UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed

by the Registrant ☒ Filed by a Party other

than the Registrant ☐

Check

the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material under Rule 14a-12

Freedom Holding Corp.

(Name

of Registrant as Specified in Its Charter)

------------------------------------------------------------

(Name

of Person(s) Filing Proxy Statement, if other than the

Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒

No fee required

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11

(1)

Title of each class

of securities to which transaction applies:

_____________________________________________________________

(2)

Aggregate number of

securities to which transaction applies:

_____________________________________________________________

(3)

Per unit price or

other underlying value of transaction computed pursuant to Exchange

Act Rule 0-11 (set forth the amount on which the filing fee is

calculated and state how it was determined):

_____________________________________________________________

(4)

Proposed maximum

aggregate value of transaction:

_____________________________________________________________

_____________________________________________________________

☐

Fee paid previously with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange

Act Rule 0-11(a)(2) and identify the filing for which the

offsetting fee was paid previously. Identify the previous filing by

registration statement number, or the Form or Schedule and the date

of its filing.

(1)

Amount Previously

Paid:

_____________________________________________________________

(2)

Form, Schedule or

Registration Statement No.:

_____________________________________________________________

_____________________________________________________________

_____________________________________________________________

Freedom Holding Corp.

“Esentai Tower” BC, Floor 7

77/7 Al Farabi Ave.,

Almaty, 050040, Republic of Kazakhstan

_________________

Dear Stockholders:

You are cordially invited to attend the 2019

annual meeting of stockholders (the ‘‘2019 Annual

Meeting’’) of Freedom Holding Corp. (the

‘‘Company,’’ “FRHC,”

“us,” “our,” or “we”) which

will be held at the Ritz Carlton Hotel, Altitude Conference Hall,

28th

Floor, Esentai Tower, 77/7 Al Farabi

Ave., Almaty, 050040, Republic of Kazakhstan on September 10, 2019

at 7:00 p.m. local time.

The

formal notice of the 2019 Annual Meeting is provided in the

enclosed proxy statement. At the 2019 Annual Meeting we will

discuss each item of business described in the Notice of 2019

Annual Meeting of Stockholders and proxy statement.

Important notice regarding the

availability of proxy materials for the 2019 Annual

Meeting. On or about July 26,

2019, we will begin mailing to certain stockholders a Notice of

Internet Availability of Proxy Materials containing instructions on

how to access our proxy materials, including our Annual Report on

Form 10-K for the year ended March 31, 2019 (the “2019 Annual

Report”), via the Internet. The Notice of Internet

Availability of Proxy Materials also contains instructions on how

to receive a paper copy of the proxy materials. Stockholders who do

not receive the Notice of Internet Availability of Proxy Materials

will receive a paper copy of the Notice of Annual Meeting of

Stockholders, Proxy Statement, Form of Proxy and 2019 Annual

Report, which we will also begin mailing on or about July 26, 2019.

Copies of our Notice of Annual Meeting of Stockholders, Proxy

Statement, Form of Proxy and 2019 Annual Report are available at

www.proxyvote.com.

Voting

by the internet or telephone is fast and convenient, and your vote

is immediately confirmed and tabulated. If you receive a paper copy

of the proxy materials, you may also vote by completing, signing,

dating and returning the accompanying proxy card in the enclosed

return envelope furnished for that purpose. By using the internet

or telephone, you help us reduce postage and proxy tabulation

costs.

Your vote is important to

us. The enclosed proxy

statement provides you with detailed information regarding the

business to be considered at the 2019 Annual Meeting. Your vote is

important. We urge you to please vote your shares now whether or

not you plan to attend the 2019 Annual Meeting. You may revoke your

proxy at any time before the proxy is voted by following the

procedures described in the enclosed proxy

statement.

|

|

By order of the board of directors,

|

|

|

|

/s/ Timur Turlov

|

|

|

|

Timur Turlov

Chief Executive Officer and Chairman

|

|

July 26, 2019

FREEDOM HOLDING CORP.

NOTICE OF 2019 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 10, 2019

|

Time and Date:

|

|

7:00

p.m. local time, on September 10, 2019

|

|

|

|

|

|

Location:

|

|

Ritz Carlton Hotel, Altitude Conference Hall, 28th

Floor, Esentai Tower, 77/7 Al Farabi

Ave., Almaty, 050040, Republic of Kazakhstan.

|

|

|

|

|

|

Items of Business:

|

|

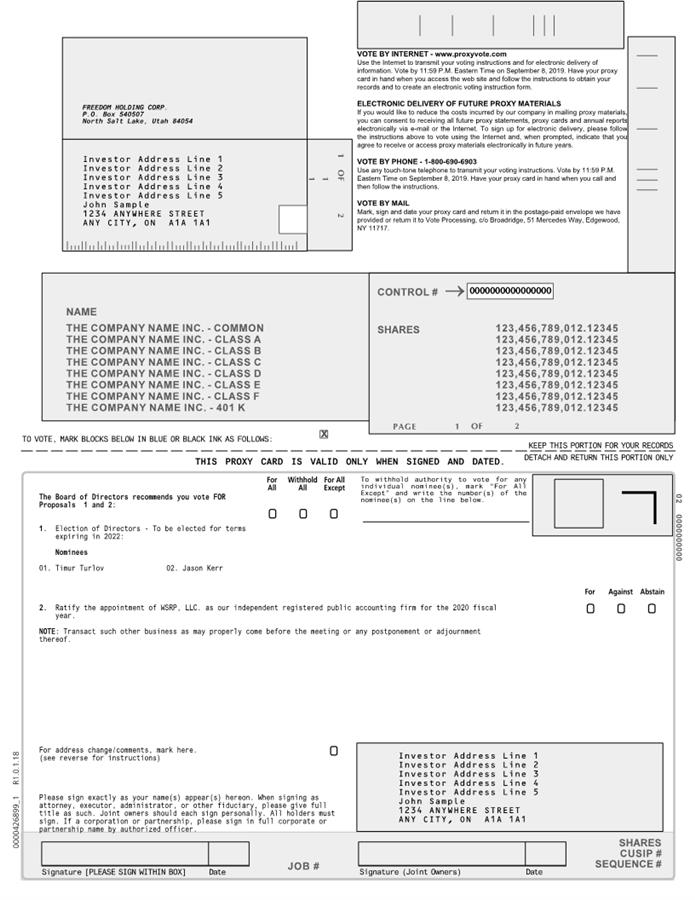

(1)

|

|

Elect

two Class III directors until the 2022 Annual Meeting of

Stockholders, and until their respective successors have been duly

elected and qualified, the following two nominees recommended by

the Board of Directors: Timur Turlov and Jason Kerr.

|

|

|

|

(2)

|

|

Ratification

of the appointment of WSRP, LLC. as our independent registered

public accounting firm for the 2020 fiscal year.

|

|

|

|

(3)

|

|

Transact

such other business as may properly come before the meeting or any

postponement or adjournment thereof.

|

|

|

|

|

|

Record Date:

|

|

You can

vote if you were a stockholder of record at the close of business

on July 15, 2019.

|

|

|

|

|

|

Internet Availability:

|

|

We are

using the internet as our primary means of furnishing our proxy

materials to our stockholders. Rather than sending stockholders a

paper copy of our proxy materials, we are sending them a notice

with instructions for accessing the materials and voting via the

internet. We believe this method of distribution makes the proxy

distribution process more efficient and less costly and will limit

our impact on the environment. This notice of the 2019 Annual

Meeting, the proxy statement and our Annual Report on

Form 10-K for the fiscal year ended March 31, 2019, are

available at www.proxyvote.com.

We anticipate that the Notice of Internet Availability of Proxy

Materials will first be sent to stockholders on or about July 26,

2019. The proxy statement and the form of proxy relating to the

2019 Annual Meeting are first being made available to stockholders

on or about July 26, 2019.

|

|

|

|

|

|

Proxy Voting:

|

|

It is

important that your shares be present or represented and voted at

the 2019 Annual Meeting. You can vote your shares on the internet

at www.proxyvote.com, by telephone by

calling 1-800-690-6903, by completing and returning your

proxy card, or in person at the 2019 Annual Meeting. Voting

instructions are printed on your proxy card or included with your

proxy materials. You can revoke a proxy before its exercise at the

2019 Annual Meeting by following the instructions in the

accompanying proxy statement.

|

|

|

By order of the board of directors,

|

|

|

|

/s/ Timur Turlov

|

|

|

|

Timur Turlov

Chief Executive Officer and Chairman

|

|

July

26, 2019

TABLE

OF CONTENTS

|

|

Page

|

|

INFORMATION ABOUT

THE 2019 ANNUAL MEETING AND VOTING

|

1

|

|

PROPOSAL ONE

– ELECTION OF DIRECTORS

|

5

|

|

CORPORATE

GOVERNANCE

|

9

|

|

DIRECTOR

COMPENSATION

|

16

|

|

SECURITY

OWNERSHIP

|

17

|

|

EXECUTIVE

COMPENSATION

|

18

|

|

PROPOSAL TWO

– RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

|

20

|

|

PRINCIPAL

ACCOUNTANT FEES AND SERVICES

|

20

|

|

CERTAIN

RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

|

21

|

|

STOCKHOLDER

PROPOSALS FOR THE 2020 ANNUAL MEETING

|

23

|

|

2019

ANNUAL REPORT ON FORM 10-K

|

24

|

|

OTHER

MATTERS

|

24

|

INFORMATION ABOUT THE 2019 ANNUAL MEETING AND

VOTING

Why did I receive these Proxy Materials?

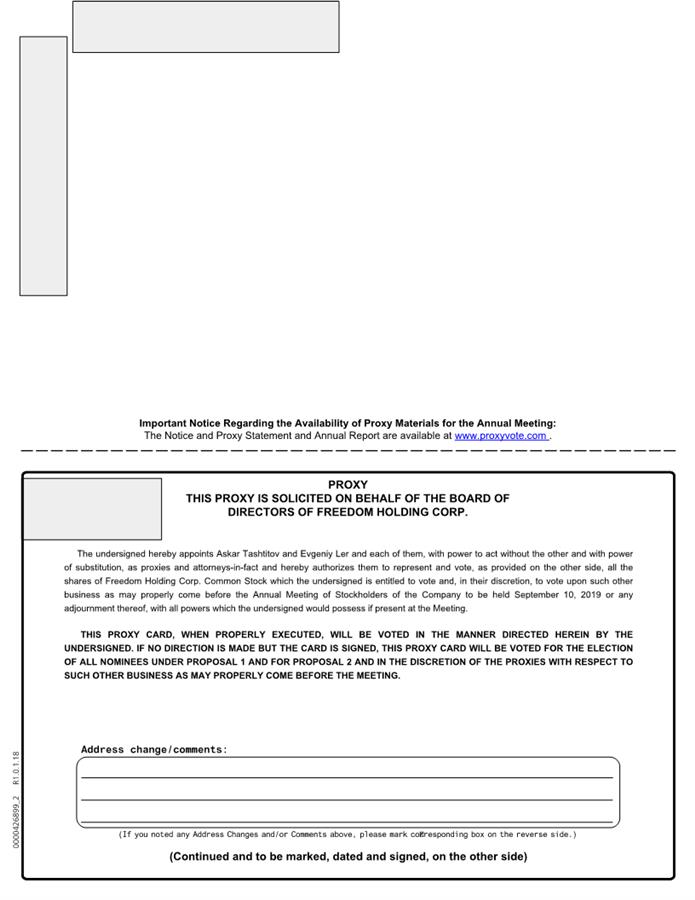

We

are providing this notice of annual meeting of stockholders, proxy

statement, voting instructions and Annual Report on Form 10-K for

the fiscal year ended March 31, 2019 (the “Proxy

Materials”) in connection with the solicitation by the board

of directors (the “Board”) of Freedom Holding Corp.

(the “Company,” “FRHC,” “we,”

“us” or “our”), a Nevada corporation, of

proxies to be voted at our 2019 annual meeting of stockholders and

at any adjournment or postponement thereof (the “2019 Annual

Meeting”).

We

anticipate that the Notice of Internet Availability of Proxy

Materials will first be sent to stockholders on or about July 26,

2019. The proxy statement and the form of proxy relating to the

2019 Annual Meeting are first being made available to stockholders

on or about July 26, 2019.

You are invited to attend the 2019 Annual Meeting

on September 10, 2019, beginning at 7:00 p.m. local time. The 2019

Annual Meeting will be held at the Ritz Carlton Hotel, Altitude

Conference Hall, 28th

Floor, Esentai Tower, 77/7 Al Farabi

Ave., Almaty, 050040, Republic of Kazakhstan. Stockholders will be

admitted to the 2019 Annual Meeting beginning at 6:30 p.m. local

time. Seating will be limited.

What is the difference between holding shares as a stockholder of

record and as a beneficial owner?

If

your shares are registered directly in your name with our transfer

agent, Pacific Stock Transfer Company, you are considered the

“stockholder of record” with respect to those shares.

If you are a stockholder of record, we are sending the Proxy

Materials directly to you at the address of record on account with

Pacific Stock Transfer Company.

If

your shares are held in a stock brokerage account or by a bank or

other holder of record, those shares are held in “street

name.” You are considered the “beneficial owner”

of those shares held in street name. The Proxy Materials have been

forwarded to you by your broker, bank or other holder of record who

is considered, with respect to those shares, the stockholder of

record. As the beneficial owner, you have the right to direct your

broker, bank or other holder of record on how to vote your shares

by using the proxy or voting instructions included in the mailing

or by following their instructions for voting by telephone or on

the internet.

Why did I receive in the mail a Notice of Internet Availability of

Proxy Materials?

Under

rules adopted by the United States Securities and Exchange

Commission (the “SEC”), we are providing access to our

Proxy Materials over the internet. Accordingly, we are sending a

Notice of Internet Availability of Proxy Materials to many of our

stockholders. If you received a notice by mail, you will not

receive a printed copy of the Proxy Materials unless you request

one. The notice tells you how to access and review the Proxy

Materials over the internet at www.proxyvote.com. The notice also

tells you how to access your proxy card to vote on the internet. If

you received a notice by mail and would like to receive a printed

or email copy of the Proxy Materials, please follow the

instructions included in the notice.

What should I bring with me to attend the 2019 Annual

Meeting?

Stockholders

must present a form of personal identification to be admitted to

the 2019 Annual Meeting.

If

your shares are held beneficially in the name of a broker, bank or

other holder of record and you plan to attend the 2019 Annual

Meeting, you must also present proof of your ownership of Company

common stock, such as a brokerage or bank account statement in your

name or a signed letter from the brokerage or bank that

beneficially holds your shares identifying you as the ultimate

beneficial owner of the shares, to be admitted to the 2019 Annual

Meeting.

No

cameras, recording equipment, electronic devices, large bags,

briefcases or packages will be permitted in the 2019 Annual

Meeting.

Who is entitled to vote at the 2019 Annual Meeting?

Stockholders

of record at the close of business on July 15, 2019, the record

date for the 2019 Annual Meeting, are entitled to receive notice of

and vote at the 2019 Annual Meeting. You are entitled to one vote

on each matter presented at the 2019 Annual Meeting for each share

of common stock you owned at that time. Stockholders have no right

to cumulative voting as to any matter, including the election of

directors. At the close of business on July 15, 2019, there were

58,093,212 shares of our common stock outstanding.

How do I vote?

You

may vote using any of the following methods:

By Mail

If

you received paper copies of the Proxy Materials, you may vote by

completing, signing and dating your proxy card and returning it in

the enclosed envelope.

By Internet

We

encourage you to vote and submit your proxy over the internet at

www.proxyvote.com.

By Telephone

You

may vote by telephone by calling 1-800-690-6903.

In person at the 2019 Annual Meeting

Stockholders

may vote in person at the 2019 Annual Meeting. You may also be

represented by another person at the 2019 Annual Meeting by

executing a proper proxy designating that person. If you are a

beneficial owner of shares, you must obtain a legal proxy from your

broker, bank or other holder of record and present it to the

inspector of election with your ballot and a form of identification

to be able to vote at the 2019 Annual Meeting.

What can I do if I change my mind after I vote my

shares?

If

you are a stockholder of record, you can revoke your proxy before

it is exercised by:

●

written notice of

revocation to our Corporate Secretary at Freedom Holding

Corp.,

1930 Village Center Cir. #3-6972, Las Vegas Nevada

89134;

●

timely submission

of a valid, later-dated proxy via mail, the internet or the

telephone; or

●

voting by ballot at

the 2019 Annual Meeting.

If

you are a beneficial owner of shares, you may submit new voting

instructions by contacting your broker, bank or other holder of

record. You may also vote in person at the 2019 Annual Meeting if

you obtain a legal proxy as described in the answer to the previous

question.

Can I vote if my shares are held in “street

name”?

If

the shares you own are held in “street name” by a

brokerage firm, your brokerage firm, as the record holder of your

shares, is required to vote your shares according to your

instructions. To vote your shares, you will need to follow the

directions your brokerage firm provides you. Many brokers also

offer the option of voting over the internet or by telephone,

instructions for which would be provided by your brokerage firm on

your voting instruction form.

If

you do not give instructions to your brokerage firm, it will still

be able to vote your shares with respect to certain

“discretionary” items, but it will not be allowed to

vote your shares with respect to

certain “non-discretionary” items. The

ratification of WSRP, LLC as our independent registered public

accounting firm (Proposal Two) is considered to be a discretionary

item, and your brokerage firm will thus be able to vote on that

item even if it does not receive instructions from you, so long as

it holds your shares in its name. The election of directors

(Proposal One) is considered to be a non-discretionary item;

therefore if you do not instruct your broker how to vote with

respect to this proposal, your broker is not permitted to vote with

respect to that proposal and those votes will thus be considered

“broker non-votes.” “Broker non-votes” are

shares that are held in “street name” by a bank or

brokerage firm that indicates on its proxy that it does not have or

did not exercise discretionary authority to vote on a particular

matter.

If

your shares are held in street name, you must bring an account

statement or letter from your bank or brokerage firm showing that

you are the beneficial owner of the shares as of the record date

(July 15, 2019) along with a form of personal identification to be

admitted to the 2019 Annual Meeting on September 10, 2019. To be

able to vote your shares held in street name at the 2019 Annual

Meeting, you will need to obtain a proxy card from the holder of

record.

How will votes be counted?

Each

share of common stock will be counted as one vote according to the

instructions contained on a proper proxy card, whether submitted by

mail, over the internet or by telephone, or on a ballot voted in

person at the 2019 Annual Meeting.

What constitutes a quorum?

For

business to be conducted at the 2019 Annual Meeting, a quorum must

be present in person or represented by valid proxies. For each of

the proposals to be presented at the 2019 Annual Meeting, a quorum

consists of the holders of a majority of the shares of common stock

issued and outstanding on July 15, 2019, the record date, or at

least 29,046,607 shares.

Shares

of common stock present in person or represented by proxy

(including “broker non-votes” and shares that

abstain or do not vote with respect to a particular proposal) will

be counted for purposes of determining whether a quorum exists at

the 2019 Annual Meeting.

If

a quorum is not present, the 2019 Annual Meeting will be adjourned

until a quorum is obtained.

What vote is required for each item and how does the Board

recommend that I vote?

Proposal One – Election

of Directors. Under our

By-Laws, a nominee for director will be elected to the Board by a

plurality of votes given at the election, meaning the nominee will

be elected if the votes cast “for” the nominee’s

election exceed the votes cast “against” the

nominee’s election. Abstentions and

broker non-votes are not considered votes cast for or

against the nominee and will have no effect on the proposal. If you

do not instruct your broker how to vote with respect to this

proposal, your broker cannot vote your shares with respect to the

election of directors.

Our

Restated Articles of Incorporation provide that our Board shall be

divided into three classes. Each class shall consist, as nearly as

may be possible, of one-third of the total number of directors,

with each director serving for a term of three years and until his

or her successor has been duly elected and qualified. Our

Nominating and Corporate Governance Committee (“nominating

committee”) recommended to the Board, and Board has nominated

two individuals, Timur Turlov and Jason Kerr, each of whom

currently serves as a Class III director, for election as Class III

directors at the 2019 Annual Meeting.

THE BOARD RECOMMENDS THAT YOU VOTE FOR THE ELECTION OF THE TWO

NOMINEES NAMED IN THE ENCLOSED PROXY MATERIALS TO THE

BOARD

Proposal Two –

Ratification of Independent Registered Public Accounting

Firm. The affirmative vote of

the holders of a majority of the total number of votes of our

common stock present in person or represented by proxy and entitled

to vote on the proposal is needed to ratify the selection of WSRP,

LLC as our independent registered public accounting firm for our

2020 fiscal year. Abstentions count as votes against the proposal.

If you do not provide instructions to your brokerage firm regarding

how to vote your shares on this proposal, your broker may

(a) vote your shares on your behalf (because this proposal is

a “discretionary” item) or (b) leave your shares

unvoted. Our By-laws do not require that stockholders ratify the

appointment of our independent auditors. However, we are submitting

the appointment of WSRP, LLC to you for ratification as a matter of

good corporate governance. If our stockholders fail to ratify the

selection, we will consider that failure as a direction to the

Board and the Audit Committee of the Board (the “audit

committee”) to consider the selection of a different firm.

Even if the selection is ratified, the audit committee in its

discretion may select a different independent registered public

accounting firm, at any time during the year if it determines that

such a change would be in the best interests of the Company and our

stockholders.

THE BOARD RECOMMENDS THAT YOU VOTE FOR RATIFICATION OF THE

APPOINTMENT OF WSRP, LLC AS OUR INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM.

Where can I find the voting results?

We

will report the voting results in a Current Report on

Form 8-K within four business days after completion of

our 2019 Annual Meeting.

Could other matters be decided at the 2019 Annual

Meeting?

At

the date this proxy statement went to press, we did not know of any

matters to be raised at the 2019 Annual Meeting other than those

described in this proxy statement. If other matters are properly

presented at the 2019 Annual Meeting for consideration, however,

the proxies appointed by the Board will have the discretion to vote

on those matters for you.

Who will pay for the cost of this proxy solicitation?

We

will pay for the cost of this proxy solicitation. We do not intend

to solicit proxies other than by use of the mail or website

posting, but certain of our directors, officers and other

employees, without additional compensation, may solicit proxies

personally or by telephone, facsimile or email on our

behalf.

Who will count the vote?

The

inspector of elections appointed for the 2019 Annual Meeting will

tabulate all votes.

What is “householding” and how does it affect

me?

We

have adopted a procedure approved by the SEC called

“householding.” Under this procedure, stockholders of

record who have the same address and last name will receive only

one copy of the Proxy Materials, unless one or more of these

stockholders notifies us that they wish to continue receiving

individual copies. This procedure will reduce our printing costs

and postage fees.

Stockholders

who participate in householding will continue to receive separate

proxy cards. Also, householding will not in any way affect dividend

check mailings, if any.

If you are eligible for householding, but you and

other stockholders of record with whom you share an address

currently receive multiple copies of the Proxy Materials, or if you

hold stock in more than one account, and in either case you wish to

receive only a single copy of each of these documents for your

household, please make a written request to the: Corporate

Secretary, Freedom Holding Corp., 1930 Village Center Cir.

#3-6972, Las Vegas, Nevada 89134, email usoffice@freedomholdingcorp.com or contact

our Corporate Secretary at (801) 355-2227. If multiple stockholders

of record who have the same address receive only one copy of the

Proxy Materials and would like to receive additional copies, or if

they would like to receive a copy for each stockholder living at

that address in the future, send a written request to the address

or email address above or contact our Corporate Secretary at (801)

355-2227. Upon such written or oral request, we will promptly

deliver separate Proxy Materials to any stockholders who receive

one paper copy at a shared address.

Beneficial

owners can request information about householding from their

brokers, banks or other holders of record.

Other information

Our

Annual Report on Form 10-K for the fiscal year ended

March 31, 2019 (the “2019 Annual Report”), accompanies

this proxy statement. No material contained in the Annual Report is

to be considered a part of the Proxy Materials. “Fiscal

2019” refers to the 52-week fiscal year that ended

on March 31, 2019. “Fiscal 2018” refers to

the 52-week fiscal year that ended on March 31,

2018. The contents of our corporate website or the corporate

website of any of our subsidiaries are not incorporated by

reference into this proxy statement.

PROPOSAL ONE—ELECTION OF DIRECTORS

Our

Restated Articles of Incorporation provide that our Board shall be

divided into three classes. Generally, each director serves for a

term of three years and until his or her successor has been duly

elected and qualified. The term of office of the Class III

Directors expires at the 2019 Annual Meeting. The nominating

committee recommended and the Board has nominated Timur Turlov and

Jason Kerr to stand for re-election at the 2019 Annual Meeting as

Class III Directors. Mr. Turlov has served as a member of the board

since November 2015 and Mr. Kerr has served as a member of the

board since May 2008. If elected at the 2019 Annual Meeting each of

these nominees would serve until the 2022 Annual Meeting and until

his successor is duly elected and qualified, or if sooner, until

the director’s death, resignation or removal.

Directors

are elected by a plurality of the votes cast in person or by proxy

and entitled to vote on the election of directors. The two nominees

receiving the most “For” votes (from the holders of

shares present in person or represented by proxy at the 2019 Annual

Meeting and voting on the election of directors) will be elected.

If no contrary indication is made, shares represented by executed

proxies will be voted “For” the election of the two

nominees named above. If, prior to the 2019 Annual Meeting, it

should become known that either of the nominees will be unwilling

or unable to serve as a director after the 2019 Annual Meeting by

reason of resignation, death, incapacity or other unexpected

occurrence, the proxies will be voted “For” such

substitute nominee as is determined by nominating committee and the

Board or, alternatively, not voted for any nominee. The Board has

no reason to believe that either nominee will withdraw or be unable

to serve. Proxies cannot be voted for more than the number of

nominees proposed for election.

The

Board believes that it is necessary for each of our directors to

possess many qualities and skills. When searching for candidates,

the nominating committee considers the evolving needs of the Board

and searches for candidates that fill any current or anticipated

future gap. The nominating committee considers a candidate’s

business experience, issues of judgment, background, stature,

conflicts of interest, integrity, ethics and commitment to the goal

of maximizing stockholder value. Candidates should possess one or

more of the following skills and qualifications: experience in the

financial services industry, experience in international business

regulation, financial expertise, accounting skills, human resource

management, public company management, etc. The nominating

committee does not have a formal policy with respect to Board

diversity. The Board and the nominating committee believe that it

is desirable to have a variety of viewpoints on the Board, which

may be enhanced by a mix of different professional and personal

backgrounds and experience. In considering candidates for the

Board, the nominating committee considers the entirety of each

candidate’s credentials in the context of these standards.

With respect to the nomination of continuing directors

for re-election, the individual’s contributions to

the Board are also considered.

The

following is a brief biography of the nominees for Class III

directors and each person whose term as a Class I or Class II

director will continue after the 2019 Annual Meeting.

|

Timur Turlov

Age:

31

Class

III Director Since:

November

2015

Non-independent

Committee

Memberships:

Nominating

and Corporate Governance

|

|

Mr.

Turlov graduated from Russia State Technic University (named after

Tsiolkovsky) in 2009 with a Bachelor of Science degree in economics

and management. Mr. Turlov has more than 10 years of experience in

various areas in the international securities industry. From July

2013 to July 2017, Mr. Turlov served as the Advisor to the Chairman

of the Board of JSC Freedom Finance (“Freedom KZ”). In

that capacity, Mr. Turlov was primarily responsible for strategic

management, public and investor relations events, investment

strategy, sales strategy, and government relations. In July 2017,

Mr. Turlov became Chairman of the Board of Directors of Freedom KZ.

He has also served as the General Director of LLC IC Freedom

Finance (“Freedom RU”), since August 2011. As the

General Director, Mr. Turlov is responsible for establishing

Freedom RU’s strategic goals, including acquisition and

retention of large clients, sales strategy and company development.

From May 2012 through January 2013, Mr. Turlov served as the

Chairman of the Board of Directors of JSC Nomad Finance where he

oversaw business set up and acquisition of large clients. From July

2010 through August 2011, Mr. Turlov was employed as the Vice

Director of the International Sales Department of Nettrader LLC. In

this capacity, his major responsibilities included consulting to

set up access to foreign markets, trading, back office, and

internal accounting functions. Mr. Turlov also owns interests in

other businesses, including other securities brokerage firms that

are not subsidiaries of the Company.

|

|

|

|

|

|

|

Skills and Qualifications: Mr.

Turlov was selected as a director nominee based on his in depth

knowledge of the business of the Company and capital markets, his

professional experience and his educational background in economics

and management.

|

|

|

|

|

Jason Kerr

Age:

47

Class

III Director Since:

May

2008

Independent

|

|

Mr. Kerr earned his

Bachelor of Science degree in economics in 1995 and a Juris

Doctorate in 1998 from the University of Utah, where he was named

the William H. Leary Scholar. In 2011, Mr. Kerr founded the law

firm Price, Parkinson & Kerr, where he practices commercial

litigation. From 2006 to 2011, Mr. Kerr was the associate general

counsel of Basic Research, LLC, concentrating in intellectual

property litigation. Before joining Basic Research, Mr. Kerr was a

partner with the law firm of Plant, Christensen & Kanell in

Salt Lake City, Utah. Mr. Kerr was employed with Plant, Christensen

& Kanell from 1996 through 2001 and from 2004 to 2006. From

2001 through 2004, Mr. Kerr was employed as a commercial litigator

with the Las Vegas office of Lewis and Roca. Mr. Kerr became our

director in May 2008.

|

|

Committee

Memberships: |

|

|

|

Audit

Nominating

and Corporate Governance

|

|

Skills and Qualifications: Mr. Kerr was selected as a director

nominee based on his educational background in economics, his

managerial and business management skills, and his extensive

professional experience as both in-house and outside legal

counsel.

|

|

|

|

|

|

|

|

Boris Cherdabayev

Age:

65

Class I

Director Since:

February

2019

Continuing

in office until the 2020 Annual Meeting

Independent

Committee

Memberships:

Audit

Compensation

|

|

Since

2012 Mr. Cherdabayev has served as Counsellor to the Chairman of

the management board of Weatherford-CER, a privately owned joint

venture company between Weatherford International and Caspian

Energy Research LLP. Mr. Cherdabayev served as the Chairman of the

board of BMB Munai Inc., the predecessor of the Company, from

November 2003 to November 2015 and also as Chief Executive Officer

from November 2003 through August 2007. From May 2000 to May 2003,

Mr. Cherdabayev served as Director at TengizChevroil LLP

multi-national oil and gas company owned by Chevron, ExxonMobil,

KazMunayGas and LukOil. From 1998 to May 2000, Mr. Cherdabayev

served as a member of the Board of Directors, Vice-President of

Exploration and Production and Executive Director on Services

Projects Development for NOC “Kazakhoil”, an oil and

gas exploration and production company. From 1983 to 1988 and from

1994 to 1998 he served as a people’s representative at

Novouzen City Council (Kazakhstan); he served as a people’s

representative at Mangistau Oblast Maslikhat (regional level

legislative structure) and a Chairman of the Committee on Law and

Order. For his achievements Mr. Cherdabayev has been awarded with a

national “Kurmet” order. Mr. Cherdabayev earned an

engineering degree from the Ufa Oil & Gas Institute, with a

specialization in “machinery and equipment of oil and gas

fields” in 1976. Mr. Cherdabayev also earned an engineering

degree from Kazakh Polytechnic Institute, with a specialization in

“mining engineer on oil and gas fields’

development.” During his career he also completed an English

language program in the United States, the

СНАМР Program (Chevron Advanced

Management Program) at Chevron Corporation offices in San

Francisco, California, and the CSEP Program (Columbia Senior

Executive Program) at Columbia University.

|

|

|

|

|

|

|

|

Skills and Qualifications: Mr. Cherdabayev was selected as a

director because of his extensive executive management and board

experience with both private and U.S. public

companies.

|

|

Askar Tashtitov

Age:

40

Class I

Director Since:

May

2008

Continuing

in office until the 2020 Annual Meeting

Non-independent

|

|

Mr. Tashtitov has served as the president of the Company since June

2018 and leads our investment banking activities. He has served as

a director of the Company since May 2008 and was employed with BMB

Munai, Inc., the predecessor of the Company, from December 2004

through November 2015, serving as the president from May 2006 to

November 2015. Mr. Tashtitov earned a Bachelor of Arts degree from

Yale University majoring in economics and history in 2002. Mr.

Tashtitov passed the AICPA Uniform CPA Examination in

2006.

Skills and Qualifications: Mr. Tashtitov was selected as a

director because he has 15 years of experience in the public

company arena, with particular expertise in interfacing with equity

and debt financing professionals, as well as investment banking and

significant business management experience.

|

|

Committee

Memberships:

Compensation

|

|

|

|

|

|

|

Leonard Stillman

Age:

76

Class

II Director Since:

October

2006

Continuing

in office until the 2020 Annual Meeting

Independent

Committee

Memberships:

Audit

Compensation

Nominating

and Corporate Governance

|

|

Mr.

Stillman earned his Bachelor of Science degree in mathematics from

Brigham Young University and Masters of Business Administration

from the University of Utah. He began his career in 1963 with

Sperry UNIVAC as a programmer developing trajectory analysis

software for the Sergeant Missile system. Mr. Stillman spent many

years as a designer and teacher of computer language classes at

Brigham Young University, where he developed applications for the

Administrative Department including the school’s first

automated teacher evaluation system. During that time, he was also

a vice-president of Research and Development for Automated

Industrial Data Systems, Inc. and the Owner of World Data Systems

Company, which provided computerized payroll services for companies

such as Boise Cascade. Mr. Stillman has over 45 years of extensive

business expertise, including strategic planning, venture capital

financing, budgeting, manufacturing planning, cost controls,

personnel management, quality planning and management, and the

development of standards, policies, and procedures. He has

extensive skills in the design and development of computer software

systems and computer evaluation. Mr. Stillman helped found Stillman

George, Inc. in 1993 and founded Business Plan Tools, LLC in 2004.

He was employed with Stillman George, Inc. until 2010, where his

primary responsibilities included managing information, technical

development, and financial analysis projects and development, as

well as general company management and consulting activities. From

2008 to 2009 Mr. Stillman served as the interim chief financial

officer of BMB Munai, Inc., the predecessor to the Company. He is

currently employed by Business Plan Tools, LLC, which provides

cloud-based SaaS business planning software and consolidates a

broad variety of skills from a growing group of business

professionals to provide needed support in finance, marketing,

management, sales, planning, product development, and more to

businesses worldwide.

Skills and Qualifications: The Board selected Mr. Stillman as a

director because of his significant background in business

management, strategic planning, corporate finance, and information

management.

|

No

directors, nominees for director or executive officers have any

family relationship to any other director, nominee for director or

executive officer. None of the nominees have held directorships

with other public corporations during the past five

years.

No

director, nominee for director or executive officers or, to our

knowledge, any owner of record or beneficially of more than five

percent of our common stock, or any associate of any such director,

officer, affiliate of the Company, or security holder is a party

adverse to us or any of our subsidiaries or has a material interest

adverse to us or any of our subsidiaries.

|

|

THE BOARD

RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF

EACH OF THE DIRECTOR NOMINEES LISTED ABOVE

|

|

CORPORATE GOVERNANCE

Director Independence

The

Board relies upon the OTC Markets Group OTCQX Rules for U.S.

Companies and the SEC’s director independence requirements to

provide guidelines to assist it in its determination of director

independence. The Company is a “Controlled Company” as

defined by the NYSE and NASDAQ. As such, we are not required to

have a majority of independent directors on our Board, nor are we

required to have a majority of independent directors on our

nominating committee or our compensation committee. While our Board

is presently staffed by a majority of independent directors that

may not always be the case. Our audit committee is currently

staffed solely by independent directors, but our compensation

committee and nominating committee each have one member that is not

independent. For so long as the Company remains a Controlled

Company, we anticipate we may take advantage of the exemptions to

the independence requirements available to Controlled

Companies.

The

nominating committee and the full Board review the independence of

all members of the Board for purposes of determining which Board

members are deemed independent. Based on the director independence

standards of the OTC Markets Group OTCQX Rules for U.S. Companies,

the nominating committee and the full Board affirmatively

determined that Mr. Kerr, Mr. Stillman and Mr. Cherdabayev are

independent. In making this determination, our nominating committee

and Board considered the current and prior relationships that each

of the directors has with our Company and all other facts and

circumstances our nominating committee and Board deemed relevant in

determining their independence, including the beneficial ownership

of our capital stock by each non-employee director and other

transactions, relationships, and arrangements that are not required

to be disclosed in this proxy statement.

Transactions with Related Persons

Our

named executive officers and the Board are required to complete a

questionnaire on an annual basis that requires them to disclose any

related person transactions and potential conflicts of interest.

Our Chief Financial Officer reviews the responses to the

questionnaires and, if a related person transaction or potential

conflict of interest is reported by a director or named executive

officer, the questionnaire will be submitted to the audit committee

for review. If necessary, the audit committee will determine

whether the relationship is material and will have any effect on

the director’s independence. After making that determination,

the audit committee will approve or reject the

transaction.

Communication with the Board

The Board encourages communication from our

stockholders. Any interested parties who wish to communicate with

the non-management directors should send any such

communication to the Corporate Secretary at 1930 Village

Center Cir. #3-6972, Las Vegas, Nevada 89134. All such stockholder communication will be

reviewed by the Corporate Secretary who will determine the

appropriate response or course of action.

BOARD LEADERSHIP STRUCTURE

Board Leadership

The Chairman of the Board and Chief

Executive Officer of the Company is Timur Turlov, our controlling

stockholder. Mr. Turlov, along with the executive management

team, is responsible for

setting our strategic direction and

our day-to-day leadership and performance, while the

Board is responsible to hold management accountable for execution

of strategy once it is developed. The Board believes that it is

currently in the best interests of the Company and our stockholders

for Mr. Turlov to serve as Chief Executive Officer and Chairman of

the Board. Our directors bring different perspectives, experience,

insight and expertise from outside the Company while Mr. Turlov

brings Company specific experience and expertise. The Board

believes that the combined role of Chairman and Chief Executive

Officer also facilitates flow of information between the Board and

management.

The

Board currently consists of five members; our Chief Executive

Officer, our President and three non-employee directors, all of

whom are independent. Members of the Board are kept informed of the

Company’s operations by reviewing materials provided to them,

speaking to our executives, employees and legal counsel and by

attending meetings of the Board. We do not currently have a lead

independent director.

BOARD COMMITTEES

Prior

to July 2018, the full Board fulfilled the functions which have now

been assigned to the Board committees listed in the table below. As

noted above, as a Controlled Company we are exempt from certain

board and committee independence requirements of the NYSE and

NASDAQ. Our audit committee consists of all independent directors.

Our compensation committee and our nominating committee are each

staffed by two independent directors and one non-independent

director.

The

memberships of each committee as of the date of this proxy

statement are listed below:

|

Name

|

|

|

Nominating and

Corporate Governance Committee

|

|

Leonard

Stillman

|

C

|

X

|

X

|

|

Jason

Kerr

|

X

|

|

X

|

|

Boris

Cherdabayev

|

X

|

X

|

|

|

Timur

Turlov*

|

|

|

C

|

|

Askar

Tashtitov*

|

|

C

|

|

An

“X” indicates membership on the committee.

A

“C” indicates that the director serves as the chairman

of the committee.

* Mr.

Turlov and Mr. Tashtitov do not meet the independence

qualifications.

Audit Committee

The Audit Committee Charter provides that the

audit committee is primarily responsible for the integrity of our

accounting and financial reporting process, our compliance with

legal and regulatory requirements, the independence, qualifications

and the performance of our independent registered public accounting

firm, and performance of internal audit functions. Specifically,

these duties include: selecting, retaining, compensating,

overseeing, and if necessary, terminating our independent

registered public accounting firm and any other registered public

accounting firm, as necessary; approving audit and non-audit

services provided to us by the independent registered public

accounting firm; approving all audit engagement fees and terms;

reviewing the scope of the audit to be conducted by such firm,

including the firm’s internal quality control procedures, and

issues raised by the most recent peer review or public company accounting oversight board (United

States) (“PCAOB”)

review or inspection, as well as the results of its audit;

evaluating, at least annually, the qualifications, performance and

independence of the independent auditors; reviewing and discussing

with the independent auditors any audit problems, difficulties and

disagreements and management’s responses to same; overseeing

our financial reporting activities, including annual and quarterly

reports and the accounting standards and principles followed;

reviewing and approving the design and implementation of an

internal audit function; reviewing and approving related-party

transactions; overseeing legal and regulatory compliance;

overseeing disclosure and internal controls, including establishing

and overseeing procedures to address concerns about the same; and

preparing the report of the audit committee, as required by the

rules and regulations of the SEC, included in this proxy

statement.

Each

member of the audit committee is financially literate. Mr.

Stillman, Mr. Kerr and Mr. Cherdabayev each meet the

“Independent Director” definition of the OTC Markets

Group OTCQX Rules for U.S. Companies and the SEC. The Board has

determined that Mr. Stillman qualifies as an audit committee

financial expert as defined in Item 407(d)(5)(ii) of Regulation

S-K. We did not staff our audit committee until July 2018 and the

full Board performed the functions of the audit committee. During

fiscal 2019, the audit committee did not meet independent of the

full board. The amendments to the Audit Committee Charter adopted

in February 2019 provide that the audit committee will meet at

least four times annually. As of the date of printing the audit

committee has met three times during fiscal 2020.

Report of the Audit Committee

The

audit committee oversees our financial reporting process on behalf

of the Board. Management is responsible for our internal controls,

financial reporting process and compliance with laws, regulations

and ethical business standards. Our independent registered public

accounting firm is responsible for performing an integrated audit

of our consolidated financial statements and of our internal

control over financial reporting in accordance with standards of

the PCAOB, and to issue opinions thereon. The audit

committee’s responsibility is to monitor and oversee these

processes. In this capacity, the audit committee provides advice,

counsel, and direction to management and the auditors on the basis

of the information it receives, discussions with management and the

auditors, and the experience of the audit committee’s members

in business, financial and accounting matters.

The

audit committee reviewed and discussed with management and WSRP,

LLC, our independent registered public accounting firm, our audited

financial statements for the fiscal year ended March 31, 2019. The

audit committee reviewed and discussed with management and WSRP,

LLC, management’s assessment of the effectiveness of the

Company’s internal control over financial reporting and WSRP,

LLC’s opinion about the effectiveness of the Company’s

internal control over financial reporting. The audit committee

discussed with WSRP, LLC the matters required to be discussed by

applicable requirements of the PCAOB as currently in effect. The

audit committee also received the written disclosures and the

letter from WSRP, LLC required by applicable requirements of the

PCAOB regarding auditor-audit committee communications concerning

independence and discussed with WSRP, LLC its independence from

Freedom Holding Corp. and its management.

In

reliance on the reviews and discussions referred to above, the

audit committee recommended to the Board, and the Board approved,

that our audited financial statements be included in the

Company’s 2019 Annual Report, which has been filed with the

SEC. These are the same financial statements that appear in our

Annual Report.

Members of the Audit

Committee:

Leonard

Stillman, Chair

Jason

Kerr

Boris

Cherdabayev

Compensation Committee

The

compensation committee charter provides that the primary function

of the compensation committee is to carry out the duties assigned

to it by the Board relating to review and determination of

executive compensation. The Compensation Committee Charter assigns

the compensation committee the following authority and

responsibilities: reviewing and approving corporate goals and

objectives applicable to the compensation of the chief executive

officer (“CEO”) and evaluation of the CEO’s

performance to determine and approve CEO compensation; reviewing

and approving the compensation of all other executive officers;

reviewing, approving and, when appropriate, recommending to the

Board for approval, incentive compensation plans and equity-based

plans, and where appropriate or required, recommending such plans

for approval by our stockholders; reviewing with management

executive compensation disclosure to be included, as required by

SEC rules and regulations, in our annual reports on Form 10-K

and/or proxy statements; reviewing, approving and, when

appropriate, recommending to the Board for approval, any employment

agreements and severance arrangements or plans, including any

benefits to be provided in connection with a change in control, and

any amendments or terminations thereto; determining stock ownership

guidelines for executive officers and monitoring compliance with

such guidelines; reviewing incentive compensation arrangements and

the relationship between risk management policies and practices and

compensation policies and practices; reviewing and recommending to

the Board for approval the frequency of Say on Pay votes; reviewing

all director compensation and benefits; and overseeing engagement

with stockholder and proxy advisory firms on matters of executive

compensation.

The

Compensation Committee Charter allows the compensation committee to

invite such members of management to its meeting as it deems

appropriate, but in all cases the CEO and any other such officers

shall not be present at meetings at which their compensation or

performance is discussed or determined.

The

Compensation Committee Charter provides that the compensation

committee will annually conduct an evaluation of its duties under

the charter and present the result to the Board. The Compensation

Committee Charter also authorizes the compensation committee to

access, at our expense, such internal and external resources,

including retaining, legal, financial and other advisors, such as

compensation consultants, as the compensation committee deems

necessary or appropriate to fulfill its responsibilities. Neither

the compensation committee nor the Board retained the services of a

compensation consultant during fiscal 2019. The Compensation

Committee Charter authorizes the compensation committee to delegate

any of its responsibilities and authority to one or more

subcommitees as it deems appropriate.

Mr.

Tashtitov is the Chairman of the compensation committee and Mr.

Stillman and Mr. Cherdabayev are members of the committee. As our

president, Mr. Tashtitov does not qualify as an independent

director. Mr. Stillman and Mr. Cherdabayev do qualify as

independent directors. To the extent securities laws or other laws,

rules or regulations require approval by the full Board, or by the

independent members of the Board, such matters will be submitted

for appropriate approval. The compensation committee did not meet

independent of the full board during fiscal 2019, but as of the

date of printing, it has met once during fiscal 2020.

Nominating and Corporate Governance Committee

The

Nominating and Corporate Governance Committee Charter provides that

the nominating committee’s responsibilities include, among

other things: determining the qualifications, qualities, skills,

and other expertise required to be a director; identifying

individuals qualified to become Board members; recommending to the

Board nominees to stand for election or to fill any vacancies;

developing and recommending a set of corporate governance

guidelines; overseeing our corporate governance practices and

procedures; developing, subject to approval by the Board, a process

for an annual evaluation of the Board and its committees and

overseeing the conduct of the annual evaluation; reviewing the

Board’s committee structure and composition and making

recommendations to the Board regarding the appointment of directors

to serve as members of each committee; developing and recommending

to the Board for approval director standards for determining

whether a director has a material relationship with the Company

that would impair his or her independence; as necessary, amending

and updating our Code of Ethics and Business Conduct; monitoring

compliance with, investigating any alleged breach or violation of,

and enforcing the provisions of our Code of Ethics and Business

Conduct; developing and recommending to the Board for approval an

officer succession plan; and reviewing all tendered director

resignation letters and evaluating and recommending to the Board

whether such resignations should be accepted.

In

discharging its responsibilities to nominate candidates for

election to the Board neither the Board, nor the nominating

committee has, at this time, specified any minimum qualifications

for serving on the Board. We believe that our directors should have

the highest professional and personal ethics and values, consistent

with our values and standards. They should be committed to

enhancing stockholder value and should have sufficient time to

carry out their duties and to provide insight and practical wisdom

based on experience. Their service on other boards of public

companies should be limited to a number that permits them, given

their individual circumstances, to perform responsibly all director

duties for us. Each director must represent the interests of all

stockholders. When considering potential director candidates, the

nominating committee also considers the candidate’s

character, judgment, diversity, age and skills, including financial

literacy and experience in the context of our needs and the needs

of the Board.

Because

of the size of the Company and the limited need to seek additional

directors, there is no assurance that all stockholder proposed

candidates will be fully considered, that all candidates will be

considered equally, or that the proponent of any candidate or the

proposed candidate will be contacted by the Company, the Board or

the nominating committee, and no undertaking to do so is implied by

the willingness to consider candidates proposed by stockholders.

The nominating committee did not meet independent of the full board

during fiscal 2019. As of the date of printing the nominating

committee has met once during fiscal 2020.

The

Nominating and Corporate Governance Charter authorizes the

nominating committee to access, at our expense, such internal and

external resources, including retaining, legal, financial and other

advisors, such as the nominating committee deems necessary or

appropriate to fulfill its responsibilities.

Stockholder Nominees for Director

Our

nominating committee will consider qualified director nominees

recommended by stockholders when such recommendations are submitted

in accordance with applicable SEC requirements, our By-laws, Nevada

state corporate law and any other applicable law, rule or

regulation regarding director nominations. Under our By-laws,

nominations of persons for election to the Board may be made at an

annual meeting of stockholders by any stockholder who was a

stockholder of record as of the record date and at the time of

giving of the notice provided for in our By-laws and at the time of

the annual meeting; and provides timely notice and otherwise

complies with the procedures set forth in our By-laws.

No

candidates for director nominations were submitted to the

nominating committee by any stockholder in connection with 2019

Annual Meeting. Any stockholder desiring to present a nomination

for consideration by the nominating committee prior to the 2020

Annual Meeting must do so in accordance with our By-laws and

policies as described in more detail in “Stockholder

Proposals for the 2020 Annual Meeting,” elsewhere in this

proxy statement.

Advance Notice Provisions

To be timely, a stockholder’s notice

pursuant to the advance notice provisions of our By-laws must be in

writing and delivered to us at our principal executive offices not

later than the close of business on the 90th day, nor earlier than

the close of business on the 120th day, in advance of the

anniversary of the previous year’s annual meeting if such

meeting is to be held on a day which is not more than 30 days in

advance of the anniversary of the previous year’s annual

meeting or not later than 60 days after the anniversary of the

previous year’s annual meeting; and with respect to any other

annual meeting of stockholders, including in the event that no

annual meeting was held in the previous year, not earlier than the

close of business on the 120th day prior to the annual meeting and

not later than the close of business on the later of: (1) the 90th

day prior to the annual meeting and (2) the tenth day

following the day following the day on which public announcement of

the date of such meeting is first made. A stockholder’s notice pursuant to the

advance notice provision of our By-Laws should be delivered to:

Chairman of the Nominating and Corporate Governance Committee c/o

Corporate Secretary, Freedom Holding Corp, “Esentai

Tower” BC, Floor 7, 77/7 Al Farabi Ave., Almaty, 050040,

Republic of Kazakhstan.

To

be in proper form, a stockholder’s notice pursuant to the

advance notice provisions of our By-laws must set forth, as to the

stockholder giving the notice and the beneficial owner, if any, on

whose behalf the nomination is made:

●

the

name and address of the stockholder as they appear on our books and

of the beneficial owner, if any, on whose behalf the nomination is

being made;

●

the

class and number of our shares which are owned by the stockholder

(beneficially and of record) and owned by the beneficial owner, if

any, on whose behalf the nomination is being made, as of the date

of the notice, and a representation that the stockholder will

notify us in writing of the class and number of such shares owned

of record and beneficially by the stockholder as of the record date

for the meeting within five business days after the record date for

such meeting;

●

a

description of any agreement, arrangement, or understanding with

respect to such nomination between or among the stockholder or the

beneficial owner, if any, on whose behalf the nomination is being

made and any of their affiliates or associates, and any others

(including their names) acting in concert with any of the

foregoing, and a representation that the stockholder will notify us

in writing of any such agreement, arrangement, or understanding in

effect as of the record date for the meeting within five business

days after the record date for such meeting;

●

a

description of any agreement, arrangement, or understanding

(including any derivative or short positions, profit interests,

options, hedging transactions, and borrowed or loaned shares) that

has been entered into as of the date of your notice by, or on the

stockholder’s behalf, or the beneficial owner, if any, on

whose behalf the nomination is being made and any of their

affiliates or associates, the effect or intent of which is to

mitigate loss to, manage risk or benefit of share price changes

for, or increase or decrease the voting power of such person or any

of their affiliates or associates with respect to shares of our

stock, and a representation that the stockholder will notify us in

writing of any such agreement, arrangement, or understanding in

effect as of the record date for the meeting within five business

days after the record date for such meeting;

●

a

representation that the stockholder is a holder of record of our

shares entitled to vote at the meeting and intends to appear in

person or by proxy at the meeting to nominate the person or persons

specified in the notice, and

●

a

representation whether the stockholder intends to deliver a proxy

statement and/or form of proxy to holders of at least the

percentage of our outstanding capital stock required to approve the

nomination and/or otherwise to solicit proxies from stockholders in

support of the nomination. We may require any proposed nominee to

furnish such other information as we may reasonably require to

determine the eligibility of such proposed nominee to serve as an

independent director or that could be material to a reasonable

stockholder’s understanding of the independence, or lack

thereof, of such nominee.

The

stockholder’s notice must provide the nominating committee

the following:

●

the name, age,

business address, and residence address of each proposed

nominee;

●

the principal

occupation or employment of each such nominee;

●

the class and

number of shares of capital stock of the Corporation which are

owned of record and beneficially by each such nominee (if

any);

●

such other

information concerning each such nominee as would be required to be

disclosed in a proxy statement soliciting proxies for the election

of such nominee as a director in an election contest (even if an

election contest is not involved) or that is otherwise required to

be disclosed, under Section 14(a) of the Exchange Act;

●

a

written questionnaire with respect to the background and

qualification of such proposed nominee (which questionnaire shall

be provided by the Corporate Secretary upon written request) and a

written statement and agreement executed by each such nominee

acknowledging that such person:

o

consents

to being named in the Corporation’s proxy statement as a

nominee and to serving as a director if elected,

o

intends

to serve as a director for the full term for which such person is

standing for election, and

o

makes

the following representations: (1) that the nominee has read and

agrees to adhere to our Code of Ethics and Business Conduct and

other corporate governance policies and guidelines applicable to

directors, (2) that the nominee is not and will not become a party

to any agreement, arrangement, or understanding with, and has not

given any commitment or assurance to, any person or entity as to

how such person, if elected as a director, will act or vote on any

issue or question, (3) that the nominee is not and will not become

a party to any agreement, arrangement, or understanding with any

person or entity other than the Corporation with respect to any

direct or indirect compensation, reimbursement, or indemnification

in connection with such person’s nomination for director or

service as a director.

Proxy Access Provisions

Pursuant

to the proxy access provisions of our By-laws, a stockholder, or a

group of not more than 20 stockholders, that has continuously owned

for at least three years a number of shares that represents at

least 3% of our outstanding voting shares can nominate for

inclusion in the Company’s proxy statement a number of

nominees not to exceed 20% of the number of directors in office as

of the last day on which notice of a nomination may be delivered to

the Company, or if such amount is not a whole number, the closest

whole number less than 20%, provided that the stockholder(s) and

the stockholder nominee(s) satisfy the requirements specified in

our By-laws. Such requirements include the timely delivery of a

stockholder’s notice to our Corporate Secretary.

To be timely, a stockholder’s notice

pursuant to the proxy access provisions must be delivered to our

Corporate Secretary at our principal executive offices not later

than 120 days nor more than 150 days prior to the first anniversary

of the date the definitive proxy statement was first sent to

stockholders in connection with the preceding year’s annual

meeting; provided, however, that in the event that the date of the

annual meeting is advanced more than 30 days or delayed more than

60 days from the anniversary of the preceding year’s annual

meeting, or if no annual meeting was held in the preceding year,

the notice must be delivered not earlier than the close of business

on the 150th

day prior to such annual meeting and

not later than the close of business on the later of (i) the

120th

day prior to such annual meeting or

the tenth day following the day on which public announcement of the

date of such meeting is first made.

A

stockholder’s notice pursuant to the proxy access provisions

must set forth, as to the stockholder giving the notice and the

beneficial owner, if any, on whose behalf the nomination is

made:

●

the

information required in a stockholder’s notice pursuant to

the advance notice provisions of our By-laws;

●

a statement of the

stockholder (a) setting forth and certifying to the number of

shares of the Company the stockholder owns and has owned

continuously for at least three years as of the date of the notice

and (b) agreeing to continue to own such shares through the

applicable annual meeting;

●

a copy of the

Schedule 14N that has been or concurrently is filed with the SEC as

required by Rule 14a-18 under the Exchange

Act;

●

the

details of any relationship that existed within the past three

years and that would have been described pursuant to Item 6(e) of

Schedule 14N if the relationship existed on the date of submission

of the Schedule 14N; and

●

written agreements

of the stockholder(s) setting forth certain additional agreements,

representations and warranties specified in our

By-laws.

Corporate Governance Guidelines

The

Nominating and Corporate Governance Committee Charter provides that

the nominating committee will develop Corporate Governance

Guidelines, and once developed, assess and review those guidelines

at least annually. The Corporate Governance Guidelines are

anticipated to describe our corporate governance practices and

address corporate governance areas such as Board composition and

responsibilities, compensation of directors and executive

succession planning.

Executive Sessions

The

Board held no executive sessions with only the independent

directors in attendance during the 2019 fiscal year. We anticipate

the Corporate Governance Guidelines to be developed by the

nominating committee will provide guidelines for holding executive

sessions.

Meeting Attendance

The

Board met three times during fiscal 2019 and took action by

unanimous written consent of the board of directors one other time

during fiscal 2019. Each director attended at least 75% of the

meetings of the Board. In addition to participation in Board

meetings, our directors discharged their responsibilities

throughout the year through personal meetings and other

communications, including telephone contact on any matters of

interest and concern.

We

do not have a formal policy requiring members of the Board to

attend the annual meeting, although all directors are encouraged to

attend if available. Two members of our board of directors attended

the 2018 annual meeting of stockholders.

Risk Management

The

Board has an active role, in overseeing management of our risks. In

June 2018, the Board adopted a charter for the audit committee and

in July the Board adopted charters for the compensation committee

and the nominating committee. These charters were amended in

February 2019. The Board committees were initially staffed by the

Board in July 2018. Prior to July 2018, the full Board fulfilled

the functions which are now assigned to those committees. The audit

committee oversees management of financial risks. The compensation

committee is responsible for overseeing the management of risks

relating to our executive compensation plans and arrangements. The

nominating committee manages risks associated with the independence

of the Board and potential conflicts of interest. While each

committee is responsible for evaluating certain risks and

overseeing the management of such risks, the entire Board is

regularly informed about those risks. The Board seeks to ensure

that management has in place processes for dealing appropriately

with risk. It is the responsibility of our senior management to

develop and implement our short-term and long-term objectives and

to identify, evaluate, manage and mitigate the risks inherent in

seeking to achieve those objectives. Management is responsible for

identifying risks and risk controls related to significant business

activities and Company objectives, developing programs to determine

the sufficiency of risk identification, balancing of potential risk

to potential reward and the appropriate manner in which to control

risk.

Indemnification

As

permitted by Nevada state corporate law, our Restated Articles of

Incorporation and By-Laws authorize and require us to indemnify our

officers and directors to the fullest extent permitted under Nevada

law.

Other Corporate Governance Resources

The

charters of each committee and our Code of Ethics and Business

Conduct are available on the Investor Relations Section of our

website, www.freedomholdingcorp.us.

DIRECTOR COMPENSATION

We

had five directors on March 31, 2019, the last day of our 2019

fiscal year. The independent members of our Board are paid an

annual cash retainer of $24,000. Generally, Directors do not

receive board meeting attendance fees. Our independent directors

are also paid an annual cash retainer of $3,000 for each committee

of the Board they serve on. In addition to the above cash

retainers, directors may be compensated on an ad hoc basis for

special committee or subcommittee meetings held or tasks performed

by a committee or subcommittee designated by either the full Board

or by a standing committee of the full Board, with such

compensation determined upon completion of the tasks

performed.

The following table provides information

concerning the compensation of each director who served in fiscal

2019 other than Mr. Turlov whose compensation is described