United States

Securities and Exchange Commission

Washington, DC 20549

FORM 10-KSB

Annual Report under Section 13 or 15(d) of

The Securities Exchange Act of 1934

For the Fiscal Year Ended Commission File Number

March 31, 2006 000-28638

BMB MUNAI, INC.

(Exact name of registrant as specified in its charter)

NEVADA

(State or other jurisdiction of incorporation or organization)

30-0233726

(I.R.S. Employer Identification No.)

202 Dostyk Ave. 4th Floor, Almaty, Kazakhstan 050051

(Address of principal executive offices)

+7 (3272) 37-51-25/31

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12 (g) of the Act: Common Stock $0.001

Par Value.

Check whether the issuer (1) filed all reports required to be filed by Section

13 or 15(d) of the Exchange Act during the past 12 months (or such shorter

period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Check if there is no disclosure of delinquent filers in response to item 405 of

Regulation S-B is not contained in this form, and no disclosure will be

contained, to the best of the registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-KSB

or any amendment to this Form 10-KSB. [ ]

Indicate by check mark whether the registrant is an accelerated filer.

YES [ ] NO [X]

The registrant's revenues for its most recent fiscal year: $5,956,731

The aggregate market value of the voting stock held by non-affiliates based on

the average bid and ask prices of such stock on June 22, 2006 was approximately

$202,301,934.

As of June 22, 2006, the registrant had 43,740,657 shares of its $.001 par value

common stock outstanding.

Transitional small business disclosure format (check one) Yes [ ] No [X]

DOCUMENTS INCORPORATED BY REFERENCE: None

BMB MUNAI, INC.

FORM 10-KSB

TABLE OF CONTENTS

PART I Page

Items 1 and 2. Business and Properties 3

Item 3. Legal Proceedings 23

Item 4. Submission of Matters to Vote of Security Holders 25

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Small

Business Issuer Purchases of Equity Securities 25

Item 6. Management's Discussion and Analysis of Financial Condition and

Results of Operations 29

Item 7. Financial Statements 39

Item 8. Changes in and Disagreements with Accountants on Accounting and

Financial Disclosures 39

Item 8A. Controls and Procedures 39

Item 8B. Other Information 40

PART III

Item 9. Directors and Executives Officers of the Registrant 40

Item 10. Executive Compensation 45

Item 11. Security Ownership of Certain Beneficial Owners and Management 46

Item 12. Certain Relationships and Related Transactions 48

Item 13. Exhibits 49

Item 14. Principal Accountant Fees and Services 49

Signatures 50

2

BMB MUNAI, INC.

Unless otherwise indicated by the context, references herein to the

"Company", "BMB", "we", our" or "us" means BMB Munai, Inc., a Nevada corporation,

and its corporate subsidiaries and predecessors.

Forward Looking Information

Certain of the statements contained in all parts of this document

including, but not limited to, those relating to our drilling plans, future

expenses, changes in wells operated and reserves, future growth and expansion,

future exploration, future seismic data, expansion of operations, our ability to

generate new prospects, our ability to obtain a production license, review of

outside generated prospects and acquisitions, additional reserves and reserve

increases, managing our asset base, expansion and improvement of capabilities,

integration of new technology into operations, credit facilities, new prospects

and drilling locations, future capital expenditures and working capital,

sufficiency of future working capital, borrowings and capital resources and

liquidity, projected cash flows from operations, future commodity price

environment, expectations of timing, the outcome of legal proceedings,

satisfaction of contingencies, the impact of any change in accounting policies

on our financial statements, the number, timing or results of any wells, the

plans for timing, interpretation and results of new or existing seismic surveys

or seismic data, future production or reserves, future acquisitions of leases,

lease options or other land rights, management's assessment of internal control

over financial reporting, financial results, opportunities, growth, business

plans and strategy and other statements that are not historical facts contained

in this report are forward-looking statements. When used in this document, words

like "expect," "project," "estimate," "believe," "anticipate," "intend,"

"budget," "plan," "forecast," "predict," "may," "should," "could," "will" and

similar expressions are also intended to identify forward-looking statements.

Such statements involve risks and uncertainties, including, but not limited to,

market factors, market prices (including regional basis differentials) of

natural gas and oil, results for future drilling and marketing activity, future

production and costs and other factors detailed herein and in our other

Securities and Exchange Commission filings. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove incorrect,

actual outcomes may vary materially from those indicated. These forward-looking

statements speak only as of their dates and should not be unduly relied upon. We

undertake no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or otherwise.

PART I

Items 1 and 2. Business and Properties

Overview

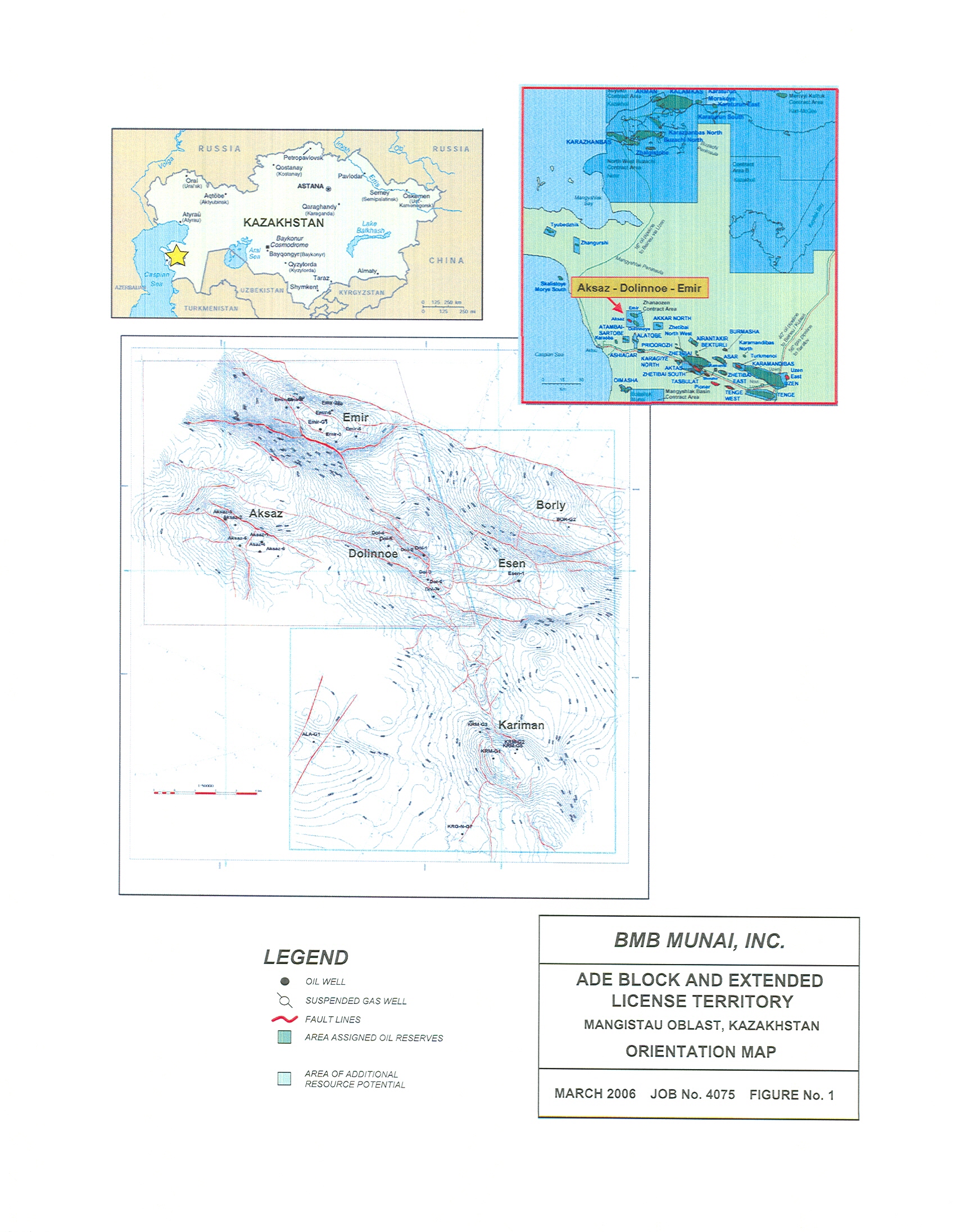

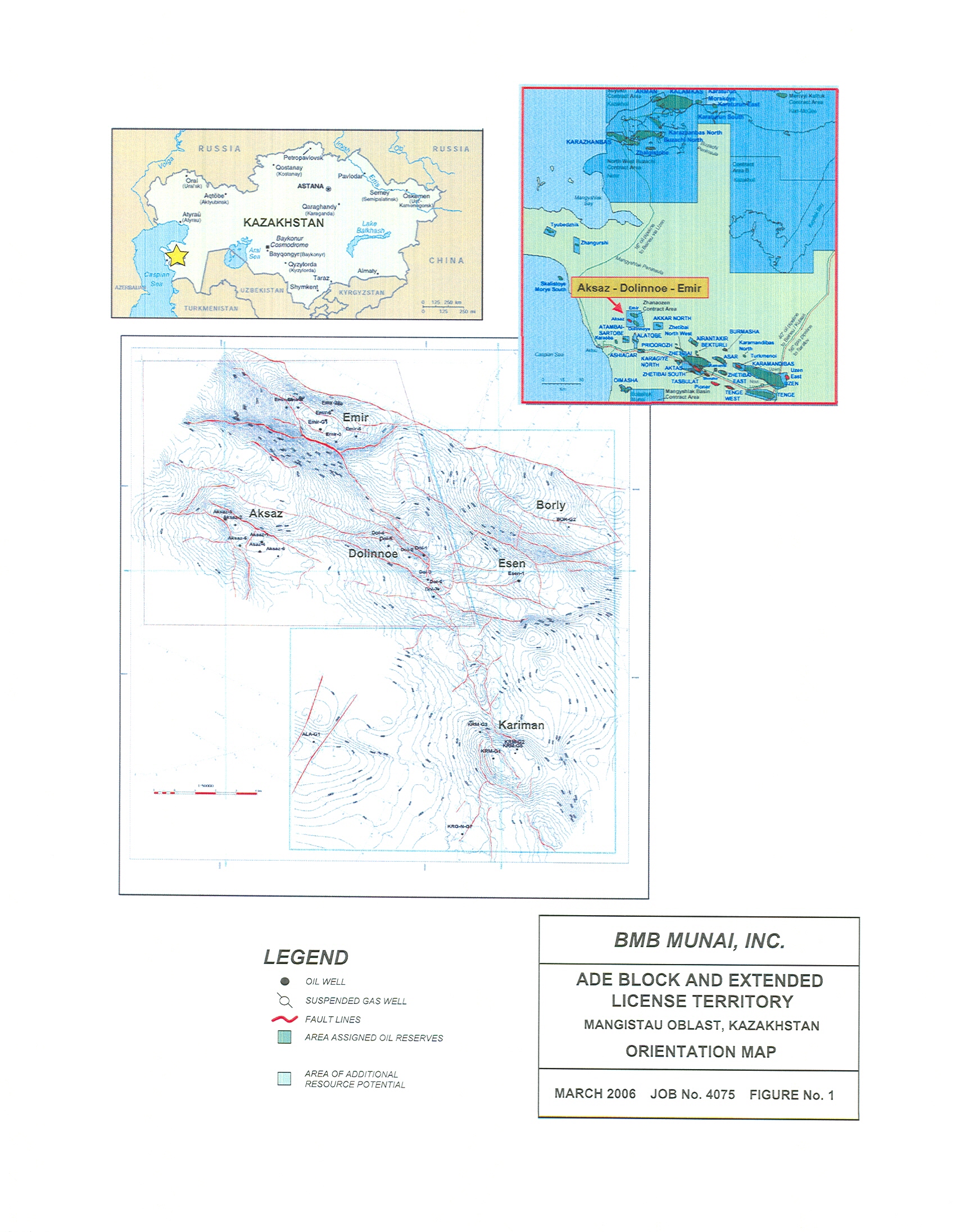

BMB Munai, Inc. is an independent oil and natural gas company engaged

in the exploration, development, acquisition and production of crude oil and

natural gas properties in the Republic of Kazakhstan (sometimes also referred to

herein as the "ROK" or "Kazakhstan"). We hold a contract that allows us to

explore and develop approximately 460 square kilometers in western Kazakhstan.

Our contract grants us the right to explore and develop the Aksaz, Dolinnoe and

3

Emir oil and gas fields, referred to herein as "the ADE Block" as well as an

area adjacent to the ADE Block referred to herein as "the Extended Territory."

The ADE Block and Extended Territory are collectively referred to herein as "our

properties."

We generate revenue, income and cash flow by producing and marketing

crude oil from production from our oil properties. We make significant capital

expenditures in our exploration and development activities that we anticipate

will allow us to increase and improve our ability to generate revenue. Our

drilling strategy is focused toward enhancing cash flows by drilling

developmental wells and increasing proved developed reserves by drilling

developmental wells within a proximity of existing wells, (which we believe

decreases our likelihood of drilling a dry hole), while at the same time

increasing our current production and cash flow. As our cash flow and proved

developed reserves grow, we will begin drilling exploratory wells to find new

reservoirs or extend known reservoirs. We believe this strategy will result in

growth of proved developed reserves, production and financial strength.

Until recently, we were deemed to be a development stage company. To

date, we have relied primarily on funds raised through the sell of our equity

securities to fund operations. We currently use more cash in operations than we

generate. We believe, however, that we have now raised sufficient capital to

fund exploration and development of our properties to a point where the revenue

derived from our properties will be sufficient to meet our future operating

needs.

Industry and Economic Factors

In managing our business, we must deal with many factors inherent in

our industry. First and foremost is the fluctuation of oil and gas prices.

Historically, oil and gas markets have been cyclical and volatile, with future

price movements that are difficult to predict. While our revenues are a function

of both production and prices, wide swings in commodity prices will likely have

the greatest impact on our results of operations. We have no way of predicting

those prices or of controlling them without losing an advantage from a potential

upswing. The oil and gas industry has continued to experience high commodity

prices in 2005 and 2006, which has positively impacted the entire industry as

well as our Company.

Our operations entail significant complexities. Advanced technologies

requiring highly trained personnel are utilized in both exploration and

development. Even when the technology is properly used, we still may not know

conclusively whether hydrocarbons will be present nor the rate at which they may

be produced. Despite our best efforts to limit risk, exploration is a high-risk

activity, often times resulting in no discovery of commercially productive

reserves. Moreover, operating costs in our industry are substantial.

Our business, as with other extractive industries, is a depleting one

in which each oil and gas equivalent produced must be replaced or our business,

and a critical source of future liquidity, will shrink.

Strategy

Our goal is to increase stockholder value by investing in oil and

natural gas projects with attractive rates of return on capital employed. We

4

plan to achieve this goal by exploiting and developing our existing oil and gas

properties and pursuing the acquisition of additional properties. We have and

will continue to focus on the following:

Increasing our Production and Cash Flow. To sustain our operations we

need capital. To date most of our operating capital has come from the sale of

our securities. We believe that to increase shareholder value and economic

stability, we must increase our revenues through increased production. For this

reason, we have focused our efforts on drilling developmental wells

strategically located within proved areas with the intent to drill wells with a

high probability of success. We believe this strategy will allow us to increase

our current production and correspondingly our cash flows.

Developing and Exploiting Existing Properties. We believe that there is

significant value to be created by drilling the identified undeveloped

opportunities on our properties. We own interest in 640 gross (640 net)

developed acres, plus 160 gross (160 net) acres of proved undeveloped reserves.

We also own interest in approximately 49,950 gross (49,950 net) unproved,

undeveloped acres. Our budgeted capital expenditures for the upcoming fiscal

year are about $60 million to $70 million for exploration, development,

production and acquisitions. We expect to fund these expenditures with cash on

hand and revenue from operations. We believe our export quota and favorable

world market prices will allow us to generate sufficient oil and gas revenues to

finance the shortfall of $10 million to $20 million in our budget required for

our planned exploration, development, production and acquisitions.

Pursuing Profitable Acquisitions. While our emphasis in fiscal 2007 is

anticipated to focus on the further development of our existing properties, we

will continue to look for properties with both existing cash flow from

production and future development potential. We intend to pursue acquisitions of

properties that we believe will provide attractive rates of return on capital

invested. We have an experienced team of management professionals who will

identify and evaluate acquisition opportunities.

Oil and Natural Gas Reserves

The following table sets forth our estimated net proved oil and natural

gas reserves and the present value of estimated cash flows related to such

reserves as of March 31, 2006. We engaged Chapman Petroleum Engineering, Ltd.

("Chapman"), to estimate our net proved reserves, projected future production,

estimated net revenue attributable to our proved reserves, and the present value

of such estimated future net revenue as of March 31, 2006. Chapman's estimates

are based upon a review of production histories and other geologic, economic,

ownership and engineering data provided by us. Chapman has independently

evaluated our reserves for the past twelve months. In estimating the reserve

quantities that are economically recoverable, Chapman used oil and natural gas

prices in effect as of March 2006 without giving effect to hedging activities.

In accordance with requirements of the Securities and Exchange Commission (the

"SEC") regulations, no price or cost escalation or reduction was considered by

Chapman. The present value of estimated future net revenues before income taxes

was prepared using constant prices as of the calculation date, discounted 10%

per annum on a pretax basis, and is not intended to represent the current market

5

value of the estimated oil and natural gas reserved owned by us. The oil and

natural gas reserve data included in or incorporated by reference in this

document are only estimates and may prove to be inaccurate.

Proved Reserves

------------------------------------------------------------

Developed(1) Undeveloped(2) Total

----------------- ------------------- ----------------

Oil and condensate (MBbls)(3) 11,168 2,580 13,748

Natural gas (MMcf) - - -

Total BOE (MBbls) 11,168 2,580 13,748

Estimated future net cash flows before

income taxes (M$) $ 361,990 $ 72,342 $434,332

Present value of estimated future net cash

flows before income taxes (discounted

10% per annum)(4) $ 166,491 $ 20,589 $187,080

Standardize measure of discounted future net

cash flows(5) $102,645

- -------------------

(1) Proved developed reserves are proved reserves that are expected to be

recovered from existing wells with existing equipment and operating

methods.

(2) Proved undeveloped reserves are proved reserves which are expected to be

recovered from new wells on undrilled acreage or from existing wells where

a relatively major expenditure is required for recompletion.

(3) Includes natural gas liquids.

(4) Estimated future net cash flows represents estimated future gross revenue

to be generated from the production of proved reserves, net of estimated

future production and development costs, using the average oil price we had

been receiving in the world market net of transportation expenses and other

overhead, as of March 31, 2006, which was $50.76 per Bbl of oil.

(5) The standardized measure of discounted future net cash flows represents the

present value of future net cash flow less the computed discount.

The reserve data set forth herein represents estimates only. Reserve

engineering is a subjective process of estimating underground accumulations of

oil and natural gas that cannot be measured in an exact manner. The accuracy of

any reserve estimate is a function of the quality of available data and of

engineering and geological interpretation and judgment. As a result, estimates

made by different engineers often vary from one another. In addition, results of

drilling, testing and production subsequent to the date of an estimate may

justify revision of such estimates, and such revisions may be material.

Accordingly, reserve estimates are generally different from the quantities of

oil and natural gas that are ultimately recovered. Furthermore, the estimated

future net revenue from proved reserves and the present value thereof are based

upon certain assumptions, including current prices, production levels and costs

that may not be what is actually incurred or realized.

No estimates of proved reserves comparable to those included herein

have been included in reports to any federal agency other than the SEC.

In accordance with SEC regulations, the Chapman Report used oil and

natural gas prices in effect at March 31, 2006. The prices used in calculating

6

the estimated future net revenue attributable to proved reserves do not

necessarily reflect market prices for oil and natural gas production subsequent

to March 31, 2006. There can be no assurance that all of the proved reserves

will be produced and sold within the periods indicated, that the assumed prices

will actually be realized for such production or that existing contracts will be

honored or judicially enforced.

Production

All of our six wells are currently in workover, testing or test

production. According to the laws of the Republic of Kazakhstan, we are required

to test every prospective object on our properties separately, this includes the

completion of well surveys on different modes with various choke sizes on each

horizon. This testing can take up to three months per horizon.

In the course of well testing, when the transfer from object to object

occurs, the well must be shut-in; oil production ceases for the period of

mobilization/ demobilization of workover rig, pull out of hole, run in hole,

perforation, packer installation time, etc. This has the effect of artificially

diminishing production rates.

Based on the testing we have completed, which represents production

from only one interval per well at a time, the overall daily production rate

from our six wells ranges from 575 bpd to 885 bpd, depending on choke sizes,

well bore conditions, etc. Because this only accounts for one zone per well,

this is not representative of the cumulative total production rate from all of

the tested intervals in each of the wells.

During the third quarter of the 2006 fiscal year we were realizing

total daily production ranging as high as 2,100 bpd. In the process of expanding

the perforated oil-bearing zone of the Dolinnoe-3 well, however, the well was

damaged and had to be shut-in to avoid a blow out of the well. We have since

re-entered the Dolinnoe-3 well, but to date, have not realized the flow rates

experienced prior to shut-in. We are planning additional workover of the

Dolinnoe-3 well in hopes of restoring flow rates to levels experienced prior

to shutting-in the well.

Following is a brief description of the current production status of

each of our six wells.

Aksaz-1

This well is currently under workover and is not producing. Prior to

workover, four producing intervals were tested. The single interval test

production rates in Aksaz-1 using a 10 mm diameter choke was 140 bpd.

Aksaz-4

Drilling of this well was completed in August 2005. Two producing

intervals have been tested. Current production rates from single interval

testing using an 8 mm diameter choke ranges from 115 to 180 bpd.

7

Dolinnoe-1

Currently this well is producing. We recently completed acid treatment

of this well. Current production rates from single interval testing using a 6 mm

diameter choke ranges from 115 to 200 bpd.

Dolinnoe-2

Currently this well is also producing, although workover operations,

including acid treatment, are ongoing in an effort to increase production from

this well. Prior to workover, we had tested six producing intervals. Current

production rates from single interval testing using a 8 mm diameter choke ranges

from 125 to 190 bpd.

Dolinnoe-3

This well is currently producing. We have tested two producing

intervals and intend to test additional intervals as required under our

exploration contract. Current production from single interval testing using a 2

mm diameter choke ranges from 220 to 315 bpd.

Following completion of this well in April 2005, flow rates from

Dolinnoe-3 ranged from 600 to 1,200 bpd. During the current calendar year, we

planned to perforate the remaining seven meters of the oil-bearing horizon. In

the process of perforating the remaining seven meters, however, the well was

damaged and had to be shut-in to avoid a blow out. Following shut-in of the

well, we have undertaken acid and oil baths, using a dry hydrochloric mixture,

to clean the wellbore. Since putting the well back on production, however, we

have realized lower flow rates. These lower flow rates indicate that some of the

materials used to shut-in the well still remain in hole, blocking some of the

perforation zones. We are currently planning additional regular hydrochloric

acid treatment to further clean the well in hopes of restoring flow rates to

levels experienced prior to shutting-in the well.

Emir-1

This well is not currently producing. We have completed workover

operation on this well and the well is currently under inflow stimulation. We

plan to conduct acid treatment in this well to improve production. Prior to the

workover four producing intervals were tested. Single interval production from

this well prior to workover was 40 to 50 bpd.

Cost Information

Capitalized Costs

Capitalized costs and accumulated depletion, depreciation and

amortization relating to our oil and natural gas producing activities, all of

which are conducted in the Republic of Kazakhstan, are summarized below:

8

March 31, 2006 March 31, 2005

---------------------------- -----------------------------

Developed oil and natural gas properties $ 68,079,938 $49,401,710

Unevaluated oil and natural gas properties - -

Accumulated depletion, depreciation and

amortization (1,396,641) (229,406)

---------------------------- -----------------------------

Net capitalized cost $ 66,683,297 $49,172,304

============================ =============================

Exploration, Development and Acquisition Capital Expenditures

The following table sets forth certain information regarding the total

costs incurred associated with exploration, development and acquisition

activities.

March 31, 2006 March 31, 2005

----------------------------- -----------------------------

Acquisition costs:

Unproved properties $ - $ -

Proved properties 20,788,119 20,788,119

Exploration costs 6,826,695 3,373,092

Development costs 39,540,532 25,179,526

----------------------------- -----------------------------

Subtotal 67,155,346 49,340,737

Asset retirement costs 924,592 60,973

----------------------------- -----------------------------

Total costs incurred $ 68,079,938 $ 49,401,710

============================= =============================

Oil and Natural Gas Volumes, Prices and Operating Expense

The following table sets forth certain information regarding production

volumes, average sales prices and average operating expense associated with our

sale of oil and natural gas for the periods indicated.

For the Year Ended For the Year Ended

March 31, 2006 March 31, 2005

----------------------------- -----------------------------

Production:

Oil and condensate (Bbls) 242,522 68,755

Natural gas liquids (Bbls) - -

Natural gas (Mcf) - -

Barrels of oil equivalent (BOE) - -

Average Sales Price(1):

Oil and condensate ($ per Bbl) $26.13 $15.17

Natural gas liquids ($ per Bbl) $ - $ -

Natural gas ($ per Mcf) $ - $ -

Barrels of Oil equivalent ($ per BOE) $ - $ -

Average oil and natural gas operating expenses

including production and ad valorem taxes

($ per BOE)(2) $ 1.55 $ 3.08

- --------------------

(1) During the year ended March 31, 2006, the Company has not engaged in any

hedging activities, including derivatives.

9

(2) Includes direct lifting costs (labor, repairs and maintenance, materials and

supplies), expensed workover costs and the administrative costs of field

production personnel, insurance and production and ad valorem taxes.

Drilling Activity

The following table sets forth our drilling activity for the years

ended March 31, 2005 and March 31, 2006. In the table, "Gross" refers to the

total wells in which we have a working interest or back-in working interest

after payout and "Net" refers to gross wells multiplied by our working interest

therein.

March 31, 2006 March 31, 2005

------------------------------------- -----------------------------------

Gross Net Gross Net

---------------- ----------------- --------------- ---------------

Exploratory:

Productive - - - -

Non-productive - - - -

---------------- ----------------- --------------- ---------------

Total - - - -

---------------- ----------------- --------------- ---------------

Development:

Productive 6 6 5 5

Non-productive - - - -

---------------- ----------------- --------------- ---------------

Total - - - -

---------------- ----------------- --------------- ---------------

Grand Total 6 6 5 5

================ ================= =============== ===============

Productive Wells

The following table sets forth the number of productive oil and natural

gas wells in which we owned an interest as of March 31, 2006.

Company-operated Non-operated Total

---------------------------- --------------------------- ---------------------------

Gross Net Gross Net Gross Net

------------- ----------- ------------ ----------- ----------- ------------

Oil 6 6 - - 6 6

Natural Gas - - - - - -

------------- ----------- ------------ ----------- ----------- ------------

Total 6 6 - - 6 6

============= =========== ============ =========== =========== ============

Recent Developments

At year end 2006, our net proved reserves were 13.7 million barrels of

oil. Reserves quoted in BOE were calculated using a conversion of 6 Mscf/bbl.

Crude oil accounted for 100% of those proved reserves. Approximately 80% of

proved total reserves were developed as of year-end 2006 and they were all

located onshore in western Kazakhstan.

During the fiscal year ended March 31, 2006, we drilled to deepen the

Aksaz-4 well and we continued testing and development works on the Dolinnoe-1,

Dolinnoe-2, Dolinnoe-3, Emir-1 and Aksaz-1 wells.

We have commenced drilling in the Extended Territory. Our initial

project was to increase the depth of an existing non-producing well, which is

designated as the Kariman-1 well. The Kariman-1 well was cased to a depth of

10

1,661 meters and drilled to a total depth of 3,069 meters in 1967 by the Soviet

government. The drilling was suspended at that depth because it was believed

that the oil-bearing formations would not be found deeper than the lower

Jurassic formations.

In February 2006 we re-entered the existing Kariman-1 wellbore.

Drilling operations were conducted by Oil and Gas Exploration Cracow, Poland. At

a depth of 1,660 meters the wellbore was sidetracked due to the poor technical

conditions of the well. The sidetracked wellbore was drilled to a depth of 3,364

meters3,364 meters. At that depth the well started flowing oil and gas at such

pressure that we were required to halt drilling and increase drilling fluid

weight. Heavier drilling fluid caused loss circulation with no returns at

1,160-1,860 meters. We responded to the loss circulation and inflow zones by

installing a cement bridge at a depth of 3,094 meters3,094 meters to separate

the two zones. We then ran casing to the depth of 3,094 meters which completely

isolated the loss circulation zone. The new wellbore was then reamed to a depth

of 3,319 meters. Our next activity on the well will be to begin testing an

estimated net pay zone of 38 meters in the Upper Triassic sandstone formations

located at the depth of 3,167-3,275 meters.

In January 2006 we retained Great Wall Ltd., a Chinese drilling company

to deliver two drilling rigs with derrick load capacity of 450 tons and 150 tons

respectively. We plan to drill exploratory oil and gas wells in the Dolinnoe

field and the Extended Territory using the services of Great Wall Ltd.

In December 2005 we were granted our first export quota from the

Ministry of Energy and Mineral Resources of the Republic of Kazakhstan which

allowed us to begin exporting oil for sale in the world market in January 2006.

We have also been granted export quotas in March, April, May and June 2006.

Prior to January 2006, we were limited to selling our test production to the

domestic market in Kazakhstan. The price of oil in the domestic market in

Kazakhstan is materially lower than the price in the world market.

In March 2006 we received an interpretation report from the PGS-GIS

Seismic Data Processing Center in Almaty, Kazakhstan, interpreting the 3D

seismic study conducted by us on the Extended Territory. The interpretation

confirmed the presence of four perspective structures in Triassic formations and

three perspective structures in Jurassic formations in the Extended Territory.

In addition, three new perspective structures in Jurassic formations were

confirmed in the ADE Block. The results of the 3D seismic interpretation were

evaluated by Chapman Petroleum Engineering Ltd., an independent petroleum

engineering firm from Calgary, Canada, in connection with their preparation and

issuance of a resource assessment report of the ADE Block and Extended

Territory.

In April 2006 we executed an agreement with Ecotechnic Chemical AG to

have Ecotechnic Chemical AG construct a natural gas utilization facility

employing Ecotechnic Chemical's proprietary processing technology. Ecotechnic

Chemical AG has completed approximately forty similar projects in the Russian

Federation. The facility will be constructed on the exploration license

territory. The project is scheduled to be completed by the end of the current

calendar year. The processing facility will have initial capacity to process

3,532 mcf per day. The processing capacity can be enlarged at substantially

lower incremental cost to meet the requirements of increased field production.

Upon completion of construction, the gas utilization plant will be operated as

an equal joint venture between us and Ecotechnic Chemical AG. The decision to

commence the gas utilization project at the current time is a further step

toward transitioning from the exploration stage to the production stage under

our license agreement.

11

Our Properties

12

12

We currently own a 100% interest in a license to use subsurface mineral

resources and a hydrocarbon exploration contract issued by the ROK in 1999 and

2000, respectively (collectively referred to herein as the "license" or the

"contract"). The original contract granted its holder the right to engage in

exploration and development activities in an area of approximately 200 square

kilometers referred to as the ADE Block. The ADE Block is located onshore in

Kazakhstan in the Mangistau Oblast, approximately 50 kilometers from the

Kazakhstan city of Aktau, a seaport on the Caspian Sea. The ADE Block is

comprised of three fields, the Aksaz, Dolinnoe and Emir fields. When initially

granted, the exploration and development stage of the contract had a five year

term. The time for exploration and development has since been extended to July

9, 2007, and we have the right to seek a two-year extension of our exploration

contract. To move from the exploration and development to the commercial

production, we must make application to the ROK before July 9, 2007; or we may

apply to extend our exploration contract an additional two years with the

application for a commercial production license to be made prior to the

expiration of the two-year extension.

During the fiscal year ended March 31, 2005, our exploration contract

was expanded to include an additional 260 kilometers of land adjacent to the ADE

Block, which we refer to as the "Extended Territory." The Extended Territory is

governed by the terms of the original contract.

Under the terms of our contract we have the right to gather and sell

all oil and natural gas we produce in test production until the expiration of

our exploration contract, or its extension, with the revenue from such sales

belonging to BMB. We intend to continue to apply for export quotas in the future

because we realize significantly higher prices in the world market than the

domestic market price for Kazakhstan. If we are not granted future export

quotas, we will continue to sell our oil in the Kazakhstan domestic market.

To maintain our contract during the exploration and development stage

we are required to meet minimum annual capital expenditures in the exploration

and development of the ADE Block and the Extended Territory. The following table

shows the minimum capital expenditures we are required to make during the 2006

calendar year and for the period from January 1, 2007 through July 9, 2007.

Year Minimum Capital Expenditure

2006 $6,000,000

2007 $4,500,000

If we apply for the two-year extension of our exploration contract, we

will be required to make additional minimum capital expenditures during the

extension period to maintain our rights under the exploration contract.

Under the terms of the contract, we must apply to the ROK for

commercial production rights prior to the expiration of our contract, or its

extension. The terms of our commercial production rights and royalty rates will

be negotiated at the time we move to commercial production. During exploration

and development stage, we have the right to produce and sell oil and natural gas

at a royalty rate of 2%. When we move to commercial production, the negotiated

13

royalty rates vary depending on reserves and production rates. Royalty rates are

established by the taxing authorities of the ROK and are based on production

rates; the rate increases on a sliding scale. Current royalty rates range for 2%

to 6%. Commercial production rights may also require that up to 20% of our oil

production be sold to the Kazakhstan domestic market at considerably lower

prices than we receive in the world export markets, as discussed above.

Under our contract, we have the exclusive right to apply for and

negotiate a commercial production contract. The government is required to

negotiate the terms of these rights in good faith in accordance with the Law of

Petroleum of Kazakhstan. As long as we establish commercially producible

reserves and have fulfilled our obligations during exploration and development,

the government is required to grant us production rights. We have not yet

applied for commercial production rights because we enjoy certain economic

advantages during exploration and development as discussed herein.

During the fiscal year ended March 31, 2006 we drilled one new well in

the Aksaz field. This well was successfully completed and is in testing, test

production or additional workover.

Title to Properties

We hold an exploration contract from the Republic of Kazakhstan that

grants us the right for exploration and test production of hydrocarbons on the

ADE Block and the Extended Territory. Our rights to these properties will

terminate in July 2007 unless we are able to negotiate an extension of our

current exploration contract or we are granted a commercial production contract.

Marketing

Currently all of our test production is being sold to one client. We

anticipate that once we move to commercial production we will market our

production to third parties consistent with industry practices.

There are a variety of factors which affect the market for oil and

natural gas, including the extent of domestic production and imports of oil and

natural gas, the availability, proximity and capacity of natural gas pipelines

and other transportation facilities, demand for oil and natural gas, the

marketing of competitive fuels and the effects of state and federal regulations

on oil and natural gas productions and sales.

Sales to Major Customers

We are now exporting all of our test production for sell in the world

market. Currently, all of our production is being sold to one client, Euro-Asian

Oil AG. Our crude oil is transported via the Aktau sea port to world markets.

Sales prices at the port locations are based on the average quoted Brent crude

oil price from Platt's Crude Oil Marketwire for the three days following the

bill of lading date less discount of $14.15 for transportation expenses, freight

charges and other expenses.

14

In the exploration, development and production business, production is

normally sold to relatively few customers. Our customers are concentrated in the

oil and gas industry, and revenue can be materially affected by current economic

conditions and the price of certain commodities such as natural gas and crude

oil the cost of which is passed through to the customer. However, based on the

current demand for natural gas and crude oil and the fact that alternate

purchasers are readily available, we believe that the loss of Euro-Asian Oil AG

would not have a long-term material adverse effect on our operations.

Competition

Hydrocarbons exploration is highly competitive. Competition in

Kazakhstan and Central Asia includes other junior hydrocarbons exploration

companies, mid-size producers and major exploration and production companies. We

compete for additional exploration and production properties with these

companies who in many cases may have greater financial resources and larger

technical staff than we do.

We believe we have an advantage over our competitors: our executive

management and our board of directors have domestic and international experience

and have been working in Kazakhstan and Russia for up to 30 years. They have

developed relationships with the Kazakhstan government, its departments and

ministries at many levels. We also employ experienced national and foreign

specialists at senior levels in our operating subsidiary, Emir Oil, LLP.

We face significant competition for capital from other exploration and

production companies and industry sectors. At times, other industry sectors may

be more in favor with investors, limiting our ability to obtain necessary

capital.

Government Regulation

Our operations are subject to various levels of government controls and

regulations at various levels in both the United States and in Kazakhstan. We

attempt to comply with all legal requirements in the conduct of our operations

and employ business practices that we consider to be prudent under the

circumstances in which we operate. It is not possible for us to separately

calculate the costs of compliance with environmental and other governmental

regulations as such costs are an integral part of our operations.

In Kazakhstan, legislation affecting the oil and gas industry is under

constant review for amendment or expansion. Pursuant to such legislation,

various governmental departments and agencies have issued extensive rules and

regulations which affect the oil and gas industry, some of which carry

substantial penalties for failure to comply. These laws and regulations can have

a significant impact on the industry by increasing the cost of doing business

and, consequentially, can adversely affect our profitability. Inasmuch as new

legislation affecting the industry is commonplace and existing laws and

regulations are frequently amended or reinterpreted, we are unable to predict

the future cost or impact of complying with such laws and regulations.

15

Risks Relating to the Oil and Natural Gas Industry

A substantial or extended decline in oil and natural gas prices may

adversely affect our business, financial condition, cash flow, liquidity or

results of operations and ability to meet our capital expenditure obligations

and financial commitments and implement our business strategy.

Our business is heavily dependent upon the prices of, and demand for,

oil and natural gas production and the level of such production will be subject

to wide fluctuations and depend on numerous factors beyond our control,

including the following:

o the domestic and foreign supply of oil and natural gas;

o the price and quantity of imports of crude oil and natural gas:

o political conditions and events in other oil-producing and natural

gas-producing countries, including embargoes, continued hostilities

in the Middle East, Iran, Nigeria and other sustained military

campaigns, and acts of terrorism or sabotage;

o the actions of the Organization of Petroleum Exporting Countries, or

OPEC;

o domestic government regulation, legislation and policies;

o the level of global oil and natural gas inventories;

o weather conditions;

o technological advances affecting energy consumption;

o the price availability of alternative fuels; and

o overall economic conditions.

Any continued and extended decline in the price of crude oil or natural

gas will adversely affect:

o our revenues, profitability and cash flow from operations;

o the value of our proved oil and natural gas reserves;

o the economic viability of certain of our drilling prospects;

o our borrowing capacity; and

o our ability to obtain additional capital.

In December 2005 we were granted our first export quota from the

Ministry of Energy and Mineral Resources of the Republic of Kazakhstan ("MEMR")

which allowed us to begin exporting oil for sale in the world market in January

2006. We have also been granted export quotas in March, April, May and June

2006. Prior to January 2006, we were limited to selling our test production to

the domestic market in Kazakhstan. The price of oil in the domestic market in

Kazakhstan is materially lower than the price in the world market. There is no

guarantee that the Republic of Kazakhstan will continue to grant us export

quotas in the future. In the event we are not granted an export quota in the

future, we will be limited to selling our production to the domestic Kazakhstan

market, which likely will result in us realizing lower revenue per barrel of oil

sold than we would realize in the world market.

We have not entered into crude oil and natural gas price hedging

arrangements on any of our anticipated sales. However, we may in the future

enter into such arrangements in order to reduce our exposure to price risks.

Such arrangements may limit our ability to benefit from increases in oil and

natural gas prices.

16

Reserve estimates depend on many assumptions that may turn out to be

inaccurate. Any material inaccuracies in these reserve estimates or underlying

assumptions will materially affect the quantities and present value of our

reserves.

The process of estimating oil and natural gas reserves is complex. It

requires interpretations of available technical data and many assumptions,

including assumptions relating to economic factors. Any significant inaccuracies

in these interpretations or assumptions could materially affect the estimated

quantities and present value of reserves shown in this prospectus.

In order to prepare our estimates, we must project production rates and

timing of development expenditures. We must also analyze available geological,

geophysical, production and engineering data. The extent, quality and

reliability of this data can vary. The process also requires economic

assumptions about matters such as oil and natural gas prices, drilling and

operating expenses, capital expenditures, taxes and availability of funds.

Therefore, estimates of oil and natural gas reserves are inherently imprecise.

Actual future production, oil and natural gas prices, revenues, taxes,

development expenditures, operating expenses and quantities of recoverable oil

and natural gas reserves most likely will vary from our estimates. Any

significant variance could materially affect the estimated quantities and

present value of reserves shown in this prospectus. In addition, we may adjust

estimates of proved reserves to reflect production history, results of

exploration and development, prevailing oil and natural gas prices and other

factors, many of which are beyond our control.

You should not assume that the present value of future net revenues

from our proved reserves referred to in this prospectus is the current market

value of our estimated oil and natural gas reserves. In accordance with SEC

requirements, we generally base the estimated discounted future net cash flows

from our proved reserves on prices and costs on the date of the estimate. Actual

future prices and costs may differ materially from those used in the present

value estimate. If future values decline or costs increase, it could have a

negative impact on our ability to finance operations; individual properties

could cease being commercially viable; affecting our decision to continue

operations on producing properties or to attempt to develop properties. All of

these factors would have a negative impact on earnings and net income, and most

likely the trading price of our securities.

A substantial percentage of our proven properties are undeveloped;

therefore the risk associated with our success is greater than would be the case

if the majority of our properties were categorized as "proved developed

producing."

Because a substantial percentage of our proven properties are "proved

undeveloped" (approximately 20%), or "proved developed non-producing"

(approximately 68%), we will require significant additional capital to develop

such properties before they may become productive. Further, because of the

inherent uncertainties associated with drilling for oil and gas, some of these

properties may never be developed to the extent that they result in positive

17

cash flow. Even if we are successful in our development efforts, it could take

several years for a significant portion of our undeveloped properties to be

converted to positive cash flow.

We will be unable to produce up to 94% of our proved reserves if we are

not able to extend our current contract or obtain a new contract from the

Republic of Kazakhstan, which would likely require us to terminate our

operations.

Under our current contract for exploration of hydrocarbons on the

Aksaz, Dolinnoe and Emir fields, we have the right to produce oil and gas only

until July 2007, yet 94% of our proved reserves are scheduled to be produced

after July 2007. We have the ability to extend our current exploration contract

to July 2009. We also have the exclusive right to negotiate a commercial

production contract as per the terms of our exploration contract. If, however,

we are unable to obtain a commercial production contract prior to the expiration

of our exploration contract, we will lose our right to produce the reserves on

our current properties. If we are unable to produce those reserves, we will be

unable to realize revenues and earnings and to fund operations and we would most

likely be unable to continue as a going concern.

Prospects that we decide to drill may not yield oil or natural gas in

commercially viable quantities or quantities sufficient to meet our targeted

rate of return.

A "prospect" is a property which, based on available seismic and

geological data, we believe shows potential oil or natural gas. Our prospects

are in various stages of evaluation and interpretation. There is no way to

predict in advance of drilling and completion costs whether a prospect will be

economically viable. Even with seismic data and other technologies and the study

of producing fields in the same area, we cannot know conclusively prior to

drilling whether oil or natural gas will be present or, if present, will be

present in commercial quantities. The analysis that we perform using data from

other wells, more fully explored prospects and /or producing fields may not be

useful in predicting the characteristics and potential reserves associated with

our drilling prospects. If we drill additional unsuccessful wells, our drilling

success rate may decline and we may not achieve our targeted rate of return.

We may incur substantial losses and be subject to substantial liability

claims as a result of our oil and natural gas operations.

We are not insured against all risks. Losses and liabilities arising

from uninsured and underinsured events could materially and adversely affect our

business, financial condition or results of operations. Our oil and natural gas

exploration and production activities are subject to all of the operating risks

associated with drilling for and producing oil and natural gas, including the

possibility of:

o environmental hazards, such as uncontrollable flows of oil, natural

gas, brine, well fluids, toxic gas or other pollution into the

environment, including groundwater and shoreline contamination;

o abnormally pressured formations;

o mechanical difficulties, such as stuck oil field drilling and

service tools and casing collapse;

18

o fires and explosions;

o personal injuries and death; and

o natural disasters.

Any of these risks could adversely affect our ability to conduct

operations or result in substantial losses to our company. We may elect not to

obtain insurance if we believe that the cost of available insurance is excessive

relative to the risks presented. In addition, pollution and environmental risks

generally are not fully insurable. If a significant accident or other event

occurs that is not fully covered by insurance, it could adversely affect us.

We are subject to complex laws that can affect the cost, manner or

feasibility of doing business.

Exploration, development, production and sale of oil and natural gas

are subject to extensive federal, state, local and international regulation. We

may be required to make large expenditures to comply with governmental

regulations. Matters subject to regulation include:

o discharge permits for drilling operations;

o drilling bonds;

o reports concerning operations;

o the spacing of wells;

o unitization and pooling of properties; and

o taxation.

Under these laws, we could be liable for personal injuries, property

damage and other damages. Failure to comply with these laws may also result in

the suspension or termination of our operations and subject us to

administrative, civil and criminal penalties. Moreover, these laws could change

in ways that substantially increase our costs. Any such liabilities, penalties,

suspensions, terminations or regulatory changes could materially adversely

affect our financial condition and results of operations.

Our operations may incur substantial liabilities to comply with the

environmental laws and regulations.

Our oil and natural gas operations are subject to stringent federal,

state and local laws and regulations relating to the release or disposal of

materials into the environment or otherwise relating to environmental

protection. These laws and regulations may require the acquisition of a permit

before drilling commences, restrict the types, quantities and concentration of

substances that can be released into the environment in connection with drilling

and production activities, limit or prohibit drilling activities on certain

lands lying within wilderness, wetlands and other protected areas, and impose

substantial liabilities for pollution resulting from our operations. Failure to

comply with these laws and regulations may result in the assessment of

administrative, civil and criminal penalties, imposition of investigatory or

remedial obligations or even injunctive relief. Changes in environmental laws

and regulations occur frequently; any changes that result in more stringent or

costly waste handling, storage, transport, disposal or cleanup requirements

could require us to make significant expenditures to maintain compliance, and

may otherwise have a material adverse effect on our results of operations,

19

competitive position or financial condition as well as on the industry in

general. Under these environmental laws and regulations, we could be held

strictly liable for the removal or remediation of previously released materials

or property contamination regardless of whether we were responsible for the

release or whether our operations were standard in the industry at the time they

were performed.

Unless we replace our oil and natural gas reserves, our reserves and

future production will decline, which would adversely affect our cash flows and

income.

Unless we conduct successful development, exploration and exploitation

activities or acquire properties containing proved reserves, our proved reserves

will decline as those reserves are produced. Producing oil and natural gas

reservoirs generally are characterized by declining production rates that vary

depending upon reservoir characteristics and other factors. Our future oil and

natural gas reserves and production, and, therefore our cash flow and income,

are highly dependent on our success in efficiently developing and exploiting our

current reserves and economically finding or acquiring additional recoverable

reserves. If we are unable to develop, exploit, find or acquire additional

reserves to replace our current and future production, our cash flow and income

will decline as production declines, until our existing properties would be

incapable of sustaining commercial production.

If we do not satisfy our commitments to the government of Kazakhstan

while we are engaged in exploration and development activities we could lose our

rights to the ADE Block and the Extended Territory.

We have committed to the government of Kazakhstan to make various

capital investments and to develop the ADE Block and the Extended Territory in

accordance with specific requirements during exploration and development.

Additionally, to undertake commercial production, we will need to apply for and

be granted commercial production rights. The requirements of our current license

may be inconsistent with the terms of any new licenses we are issued.

Additionally, we may not be able to satisfy all commitments in the future. If we

fail to satisfy these commitments our contract may be cancelled. The

cancellation of our contract could have a material adverse effect on our

business, results of operations and financial condition. Although we would seek

waivers of any breaches or seek to renegotiate the terms of our commitments, we

cannot assure you that we would be successful in doing so.

Our activities, and correspondingly, our ability to generate revenue to

support operations, could be adversely affected because of inadequate

infrastructure in the region where our properties are located.

Our exploration and development activities could suffer due to

inadequate infrastructure in the region. We are working to improve the

infrastructure on our properties. Any problem or adverse change affecting our

operational infrastructure, or infrastructure provided by third parties, could

have a material adverse effect on our financial condition and results of

operations. Similarly, if we are unsuccessful in developing the infrastructure

on our properties it could have a material adverse effect on our financial

conditions and results of operations.

20

The unavailability or high cost of drilling rigs, equipment, supplies,

personnel and oil field services could adversely affect our ability to execute

on a timely basis our exploration and development plans within our budget.

Shortages or the high cost of drilling rigs, equipment, supplies or

personnel could delay or adversely affect our development and exploration

operations. As the price of oil and natural gas increases, the demand for

production equipment and personnel will likely also increase, potentially

resulting, at least in the near-term, in shortages of equipment and personnel.

In addition, larger producers may be able to secure access to such equipment by

offering drilling companies more lucrative terms. If we are unable to acquire

access to such resources, or can obtain access only at higher prices, not only

would this potentially delay our ability to convert our reserves into cash flow,

but this could also significantly increase the cost of producing those reserves,

thereby having a negative impact on anticipated net income.

The unavailability or high price of transportation systems could

adversely affect our ability to deliver our production to oil and natural gas

markets on terms that would allow us to operate profitably, or at all.

Because of the location of our properties, the crude oil we produce

must be transported by truck or by rail. In the future it will likely also be

transported by pipelines. These railways and pipelines are operated by

state-owned entities or other third parties, and there can be no assurance that

these transportation systems will always be functioning and available, or that

the transportation costs will remain at acceptable levels. In addition, any

increase in the cost of transportation or reduction in its availability to us

could have a material adverse effect on our results of operations. There is no

assurance that we will be able to procure sufficient transportation capacity on

economical terms, if at all.

Competition in the oil and natural gas industry is intense, which may

adversely affect our ability to compete.

We operate in a highly competitive environment for acquiring

properties, marketing oil and natural gas and securing trained personnel. Many

of our competitors possess and employ financial, technical and personnel

resources which are substantially greater than ours, this can be particularly

important in the areas in which we operate. Those companies may be able both to

pay more for productive oil and natural gas properties and exploratory prospects

and to evaluate, bid for and purchase a greater number of properties and

prospects than our financial or personnel resources permit. Our ability to

acquire additional prospects and to find and develop reserves in the future will

depend on our ability to evaluate and select suitable properties and to

consummate transactions in a highly competitive environment. There is

substantial competition for capital available for investment in the oil and

natural gas industry. We may not be able to compete successfully in the future

in acquiring prospective reserves, developing reserves, marketing hydrocarbons,

attracting and retaining quality personnel or raising additional capital.

21

Risks Relating to Our Business

The loss of senior management and key personnel could adversely affect

us.

Our success is dependent on the performance of our senior management

and key technical personnel each of whom has extensive experience in the oil and

gas industry. The loss of such individuals, in particular, Boris Cherdabayev,

our CEO and Chairman of our Board of Directors, or Toleush Tolmakov, the General

Director of Emir Oil, our wholly-owned subsidiary, could have an adverse effect

on our business. We do not have employment agreements in place with our senior

management or key employees. We do not currently carry key man insurance for any

of our senior management or key employees, nor do we anticipate obtaining key

man insurance in the foreseeable future.

If you purchase shares of our stock, your investment will be subject to

the same risks inherent in international operations, including, but not limited

to, adverse governmental actions, political risks, and expropriation of assets,

loss of revenues and the risk of civil unrest or war.

We believe that the present policies of the government of the Republic

of Kazakhstan are favorable to foreign investment and to exploration and

production and we are not aware of any impending changes. While there is a

certain amount of bureaucratic "red tape" we have significant experience working

in Kazakhstan, and good relationships with government agencies at many levels.

We, however, remain subject to all the risks inherent in international

operations, including adverse governmental actions, uncertain legal and

political systems, and expropriation of assets, loss of revenues and the risk of

civil unrest or war. Our primary oil and gas properties are located in

Kazakhstan, which until 1990 was part of the Soviet Union. Kazakhstan retains

many of the laws and customs of the former Soviet Union, but has and is

continuing to develop its own legal, regulatory and financial systems. As the

political and regulatory environment changes, we may face uncertainty about the

interpretation of our agreements; in the event of dispute, we may have limited

recourse within the legal and political system.

If we are successful in establishing commercially producible reserves

on our properties, an application will be made for a commercial production

contract. We have the exclusive right to negotiate this contract for the ADE

Block and Extended Territory, and the government is required to conduct these

negotiations under the "Law of Petroleum." Such contracts are customarily

awarded upon determination that the field is capable of commercial rates of

production and that we have complied with the other terms of our license and

exploration contract. The terms of the commercial production contract will

establish the royalty and other payments due to the government in connection

with commercial production. At the time the commercial production contract is

issued, we will be required to begin repaying the government its historical

investment costs of exploration and development of the ADE Block and the

Extended Territory. Our obligation associated with the ADE Block is

approximately $6 million. Our obligation associated with the Extended Territory

22

has not yet been determined and is currently being negotiated. If satisfactory

terms for commercial production rights cannot be negotiated, it could have a

material adverse effect on our financial position.

Employees

As of May 15, 2006 we had 199 full-time employees. We believe that our

relationships with our employees are good. None of our employees are covered by

a collective bargaining agreement. From time to time we utilize the services of

independent consultants and contractors to perform various professional

services. Field and on-site production operation services, such as pumping,

maintenance, dispatching, inspection and testing are generally provided by

independent contractors.

Executive Offices

Our principal executive and corporate offices are located in an office

building located at 202 Dostyk Avenue, in Almaty, Kakzakhstan. We lease this

space and believe it is sufficient to meet our needs for the foreseeable future.

We also maintain administrative office in Salt Lake City, Utah. The

address is 324 South 400 West, Suit 225, Salt Lake City, Utah 84101, USA.

Reports to Security holders

We file Annual Reports on Form 10-KSB, Quarterly Reports on Form

10-QSB, Current Reports on Form 8-K and other items with the Securities and

Exchange Commission (SEC). We provide free access to all of these SEC filings,

as soon as reasonably practicable after filing, on our Internet web site located

at www.bmbmunai.com. In addition, the public may read and copy any documents we

file with the SEC at the SEC's Public Reference Room at 100 F Street N.E.,

Washington, DC 20549. The public may obtain information on the operation of the

Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains

its Internet site www.sec.gov, which contains reports, proxy and information

statements and other information regarding issuers like BMB Munai.

Item 3. Legal Proceedings.

In December 2003, a complaint was filed in the 15th Judicial Court in

and for Palm Beach County, Florida, naming, among others, us, Georges Benarroch

and Alexandre Agaian, current or former BMB directors, as defendants. The

plaintiffs, Brian Savage, Thomas Sinclair and Sokol Holdings, Inc., allege

claims of breach of contract, unjust enrichment, breach of fiduciary duty,

conversion and violation of a Florida trade secret statute in connection with a

business plan for the development Aksaz, Dolinnoe and Emir oil and gas fields

owned by Emir Oil, LLP. The parties mutually agreed to dismiss this lawsuit

without prejudice.

In April 2005, Sokol Holdings, Inc., also filed a complaint in United

States District Court, Southern District of New York alleging that BMB Munai,

Inc., Boris Cherdabayev, Alexandre Agaian, Bakhytbek Baiseitov, Mirgali Kunayev

and Georges Benarroch wrongfully induced Toleush Tolmakov to breach a contract

23

under which Mr. Tolmakov had agreed to sell to Sokol 70% of his 90% interest in

Emir Oil LLP.

In October 2005, Sokol Holdings amended its complaint in the U.S.

District Court in New York to add Brian Savage and Thomas Sinclair as plaintiffs

and to add Credifinance Capital, Inc., and Credifinance Securities, Ltd.,

(collectively "Credifinance") as defendants in the matter. The amended complaint

alleges tortious interference with contract, specific performance, breach of

contract, unjust enrichment, breach of fiduciary duty by Georges Benarroch,

Alexandre Agaian and Credifinance, conversion, breach of fiduciary duty by Boris

Cherdabayev, Mirgali Kunayev and Bakhytbek Baiseitov, misappropriation of trade

secrets, tortuous interference with fiduciary duty by Mr. Agaian, Mr. Benarroch

and Credifinance and aiding and abetting breach of fiduciary duty by Mr.

Benarroch, Mr. Agaian and Credifinance in connection with a business plan for

the development of the Aksaz, Dolinnoe and Emir oil and gas fields owned by Emir

Oil, LLP. The plaintiffs have not named Toleush Tolmakov as defendant in the

action nor have the plaintiffs ever brought claims against Mr. Tolmakov to

establish the existence or breach of any legally binding agreement between the

plaintiffs and Mr. Tolmakov. The plaintiffs seek damages in an amount to be

determined at trial, punitive damages, specific performance and such other

relief as the Court finds just and reasonable.

We have retained the law firm of Bracewell & Giuliani LLP in New York,

New York to represent us in the lawsuit. We moved for dismissal of the amended

complaint or for a stay pending arbitration in Kazakhstan. That motion was

denied, without prejudice to renewing it, to enable defendants to produce

documents to plaintiffs relating to the issues raised in the motion. Following

completion of document production, the motion has been renewed.

In the opinion of management, the resolution of this lawsuit will not

have a material adverse effect on our financial condition, results of operations

or cash flows.

In November 2005 we learned that the Company had been added as a

defendant in a lawsuit filed by Bank CenterCredit against Optima Systems, LLP,

KazOvoshProm Company, LLP, Intexi LLP and a number of other parties. The lawsuit

was filed in the Special Interregional Economic Court of Almaty, Kazakhstan.

Under Kazakhstani law, it is illegal for a party to purchase stock of a bank

with borrowed funds. The lawsuit alleges that Optima Systems KazOvoshProm

Company and Intexi illegally shares of Bank CenterCredit in open market

transactions in the Kazakhstan Stock Market from a number of parties, including

BMB Munai, with borrowed funds.

On June 13, 2006 we learned that the Special Interregional Economic

Court of Almaty, Kazakhstan ruled that we had no liability in this lawsuit and

has dismissed us as a defendant in the lawsuit.

Other than the foregoing, to the knowledge of management, there is no

other material litigation or governmental agency proceeding pending or

threatened against the Company or our management.

24

Item 4. Submission of Matters to a Vote of Security Holders

No matters were submitted to a vote of security holders during the

quarter ended March 31, 2006. Subsequent to the quarter end on April 18, 2006,

we held a special meeting of our stockholder. The total number of shares

entitled to vote at the meeting was 42,198,690. The number of shares represented

at the special meeting of stockholders, present or by proxy was 23,320,834. At

the meeting the shareholders were asked to vote on the following matter:

1) To ratify the adoption of a corporate policy governing future

acquisitions of additional oil and gas licenses in exchange for

shares of Company common stock; and

2) To amend our Articles of Incorporation to increase the authorized

capital stock of the Company to 500,000,000 common shares.

23,320,584 shares voted to ratify the acquisitions policy and due

diligence protocol and 250 shares voted against ratification of the acquisitions

policy and due diligence protocol. No shares abstained.

22,968,520 shares voted to approve an amendment to our Articles of

Incorporation to increase our authorized common stock to 500,000,000 and 352,313

shares voted against the amendment to our Articles of Incorporation and one

share abstained from voting. On June 21, 2006 we filed an amendment to our

Articles of Incorporation increasing our authorized common stock to 500,000,000

shares.

No other items were submitted to a vote of our shareholders at the

meeting.

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Small Business

Issuer Purchases of Equity Securities

Our shares are currently traded on the Over-the-Counter Bulletin Board

("OTCBB") under the symbol BMBM. As of June 22, 2006, we had approximately 620

shareholders of record holding 43,740,657 shares of our common stock. The number

of record holders was determined from the records of our transfer agent and does

not include beneficial owners of common stock whose shares are held in the names

of various security brokers, dealers, and registered clearing agencies. We

believe that, in addition, there are beneficial owners of our common stock whose

shares are held in street name and, consequently, we are unable to determine the

actual number of beneficial holders of our common stock.

Of the issued and outstanding common stock, approximately 9,553,445 are

free trading, the balance are "restricted securities" as that term is defined in

Rule 144 promulgated by the Securities and Exchange Commission.

The published high and low bid quotations from April 1, 2004 through

March 31, 2006, were furnished to us by Pink Sheets, LLC, are included in the

chart below. These quotations represent prices between dealers and do not

include retail markup, markdown or commissions and may not represent actual

transactions.

25

High Low

Fiscal year ending March 31, 2006

First Quarter $5.30 $4.01

Second Quarter $8.15 $4.65

Third Quarter $7.50 $6.00

Fourth Quarter $9.70 $6.70

Fiscal year ending March 31, 2005

First Quarter $5.75 $3.80

Second Quarter 7.65 3.00

Third Quarter 7.05 3.00

Fourth Quarter 5.40 4.60

Cash Dividends

During the fiscal year ended March 31, 2006, the Company did not pay,

nor declare, any dividends. The Company's ability to pay dividends is subject to

limitations imposed by Nevada law. Under Nevada law, dividends may be paid to

the extent that the corporation's assets exceed it liabilities and it is able to

pay its debts as they become due in the usual course of business. The Board of

Directors does not, however, anticipate paying any dividends in the foreseeable

future; it intends to retain the earnings that could be distributed, if any, for

the operations, expansion and development of its business.

Securities for Issuance Under Equity Compensation Plans

As of June 22, 2006, shares of our common stock were subject to

issuance upon the exercise of outstanding options or warrants as set forth

below.

- ------------------------- --------------------------- --------------------------- ------------------------------------

Plan category Number of securities Weighted-average Number of securities

to be issued upon exercise price of remaining available for future

exercise of outstanding issuance under equity

outstanding options, options, warrants compensation plans

warrants and rights and rights (excluding securities reflected in

columns (a))

(a) (b) (c)

- ------------------------- --------------------------- --------------------------- ------------------------------------

Equity compensation

plans approved by

security holders 1,173,583 $5.32 2,805,000

- ------------------------- --------------------------- --------------------------- ------------------------------------

26

Equity compensation

plans not approved by

security holders 142,857 $3.50 -0-

- ------------------------- --------------------------- --------------------------- ------------------------------------

Total 1,356,440 $5.12 2,805,000

- ------------------------- --------------------------- --------------------------- ------------------------------------

On November 19, 2003 we granted an option to Credifinance Securities

Limited for services rendered by Credifinance as our agent in connection with

private placements made by us in November 2003. Georges Benarroch, a Company

director is also the CEO of Credifinance and may be deemed to be a related

party. The option grants Credifinance the right to purchase up to 142,857 shares

of our common stock at an exercise price of $3.50 per share. The option expires

on November 26, 2008. The option provides for adjustments to the number of

shares and/or the price per share to protect the holder against dilution and in

the event of mergers, reorganizations and similar events. The option also

requires that in the event we determine to make a registered public offering

during the term of the option, we shall use our best efforts to include the

common shares underlying the options in the registration statement.

In October 2004 we agreed to grant stock options under our 2004 Stock

Incentive Plan to Gary Lerner, our former corporate secretary, to purchase

60,000 shares of our common stock. The options have an exercise price of $4.00

per share and expire in October 2009. In April 2006, Mr. Lerner exercised

options to purchase 7,200 shares of our common stock.

On July 18, 2005 our Board of Directors approved stock option grants

and restricted stock awards under our 2004 Stock Incentive Plan subject to