis of the fractional share, and the

holding period of the post-split shares received will include the

holding period of the pre-split shares exchanged.

No

gain or loss will be recognized by us as a result of the Reverse

Stock Split. A stockholder who receives one whole share of common

stock in lieu of a fractional share generally may recognize gain in

an amount not to exceed the excess of the fair market value of such

share over the fair market value of the fractional share to which

the stockholder was otherwise entitled. Our view regarding the tax

consequences of the Reverse Stock Split is not binding on the

Internal Revenue Service or the courts. Accordingly, each

stockholder should not rely on the foregoing and may wish to

consult with his or her own tax advisor with respect to all of the

potential tax consequences to him or her of the Reverse Stock

Split.

CORPORATE NAME CHANGE

On July

28, 2017, the Board and the Consenting Shareholder approved a

change in the name of the corporation from BMB Munai, Inc. to

“Freedom Holding Corp.”, or such other name as the

Board may deem appropriate (the “Corporate Name

Change”) which we believe more accurately reflects our

current business.

Procedure for Implementing the Corporate Name Change

The

effective date of the Corporate Name Change will be the date of the

filing of the Amendment with the Secretary of State of the State of

Nevada. The exact timing of the filing of the Amendment will be

determined by the Board, but in no event shall such Amendment be

filed until at least 20 days after the mailing of this Information

Statement to our stockholders. As a result of the Corporate Name

Change, we plan to request a change to our stock ticker symbol on

the OTC Pink Markets to something that will more closely reflect

our new name. The change in our stock ticker symbol may or may not

coincide with the effective date of the Corporate Name

Change.

THE FREEDOM HOLDING CORP. 2018 EQUITY INCENTIVE PLAN

DESCRIPTION OF THE FREEDOM HOLDING CORP. 2018 EQUITY INCENTIVE

PLAN

A copy

of the Freedom Holding Corp. 2018 Equity Incentive Plan, (the

“Plan”) is attached to this Information Statement as

Annex B. The Plan was approved by the Board and the Consenting

Shareholder on July 28, 2017 and shall become effective on Plan

Effective Date.

The

Company has previously provided equity incentive under its 2009

Equity Incentive Plan. No awards are currently outstanding under

that plan, and the Board has resolved that the 2009 Equity

Incentive Plan shall terminate as of the Plan Effective Date. The

Company has no other equity incentives plans.

Under

the Plan our employees, officers, directors and other individuals

or entities may be awarded grants and options to purchase shares of

our common stock. The term of the Plan shall be ten (10)

years.

The

Plan permits the granting of 5,000,000 shares of common stock. No

awards or grants have been awarded or granted under the Plan and

the Board is not currently considering any awards or grants under

the Plan. The aggregate number of shares of common stock that may

be issued to any individual or entity that have been granted an

award under the Plan shall not exceed twenty percent (20%) of the

aggregate number of shares referred to in the preceding sentence.

The total number of shares issuable upon exercise of all

outstanding options shall not exceed a number of shares which is

equal to thirty percent (30%) of our then outstanding shares.

Shares shall be deemed to have been issued under the Plan only to

the extent actually issued and delivered pursuant to an award or

grant. To the extent an award or grant lapses or the rights of its

holder or grantee terminate, any shares of common stock subject to

such award or grant shall again be available for the grant of an

award or making of a grant. The aggregate number of shares which

may be issued under the Plan shall be subject to adjustment, as

provided in the Plan, with respect to shares of common stock

subject to options then outstanding, provided however, that the

number of shares authorized for grant under the Plan shall not be

subject to adjustment in connection with the Reverse Stock Split,

because the Plan will not become effective until after the Reverse

Stock Split.

An

incentive stock option award made pursuant to the Plan may be

granted only to an individual who, at the time of grant, is an

employee of the Company, a parent corporation or a subsidiary. An

award of an option which is not an incentive stock option or a

grant of common stock may be made to an individual or entity who,

at the time of award or grant, is an employee of the Company, a

parent corporation or a subsidiary, or to an individual or entity

who has been identified by the Board to receive an award or grant

due to their contribution or service to the Company.

The

term of each option granted under the Plan shall be specified at

the time of grant, but in no event shall any option granted under

the Plan be exercisable more than one hundred and twenty (120)

months from the date it is granted. The Plan provides certain

guidelines for the granting of “Incentive Stock

Options” under the provisions and subject to the limitations

of Section 422 of the Internal Revenue Code. Incentive Stock

Options and other options must be awarded at a price equal to one

hundred percent (100%) of the fair market value of the common stock

on the date that the option is granted. Further, no Incentive Stock

Option may be granted to an employee owning common stock having

more than 10% of the voting power of the Company unless the option

price for such employee's option is at least 110% of the fair

market value of the common stock subject to the option at the time

the option is granted and the option is not exercisable after the

expiration of five years from the date of granting.

Administration of the Plan

The

Plan shall be administered by the Board in compliance with

Securities Exchange Act Rule 16b-3. The Plan is administered under

the direction of the Board and/or the compensation committee of our

Board with the assistance of certain designated officers as

determined by the Board or committee. Members of the Board shall

abstain from participating in and deciding matters which directly

affect their individual ownership interests under the

Plan.

Subject

to the provisions of the Plan, the Board or compensation committee

determines the recipients who will receive awards under the Plan.

The amount, terms, rules and procedure associated with any award

shall be determined by the Board or compensation committee as it

deems proper. The Board is authorized in its sole discretion,

exercised in a nondiscriminatory manner, to construe and interpret

the Plan and the respective agreements executed thereunder, to

prescribe such rules and regulations relating to the Plan as it may

deem advisable to carry out the Plan, and to determine the terms,

restrictions and provisions of each Award or Grant, including such

terms, restrictions and provisions as shall be requisite in the

judgment of the Board.

U.S. Federal Income Tax Consequences

The

following is a brief description of the U.S. federal income tax

treatment that will generally apply to awards granted under the

Plan, based on U.S. federal income tax laws in effect on the date

hereof. The exact U.S. federal income tax treatment of awards will

depend on the specific nature of the award. Such an award may,

depending on the conditions applicable to the award, be taxable as

an option, as restricted or unrestricted stock, as a cash payment,

or otherwise. Recipients of options or other awards should not rely

on this discussion for individual tax advice, as each

recipient’s situation and the tax consequences of any

particular award will vary depending on the specific facts,

circumstances and taxing jurisdiction involved. Each recipient is

advised to consult his or her own tax advisor for particular

federal, as well as state and local, income and any other tax

advice.

Grant of Options. An optionee will not

recognize any taxable income at the time an option is granted and

the Company will not be entitled to a federal income tax deduction

at that time.

Exercise of ISOs. No ordinary income

will be recognized by a holder of an ISO at the time of exercise.

The excess of the fair market value of the Shares at the time of

exercise over the aggregate option exercise price will be an

adjustment to alternative minimum taxable income for purposes of

the federal “alternative minimum tax” at the date of

exercise. If the optionee holds the Shares purchased for the

greater of two years after the date the option was granted and one

year after the acquisition of such Shares, the difference between

the aggregate option price and the amount realized upon disposition

of the Shares will constitute a long term capital gain or loss, as

the case may be, and the Company will not be entitled to a federal

income tax deduction.

If the

Shares acquired upon exercise of an ISO are disposed of in a sale,

exchange or other “disqualifying disposition” within

two years after the date of grant or within one year after the date

of exercise, an optionee will realize taxable ordinary income in an

amount equal to the lesser of (i) the excess of the fair

market value of the Shares purchased at the time of exercise over

the aggregate option exercise price or (ii) the excess of the

amount realized upon disposition of such Shares over the option

exercise price. The Company will be entitled to a federal income

tax deduction equal to the amount of ordinary income recognized by

the optionee. The excess, if any, of the amount realized upon

disposition of the Shares in a disqualifying disposition over the

fair market value of the Shares at the time of exercise will

constitute capital gain.

Exercise of Non-Qualified Options.

Taxable ordinary income will be recognized by the holder of an

option that does not qualify as an ISO (a “non-qualified

option”) at the time of exercise, in an amount equal to the

excess of the fair market value of the Shares purchased at the time

of such exercise over the aggregate option exercise price. The

Company will be entitled to a federal income tax deduction equal to

that amount. An optionee will generally recognize a taxable capital

gain or loss based upon the difference between the per share fair

market value at the time of exercise and the per share selling

price at the time of a subsequent sale of the shares. The capital

gain or loss will be short term or long term depending on the

period of time the shares are held by the optionee following

exercise.

Incentive Bonus. An eligible person

receiving an Incentive Bonus grant will not recognize income, and

the Company will not be allowed a deduction, at the time the grant

is made as long as the Incentive Bonus is subject to a substantial

risk of forfeiture. When the Incentive Stock is no longer subject

to a substantial risk of forfeiture and the recipient receives

payment in cash or Shares, the amount of cash and the fair market

value of the Shares received will be ordinary income to the

recipient. The Company will be entitled to a federal income tax

deduction equal to that amount.

Incentive Stock. An eligible person

receiving a grant of Incentive Stock that is not subject to vesting

restrictions generally will recognize ordinary income (and the

Company will be entitled to a deduction) upon the receipt of shares

at the end of the performance period relating to such Incentive

Stock award equal to the excess of the fair market value of the

Shares received at such time over the purchase price, if

any.

If an

Incentive Stock award consists of the grant of restricted Shares

that vest over time, then the recipient will not recognize income

when the restricted shares are received, unless the recipient makes

the election described below. While the restrictions are in effect,

the recipient will recognize compensation income equal to the

amount of the dividends received and the Company will be allowed a

deduction in a like amount.

When

the restrictions on the Shares are removed or lapse, the excess of

fair market value of such Shares on the date the restrictions are

removed or lapse over the amount paid by the recipient for the

Shares will be ordinary income to the recipient. The Company will

be entitled to a federal income tax deduction equal to that amount.

Upon disposition of the Shares, the gain or loss recognized by the

recipient will be treated as a capital gain or loss. The capital

gain or loss will be short term or long term depending upon the

period of time the Shares are held by the participant following the

removal or lapse of the restrictions.

If a

Section 83(b) election is filed by the recipient with the Internal

Revenue Service within 30 days after the date of grant of

restricted Incentive Stock, then the recipient will recognize

ordinary income and the holding period will commence as of the date

of grant. The amount of ordinary income recognized by the recipient

will equal the excess of the fair market value of the shares as of

the date of grant over the amount paid by the recipient for the

Shares. The Company will be entitled to a deduction in a like

amount. If such election is made and the recipient thereafter

forfeits the restricted Shares, the recipient may be entitled to a

capital loss.

Miscellaneous Rules. Special rules will

apply in cases where a recipient of an award pays the exercise or

purchase price of the award or any applicable withholding tax

obligations under the Plan by delivering previously owned Shares or

by reducing the number of Shares otherwise issuable pursuant to the

award. The surrender or withholding of such Shares will in certain

circumstances result in the recognition of income with respect to

such Shares or a carry-over basis in the Shares acquired, and may

constitute a disqualifying disposition with respect to ISO

shares.

As

described above, the terms of the agreements pursuant to which

specific awards are made to participants under the Plan may provide

for accelerated vesting or payment of an award in connection with a

Change in Control. In that event and depending on the individual

circumstances of the recipient, certain amounts with respect to

such awards may constitute “excess parachute payments”

under the “golden parachute” provisions of the Code.

Pursuant to these provisions, a recipient will be subject to a 20%

excise tax on any excess parachute payments and the Company will be

denied any deduction with respect to such payments. Participants in

the Plan should consult their tax advisors as to whether

accelerated vesting of an award in connection with a Change in

Control would give rise to an excess parachute

payment.

Withholding Taxes. No withholding taxes

are payable in connection with the grant of any stock option or the

exercise of an ISO. However, withholding taxes must be paid at the

time of exercise of any non-qualified option. In respect of all

other awards, withholding taxes must be paid whenever the

participant recognizes income for tax purposes.

Changes in Plan

The

Plan may be terminated, suspended, or modified at any time by the

board, but no amendment increasing the maximum number of shares for

which options may be granted (except to reflect a stock split,

stock dividend or other distribution), reducing the option price of

outstanding options, extending the period during which options may

be granted, otherwise materially increasing the benefits accruing

to optionees or changing the class of persons eligible to be

optionees shall be made without first obtaining approval by a

majority of the Company’s shareholders. No termination,

suspension or modification of the Plan shall adversely affect any

right previously acquired by the grantee or other beneficiary under

the Plan.

The

foregoing description of the Plan is only a summary of the Plan and

is qualified in its entirety by reference to the Freedom Holding

Corp. 2018 Equity Incentive Plan, a copy of which is attached as

Annex B to this proxy statement.

DESCRIPTION OF THE ACQUISITIONS

Acquisition of FFIN

As

disclosed in the Current Report as amended, on November 23, 2015,

we closed the acquisition of FFIN in exchange for 224,551,913

shares of our common stock, which constituted approximately 80.1%

of our then issued and outstanding common stock after giving effect

to that acquisition. As a result, Mr. Turlov became our largest

shareholder and FFIN became our wholly owned

subsidiary.

We did

not close the acquisitions of Freedom RU and Freedom CY in November

2015, because a number of the closing conditions necessary to

complete those acquisitions had not been satisfied, including but

not limited to, (i) the preparation and delivery of the Freedom RU

and Freedom CY audited financial statements prepared in accordance

with U.S. GAAP and U.S. GAAS, (ii) receipt of required regulatory

approvals in Kazakhstan, Russia and Cyprus, and (iii) BMBM having

insufficient authorized by unissued common stock to issue to Mr.

Turlov the amount of stock agreed in the Acquisition

Agreement.

Acquisition of Freedom RU

As

disclosed in our Annual Report on Form 10-K for the fiscal year

ended March 31, 2017, filed with the Commission on June 30, 2017

(the “Annual Report on Form 10-K”), on June 29, 2017,

BMBM and Mr. Turlov closed the acquisition of Freedom RU. As noted

above, pursuant to the terms of the Acquisition Agreement, in

exchange for Mr. Turlov’s 100% equity interest in Freedom RU,

we agreed to issue Mr. Turlov 13% of our issued and outstanding

common stock, such that after giving effect to the acquisition of

Freedom RU, Mr. Turlov would own 93% of our then issued and

outstanding common stock. As we had insufficient authorized but

unissued common stock to deliver the agreed upon consideration to

Mr. Turlov at the closing, as an accommodation to facilitate the

closing, Mr. Turlov agreed to accept a partial issuance of

209,660,533 shares of our common stock and to defer issuance of the

balance of the shares agreed to until such time as we complete a

reverse stock split, to provide sufficient additional shares to

issue Mr. Turlov the percentage agreed in the Acquisition

Agreement. The required regulatory approvals to effect the transfer

of Freedom RU have been received.

Following

completion of the Reverse Stock Split, to satisfy our obligation

under the Acquisition Agreement in connection with the acquisition

of Freedom RU, we will issue additional shares to Mr. Turlov to

increase his ownership interest in our common stock to 93% of our

then issued and outstanding post-Reverse Stock Split shares of

common stock. Until giving effect to the Reverse Stock Split, we

cannot determine the exact number of additional shares that will be

issued to Mr. Turlov following completion of the Reverse Stock

Split because we cannot determine with certainty how many shares

will be issued to give effect to the rounding up of fractional

shares created by the Reverse Stock Split. However, without giving

effect to the treatment of fractional shares, we anticipate the

number of post-Reverse Stock Split shares of common stock that

would be issued to Mr. Turlov would be approximately

12,278,602.

Acquisition of Freedom CY

We

continue to make progress in our efforts to close the acquisition

of Freedom CY. We continue to work with the Cyprus Securities and

Exchange Commission (“CySEC”) to obtain the necessary

regulatory approvals to effect the transfer ownership of Freedom CY

to BMBM. At this time, we cannot predict with certainty if and/or

when the required regulatory approvals will be granted. Pursuant to

the Acquisition Agreement, in exchange for Mr. Turlov’s 100%

equity interest in Freedom CY, we agreed to issue Mr. Turlov 2% of

our issued and outstanding common stock, such that after giving

effect to the acquisitions of FFIN, Freedom RU and Freedom CY, as

contemplated in the Acquisition Agreement, Mr. Turlov would own 95%

of our then issued and outstanding common stock.

DESCRIPTION OF THE BUSINESS OF BMBM, FREEDOM RU AND FREEDOM

CY

BMBM

BMBM

was originally incorporated in the State of Utah in 1981. From 2003

to 2011, BMBM’s business activities focused on oil and

natural gas exploration and production in the Republic of

Kazakhstan. On November 23, 2015, we entered into the Acquisition

Agreement with Mr. Turlov, with the intent to build an

international, broadly based brokerage and financial services firm

to meet the growing demand from an increasing number of investors

in Russia and Kazakhstan for access to the financial opportunities,

relative stability, and comprehensive regulatory reputation of the

U.S. securities markets.

Pursuant to the

Acquisition Agreement, BMBM acquired FFIN from Mr. Turlov. FFIN was

established to serve primarily foreign clients referred from the

Freedom RU and Freedom KZ as part of a strategy to provide these

clients with access to the U.S. securities markets through a single

integrated financial services firm. In December 2015, FFIN applied

to become a member of FINRA and a licensed securities broker-dealer

with the Commission. This application was subsequently withdrawn in

2016. Through the date of this Information Statement, FFIN has not

resubmitted its new membership application to FINRA. We continue to

believe licensure as a securities broker-dealer in the U.S. may be

a valuable component of our business strategy and we continue to

evaluate the cost benefit, likelihood of success and appropriate

timing of another application, or to otherwise become a licensed

securities broker-dealer in the U.S.

As

disclosed above, on June 29, 2017, BMBM and Mr. Turlov closed the

acquisition of Freedom RU. With the closing of the acquisition of

Freedom RU, as of June 30, 2017, we had approximately 310 total

employees, including 273 full-time employees.

We

believe Freedom RU and Freedom CY serve an emerging capitalistic

and investing segment of the economies of Russia and Kazakhstan

that is interested in saving, investing, and diversifying risk

through foreign investment. Under the existing regulatory regimes

in Russia and Kazakhstan, Freedom RU and Freedom KZ are

limited in their ability to grant their customers access to the

U.S. securities markets. Currently, many of the customers of

Freedom RU and Freedom KZ access the U.S. securities markets

through Freedom CY.

We are

seeking a sustainable, long-term strategy to allow the Freedom RU

customer base in Russia and Kazakhstan to participate in the U.S.

markets because of what we perceive to be the growing disfavor of

omnibus clearing accounts for foreign financial institutions among

regulators and U.S. financial institutions as well as customer

concerns that Freedom RU exposes them to attendant political,

regulatory, currency, banking, and economic risks and uncertainties

in their respective countries of operation. With the closing of the

acquisition of Freedom RU, our principal executive offices are now

located at Office 1704, 4B Building, “Nurly Tau” BC, 17

Al Farabi Ave., Almaty, Kazakhstan 050059, its telephone number is

+7 727 311 10 64.

The Freedom Companies

Unless

otherwise specifically indicated or as is otherwise contextually

required, references herein to the “Freedom Companies”

includes Freedom RU, including its wholly own subsidiaries, Freedom

KZ, FFIN Bank, FSS and KZ Branch.

Since

the organization of Freedom RU in 2010 and the acquisitions of

Freedom KZ, FFIN Bank and FSS, they have serviced a growing

customer base with increasing amounts invested. Freedom RU and

Freedom KZ together have approximately 33,000 total customer

accounts. FFIN Bank has approximately 400 total active customer

accounts, with total deposits of approximately $3.5 million. The

customers of the Freedom RU and Freedom KZ typically execute

approximately 25,000 transactions per month, with an aggregate

transaction value of approximately $1 billion. The customers of

Freedom RU and Freedom KZ range from retail traders that frequently

execute large transactions to relatively small, inactive accounts

that hold securities positions long-term. In the preceding year,

approximately 80% or more of the aggregate trading dollar volume

was generated by about two dozen margin day traders. The Freedom RU

and Freedom KZ customers principally invest in exchange-traded

securities. The customers of FFIN Bank are generally individuals.

Approximately 77% of the FFIN Bank customers are also Freedom RU

customers.

For the

fiscal years ended March 31, 2017 and 2016, the

Freedom Companies had consolidated profits of approximately

$7.3 million and $9.2 million, respectively on revenues of about

$19.4 million and $17.3 million, respectively. As of March 31, 2017

and 2016, the consolidated total assets of the

Freedom Companies were approximately $111.7 million and $39.1

million. Collectively, as of June 30, 2017, the

Freedom Companies employed approximately 130 people in Russia

and 140 people in Kazakhstan.

In

recent years, the Freedom Companies

have pursued an aggressive growth strategy both in terms of

customer acquisition and business acquisitions. We anticipate this

will continue as the Freedom Companies seek to expand the footprint

of their brokerage, banking and financial services business in

Russia, Kazakhstan and other markets.

Freedom RU

Freedom RU

provides financial services in the Russian Federation in accordance

with the Russian government’s open-ended licenses for

brokerage, dealer, and depository operations and for activities in

securities management. The Federal Financial Markets Service of

Russia and the Central Bank of the Russian Federation provide

governmental regulation of company operations and the protection of

the interests of its customers.

Freedom KZ

Freedom

RU acquired Freedom KZ in 2013 from unrelated parties. When Freedom

RU acquired Freedom KZ, it was controlled by Korean nationals and

principally facilitated Korean investment in Kazakhstan.

Freedom KZ provides professional services in the capital

markets. Since 2006, Freedom KZ has been a professional

participant of the Kazakhstan Stock Exchange, which enables it to

manage investment portfolios for its clients. Freedom KZ is

regulated by the Committee for the Control and Supervision of the

Financial Market and Financial Organizations of the National Bank

of the Republic of Kazakhstan.

FFIN Bank

Freedom

RU purchased a 10% interest in FFIN Bank in March 2015, and

acquired the remaining 90% interest in FFIN Bank in April 2016.

FFIN Bank has a license issued by the Central Bank of the Russian

Federation for execution of banking operations in rubles and

foreign currencies for individuals and legal entities and is

regulated by the Central Bank. In accordance with federal law in

Russia, the Deposit Insurance Agency of Russia insures 100% of

deposits of individuals up to 1.4 million Russian rubles. FFIN Bank

derives revenue from providing banking services, including money

transfers, foreign currency exchange operations, interbank lending

and deposits. Currently, FFIN Bank’s operation is focused on

servicing the brokerage customers of Freedom RU. FFIN Bank is an

authorized Visa/MasterCard issuer, and has introduced internet

banking and mobile applications for Android/iOS for companies and

individuals. In addition FFIN Bank has completed development of

several investment and structured banking products (insured

deposits with option feature and currency risk hedging products.)

We anticipate FFIN Bank will continue to expand the banking

services it provides to the customers of FFIN bank and Freedom RU.

We also anticipate geographical expansion of FFIN Bank to

complement Freedom RU locations.

First Stock Store

FSS was

launched to be the first online securities marketplace for retail

customers in Russia. FSS was launched to attract new brokerage

clients for Freedom RU by providing a medium for individual

investors to buy and sell securities traded on the Russian and US

stock exchanges. The Company considers FSS to currently be one of

the most dynamic fin tech projects in the Russian Federation. With

the addition of the FSS project, Freedom RU is currently adding

approximately 600 customer accounts each month.

KZ Branch

KZ

Branch serves as the representative office of Freedom RU in

Kazakhstan.

Freedom CY

Freedom CY was

organized in August 2013 and completed its regulatory licensing in

May 2015. In 2016 Freedom CY activated its licenses to receive,

transmit and execute customer orders, establish custodial accounts,

engage in foreign currency exchange services and margin lending.

Freedom CY is in the process of obtaining its dealer license to

trade its own investment portfolio. Freedom CY provides

transaction handling and intermediary services to Freedom RU

and Freedom KZ and is regulated by the CySEC.

PROPERTIES

With

the closing of the Freedom RU acquisition, our principal executive

office are now located at Office 1704, 4B Building, “Nurly

Tau” BC, 17 Al Farabi Ave. Almaty, Kazakhstan 050059. The

Freedom Companies also maintain a securities brokerage branch at

this location. This lease expires in December 2017. As of June 29,

2017, the Freedom Companies also lease 13 other securities

brokerage branch locations in Kazakhstan, one administrative office

for their securities brokerage and banking operations in Russia, 12

securities brokerage branch locations and two bank branch locations

in Russia, and our two locations in Salt Lake City, Utah. The lease

terms for these offices range from month-to-month to year-to-year

and expire at various dates through December 2019. Monthly lease

payment obligations as of June 30, 2017 were approximately

$104,000. All locations are leased. We believe these offices are

suitable and adequate.

LEGAL PROCEEDINGS

In the

normal course of our business, and the businesses of the Freedom

Companies and Freedom CY lawsuits and claims may be brought against

us and our subsidiaries. While the

ultimate outcome of these proceedings cannot be predicted with

certainty, our management, after consultation with legal counsel

representing us in these proceedings, does not expect that the

resolution of these proceedings will have a material effect on our

financial condition, results of operations or cash

flows.

FINANCIAL STATEMENTS AND PRO FORM FINANCIAL

INFORMATION

●

The Audited

Consolidated Financial Statements of BMBM for the years ended March

31, 2017 and 2016, are attached to this Information Statements as

Annex C and are incorporated herein by this reference.

●

The Audited

Consolidated Financial Statements of Freedom RU for the years ended

March 31, 2017 and 2016, are attached to this Information

Statements as Annex D and are incorporated herein by this

reference.

●

The Audited

Financial Statements of the Freedom CY for the years ended March

31, 2017 and 2016, are attached to this Information Statements as

Annex E and are incorporated herein by this reference.

●

Unaudited Pro Forma

Condensed Combined Financial Statements for the years ended March

31, 2017 and 2016 of BMBM, Freedom RU and Freedom CY, are attached

to this Information Statements as Annex F and are incorporated

herein by this reference.

MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION

AND RESULTS OF OPERATIONS

The

management discussions and analysis of the financial condition and

results of operations of BMBM, Freedom RU and Freedom CY are

provided below. These discussions summarize the significant factors

affecting the consolidated operation results, financial condition,

liquidity and capital resources of each entity during the fiscal

years ended March 31, 2017 and 2016.

Each of the following discussions and analyses should be read in

conjunction with, and are qualified in their entirety by the

audited annual financial statements of the entity and the related

notes thereto included in Annexes C, D, and E, respectively, to

this Information Statement.

The

following management discussions and analysis of BMBM, Freedom RU

and Freedom CY may contain forward-looking statements that are not

historical in nature but concern forecasts of future results,

business plans, analyses, prospects, strategies, objectives and

other matters that may be deemed to be “forward-looking

statements” under the federal securities laws. Such

forward-looking statements are identified by words such as

“anticipate,” “estimate,”

“believe,” “expect,” “could,”

“forecast,” “may,” “intend,”

“plan,” “predict,” “project”

and similar terms and expressions.

BMBM

cannot guarantee that any forward-looking statement will be

realized, although BMBM does believe that the assumptions

underlying such forward-looking statements are reasonable.

Achievement of future results is subject to risks and

uncertainties, many of which are beyond the control of BMBM,

Freedom RU and Freedom CY, which could cause results to differ

materially from those that are presented.

Important factors

that could cause actual results to differ materially from those

presented or implied in a forward-looking statement include,

without limitation: the ability of Freedom RU and Freedom CY to

comply with the extensive and pervasive regulatory requirements in

the various jurisdictions where they operate; volatility of the

capital markets and in economic conditions generally; the ability

of Freedom CY to maintain a satisfactory clearing arrangement in

the U.S. with a qualified clearing firm with the necessary licenses

and clearing relationships; the ability of Freedom RU to profitably

invest its own funds; a possible lack of interest by foreign

investors to invest in securities of U.S. publicly traded

companies; the ability of Freedom RU and Freedom CY to manage

growth and to attract and retain key management and other properly

licensed and experienced personnel to satisfy applicable regulatory

standards; the ability of Freedom RU and Freedom CY to maintain

adequate capitalization; and other factors identified under Item

1A: Risk Factors in the Company's Annual Report on Form

10-K.

Caution

should be taken not to place undue reliance on Grainger's

forward-looking statements and Grainger undertakes no obligation to

publicly update any of its forward-looking statements, whether as a

result of new information, future events or otherwise.

BMBM

All amounts presented in this discussion are presented in US

dollars unless otherwise stated.

Overview

On June

29, 2017, we closed the acquisition of Freedom RU and its

wholly-owned subsidiaries, including their securities brokerage,

financial services and banking businesses in Russia and Kazakhstan,

as we continue our efforts to build an international broadly based

brokerage and financial services firm. We continue to work with

Cyprus securities authorities to obtain the required regulatory

approvals to transfer ownership of Freedom CY to BMBM.

Because

the acquisition of Freedom RU did not close until after March 31,

2017, our fiscal year end, unless otherwise specifically indicated

or as is otherwise contextually required, the discussion included

herein reflects the results of operations and financial condition

of BMBM as of March 31, 2017, prior to closing the acquisition of

Freedom RU.

Results of Operations

The years ended March 31, 2017 and 2016.

Revenue

We did

not generate any revenue during the years ended March 31, 2017 and

2016.

Expenses

Operating

Expenses. During the fiscal years ended March 31, 2017 and

2016, operating expenses included professional fees of $364,334 and

$222,511, general and administrative expenses of $214,310 and

$268,018, and depreciation expenses of $3,330 and $3,305,

respectively. Professional services mainly included legal,

consulting, and accounting fees incurred in connection with the

planned acquisition of the Freedom Companies. General and

administrative expenses were comprised of payroll and related

payments, rent expenses, and office supplies. Operating expenses

were higher in the fiscal year ended March 31, 2017, compared to

the fiscal year ended March 31, 2016, primarily because we incurred

more legal and consulting services in connection with FFIN’s

new membership application to FINRA. With the closing of the

acquisition of Freedom RU during the first fiscal quarter of 2018,

we anticipate operating expenses to be higher, as a result of the

increased size of our operations, during fiscal 2018.

Loss from

Operations. During the fiscal years ended March 31, 2017 and

2016, we recognized losses from operations of $581,974 and

$493,834, respectively. As discussed above, our loss from

operations was higher during the fiscal year ended March 31, 2017,

than the fiscal year ended March 31, 2016, primarily because of the

increase in professional services. With the closing of the

acquisition of Freedom RU during the first fiscal quarter of 2018,

we anticipate we will begin to realize revenue from the operations

of Freedom RU commencing in the second fiscal quarter 2018. Based

on current projected income and expenses, we anticipate realizing

operating gains in upcoming periods commencing with the second

fiscal quarter 2018.

Total Other

Income. During the fiscal year ended March 31, 2017, we

recognized total other income of $3,935 compared to $1,595 during

the fiscal year ended March 31, 2016. This other income resulted

from interest income on our cash balances.

Net Loss.

For the reasons discussed above, during the fiscal year ended March

31, 2017, we realized a net loss of $578,139, or $0.00 per share.

During the fiscal year ended March 31, 2016, we realized a net loss

of $491,999, or $0.00 per share. As noted above, with the closing

of the acquisition of Freedom RU, we anticipate beginning to

realize net income from operations commencing in the second fiscal

quarter 2018. Prior to closing the acquisition of Freedom RU, BMBM

was generating no operating revenue.

Liquidity and Capital Resources

Liquidity

is a measurement of our ability to meet potential cash requirements

for general business purposes. As of March 31, 2017, we had cash

and cash equivalents of $50,537, compared to cash and cash

equivalents of $99,678, at March 31, 2016. At March 31,

2017, we had total current assets (less restricted cash) of

$50,987, and total current liabilities (less deferred distribution

payment) of $206,071, resulting in a working capital deficit of

$155,084. By comparison, at March 31, 2016, we had total current

assets (less restricted cash) of $150,053 and total current

liabilities (less deferred distribution payment) of $50,329,

resulting in working capital of $99,724.

During

the periods covered in this management discussion and analysis, we

did not generate any revenue and were reliant upon capital contributions from Mr. Turlov our CEO and

chairman, to satisfy our operating expenses. For the year ended

March 31, 2017, Mr. Turlov provided capital contributions to us

totaling $320,000. In April 2017, Mr. Turlov provided us an

additional capital contribution of

$240,000.

With

the closing of the Freedom RU acquisition on June 29, 2017, we

anticipate that commencing in the second fiscal quarter 2018,

revenue generated by Freedom RU will be sufficient to meet our

liquidity and capital resources needs.

Regulatory

requirements applicable to the Freedom Companies require them to

maintain minimum capital levels. Their primary sources

of funds for liquidity consist of existing cash balances (i.e.,

available liquid capital not invested in their operating

businesses), capital contributions from Mr. Turlov, gains from

their proprietary investment accounts, fees and commissions, and

interest income.

The

Freedom Companies monitor and manage their leverage and liquidity

risk through various committees and processes they have

established. The Freedom Companies assess their leverage and

liquidity risk based on considerations and assumptions of market

factors, as well as factors specific to them, including the amount

of available liquid capital (i.e., the amount of their cash and

cash equivalents not invested in their operating

business).

Freedom RU has pursued an aggressive growth

strategy during the past several years, and we anticipate

continuing efforts to rapidly expand the footprint of our brokerage

and financial services business in Russia, Kazakhstan and other

markets. While this strategy has led to revenue growth it also

results in increased expenses and greater need for capital

resources. Expansion may require

greater capital resources than we currently

possess. Should we need additional capital resources, we

could seek to obtain such through debt financing. Once we complete

a reverse stock split, we could also seek to equity financing. We

do not currently possess an institutional source of financing and

there is no assurance that we could be successful in obtaining debt

or equity financing when needed on favorable terms, or at

all.

Cash Flows

During

the fiscal years ended March 31, 2017 and 2016, we used cash

primarily to pay for current expenses. See below for additional