|

x

|

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

For

the fiscal year ended March 31,

2010

|

|

¨

|

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

|

For

the transition period from ________ to

_________

|

|

Nevada

|

30-0233726

|

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

|

incorporation

or organization)

|

Identification

No.)

|

|

|

202

Dostyk Ave, 4th

Floor

|

||

|

Almaty, Kazakhstan

|

050051

|

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

|

Title of Each Class

|

Name of Exchange on Which

Registered

|

|

|

Common

- $0.001

|

NYSE

Amex

|

|

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of

the Securities Act.

|

Yes o

No x

|

|

Indicate

by check mark if the registrant is not required to file reports pursuant

to Section 13 or 15(d)

of the Exchange Act.

|

Yes

o

No x

|

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

Yes

x

No o

|

| Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files.) |

Yes o No

o

|

|

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K (§229.405 of this chapter) is not contained

herein, and will not be contained, to the best of registrant’s knowledge,

in definitive proxy or information statements incorporated by reference in

Part III of this Form 10-K or any amendment to this Form

10-K.

|

o

|

|

Indicate

by check mark whether the registrant is a large accelerated filed, an

accelerated filer, a non-accelerated filer or a smaller reporting company.

See the definitions of “large accelerated

filer,” “accelerated filer” and

“smaller reporting

company” in Rule 12b-2 of the Exchange

Act.

|

|

|

Large

accelerated filer o

|

Accelerated

filer o

|

|

Non-accelerated

filer o

|

Smaller

reporting company x

|

|

(Do

not check if smaller reporting company)

|

|

Indicate

by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act.

|

Yes o

No x

|

|

The

aggregate market value of the voting and non-voting common equity held by

non-affiliates computed by reference to the price at which the common

equity was last sold as of the last business day of the registrant’s most

recently completed second fiscal quarter was

$36,237,666.

|

|

|

As

of June 2, 2010, the registrant had 51,865,015 shares of common stock, par

value $0.001, issued and outstanding.

|

|

|

Documents

Incorporated by

Reference: None

|

|

|

PART

I

|

||

|

Page

|

||

|

Item

1.

|

Business

|

5

|

|

Item

1A.

|

Risk

Factors

|

10

|

|

Item

1B.

|

Unresolved

Staff Comments

|

21

|

|

Item

2.

|

Properties

|

22

|

|

Item

3.

|

Legal

Proceedings

|

33

|

|

Item

4.

|

[Removed

and Reserved]

|

33

|

|

PART

II

|

||

|

Item

5.

|

Market

for Registrant’s Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

|

34

|

|

Item

6.

|

Selected

Financial Data

|

36

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

37

|

|

Item

7A.

|

Quantitative

and Qualitative Disclosures About Market Risk

|

53

|

|

Item

8.

|

Financial

Statements and Supplementary Data

|

54

|

|

Item

9.

|

Changes

in and Disagreements with Accountants on Accounting and Financial

Disclosure

|

54

|

|

Item

9A.

|

Controls

and Procedures

|

54

|

|

Item

9B.

|

Other

Information

|

57

|

|

PART

III

|

||

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance

|

57

|

|

Item

11.

|

Executive

Compensation

|

64

|

|

Item

12.

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

78

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence

|

80

|

|

Item

14.

|

Principal

Accounting Fees and Services

|

82

|

|

Item

15.

|

Exhibits,

Financial Statement Schedules

|

83

|

|

PART

IV

|

||

|

SIGNATURES

|

88

|

|

•

|

require

the acquisition of a permit or other authorization before construction or

drilling commences;

|

|

•

|

restrict

the types, quantities and concentrations of various substances that can be

released into the environment in connection with drilling, production, and

natural gas processing activities;

|

|

•

|

suspend,

limit or prohibit construction, drilling and other activities in certain

lands lying within wilderness, wetlands, areas inhabited by threatened or

endangered species and other protected

areas;

|

|

•

|

require

remedial measures to mitigate pollution from historical and on-going

operations such as the use of pits and plugging of abandoned

wells;

|

|

•

|

restrict

injection of liquids into subsurface strata that may contaminate

groundwater; and

|

|

•

|

impose

substantial liabilities for pollution resulting from our

operations.

|

|

•

|

Our

ability to obtain additional financing to fund capital expenditures,

acquisitions, working capital, repay debts or for other purposes may be

impaired;

|

|

|

•

|

Our

ability to use operating cash flow in other areas of our business may be

limited because we must dedicate a substantial portion of these funds to

repay debt obligations;

|

|

|

•

|

We

may be unable to compete with others who may not be as highly leveraged;

and

|

|

|

•

|

Our

debt may limit our flexibility to adjust to changing market conditions,

changes in our industry and economic

downturns.

|

|

•

|

our

ability to obtain credit and access the capital markets may continue to be

restricted adversely affecting our financial position and our ability to

continuing exploration and drilling activities on our

territory;

|

||

|

•

|

the

values we are able to realize in transactions we engage in to raise

capital may be reduced, thus making these transactions more difficult to

consummate and more dilutive to our

shareholders; and

|

||

|

•

|

the

demand for oil and natural gas may decline due to weak international

economic conditions.

|

|

•

|

changes

in our reserves;

|

||

|

•

|

changes

in oil and gas prices;

|

||

|

•

|

changes

in labor and drilling costs;

|

||

|

•

|

our

ability to acquire, locate and produce reserves;

|

||

|

•

|

changes

in license acquisition costs; and

|

||

|

•

|

government

regulations relating to safety and the

environment.

|

|

•

|

our

proved reserves;

|

|

|

•

|

the

success or our drilling efforts;

|

|

|

•

|

the

level of oil and gas we are able to produce from existing

wells;

|

|

|

•

|

the

prices at which our oil and gas is sold; and

|

|

|

•

|

our

ability to acquire, locate and produce new

reserves.

|

|

•

|

the

domestic and foreign supply of and demand for oil and natural

gas;

|

|

|

•

|

the

price and level of foreign imports of oil and natural

gas;

|

|

|

•

|

the

level of consumer product demand;

|

|

|

•

|

weather

conditions;

|

|

|

•

|

overall

domestic and global economic conditions;

|

|

|

•

|

political

and economic conditions in oil and gas producing countries, including

embargoes and continued hostilities in the Middle East and other sustained

military campaigns, acts of terrorism or sabotage;

|

|

|

•

|

actions

of the Organization of Petroleum Exporting Countries and other

state-controlled oil companies relating to oil price and production

controls;

|

|

|

•

|

the

impact of the U.S. dollar exchange rates on oil and gas

prices;

|

|

|

•

|

technological

advances affecting energy consumption;

|

|

|

•

|

domestic

and foreign governmental regulations and taxation;

|

|

|

•

|

the

impact of energy conservation efforts;

|

|

|

•

|

the

costs, proximity and capacity of gas pipelines and other transportation

facilities; and

|

|

|

•

|

the

price and availability of alternative

fuels.

|

|

•

|

negatively

impact the value of our reserves because declines in oil and natural gas

prices would reduce the amount of oil and natural gas we can produce

economically;

|

|

|

•

|

reduce

the amount of cash flow available for capital

expenditures; and

|

|

|

•

|

limit

our ability to borrow money or raise additional

capital.

|

|

•

|

high

costs, shortages or delivery delays of drilling rigs, equipment, labor or

other services;

|

|

|

•

|

adverse

weather conditions;

|

|

|

•

|

equipment

failures or accidents;

|

|

|

•

|

pipe

or cement failures or casing collapses;

|

|

|

•

|

compliance

with environmental and other governmental requirements;

|

|

|

•

|

environmental

hazards, such as gas leaks, oil spills, pipeline ruptures and discharges

of toxic gases;

|

|

•

|

lost

or damaged oilfield drilling and service tools;

|

|

|

•

|

loss

of drilling fluid circulation;

|

|

|

•

|

unexpected

operational events and drilling conditions;

|

|

|

•

|

unusual

or unexpected or difficult geological formations;

|

|

|

•

|

natural

disasters, such as fires;

|

|

|

•

|

blowouts,

surface cratering and explosions; and

|

|

|

•

|

uncontrollable

flows of oil, gas or well fluids.

|

|

•

|

environmental

hazards, such as uncontrollable flows of oil, natural gas, brine, well

fluids, toxic gas or other pollution into the environment, including

groundwater contamination;

|

|

|

•

|

abnormally

pressured formations;

|

|

|

•

|

mechanical

difficulties, such as stuck oil field drilling and service tools and

casing collapse;

|

|

|

•

|

fires

and explosions;

|

|

|

•

|

personal

injuries and death; and

|

|

|

•

|

natural

disasters.

|

|

•

|

discharge

permits for drilling operations;

|

|

|

•

|

reports

concerning operations;

|

|

|

•

|

the

spacing of wells;

|

|

|

•

|

unitization

and pooling of properties; and

|

|

|

•

|

taxation.

|

|

•

|

our

operating performance and future prospects;

|

|

|

•

|

quarterly

variations in the rate of growth of our financial indicators, such as net

income per share, net income and revenues;

|

|

|

•

|

actual

or anticipated variations in our reserve estimates and quarterly operating

results;

|

|

|

•

|

fluctuations

in oil and natural gas prices;

|

|

|

•

|

speculation

in the press or investment community;

|

|

|

•

|

sales

of our common stock by large block stockholders;

|

|

|

•

|

short-selling

of our common stock by investors;

|

|

|

•

|

the

outcome of current litigation;

|

|

|

•

|

issuance

of a significant number of shares to raise additional capital to fund our

operations;

|

|

|

•

|

changes

in applicable laws or regulations;

|

|

|

•

|

changes

in market valuations of similar companies;

|

|

|

•

|

additions

or departures of key management personnel;

|

|

|

•

|

actions

by our creditors; and

|

|

|

•

|

international

economic, legal and regulatory factors unrelated to our

performance.

|

|

Developed

|

Undeveloped

|

Total

|

|||||||||

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

||||||

|

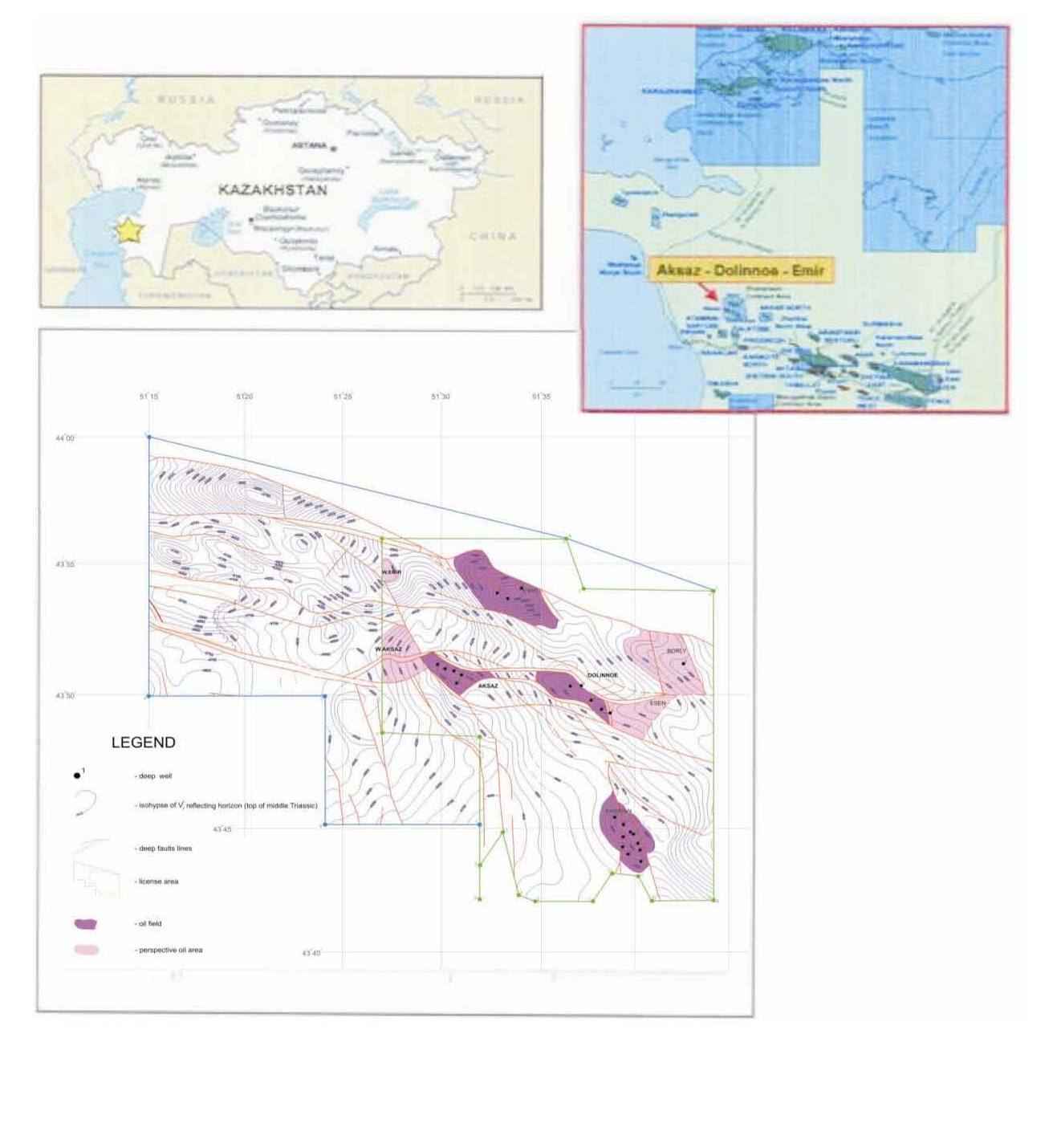

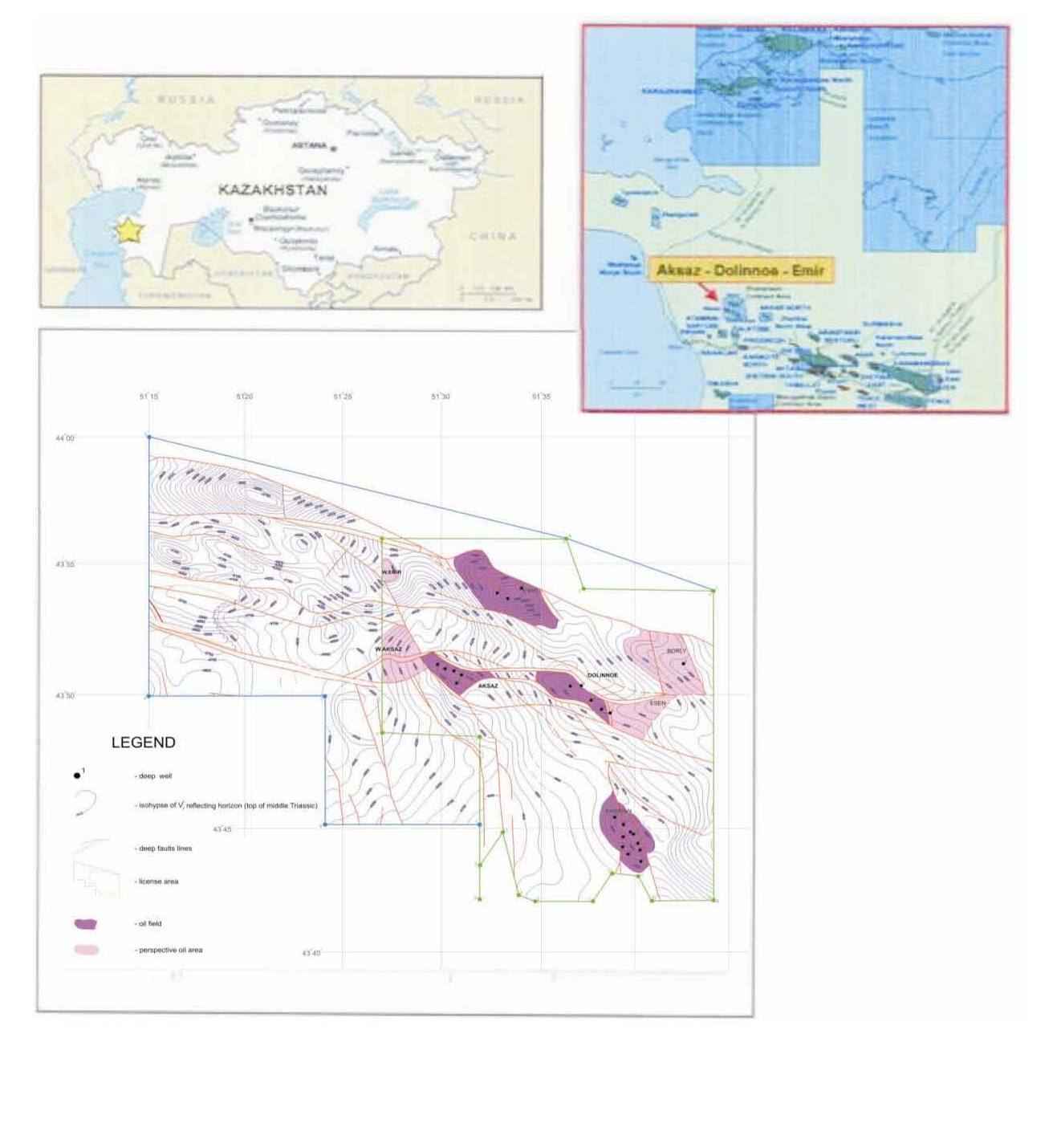

ADE

Block

|

950

|

950

|

46,805

|

46,805

|

47,755

|

47,755

|

|||||

|

Southeast

Block

|

670

|

670

|

65,245

|

65,245

|

65,915

|

65,915

|

|||||

|

Northwest

Block

|

-

|

-

|

96,370

|

96,370

|

96,370

|

96,370

|

|||||

|

Amount

of Expenditure

|

Mandated

by Contract

|

Actually

Made

|

|

Prior

to July 2007

|

$40,200,000

|

$104,750,000

|

|

July

2007 to July 2008

|

$8,480,000

|

$115,040,000

|

|

July

2008 to July 2009

|

$1,845,000

|

$44,900,000

|

|

July

2009 to January 2010

|

$8,565,000

|

$15,970,000

|

|

January

2010 to January 2011

|

$21,520,000

|

$8,727,000*

|

|

January

2011 to January 2012

|

$27,300,000

|

$

-

|

|

January

2012 to January 2013

|

$14,880,000

|

$

-

|

|

Total

|

$122,790,000

|

$289,387,000

|

|

Structures

|

Aksaz

|

Dolinnoe

|

Emir

|

Kariman

|

Borly

|

Yessen

|

Northwest

Block

|

|

Exploratory

Wells

|

1

|

1

|

1

|

1

|

1

|

1

|

3(1)

|

|

Appraisal

Wells

|

2

|

2

|

2

|

2

|

2

|

2

|

*

|

|

Existing

Wells

|

5

|

6

|

3

|

10

|

0

|

0

|

0

|

|

Wells

in Progress

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|

Remaining

Wells to

Drill

by 2013

|

0

|

0

|

0

|

0

|

3

|

3

|

*

|

|

(1)

|

Addendum

No. 6 to our exploratory contract requires the drilling of three

exploratory wells. Depending upon the results of 3D seismic

studies of the Northwest Block we may need to drill additional exploratory

and appraisal wells in the Northwest

Block.

|

|

|

*

|

Unknown at this

time.

|

|

2008

|

2009

|

2010

|

|||||||||

|

Gross

|

Net

|

Gross

|

Net

|

Gross

|

Net

|

||||||

|

Exploratory

|

|||||||||||

|

Productive

|

|||||||||||

|

Oil

|

18

|

18

|

24

|

24

|

24

|

24

|

|||||

|

Gas

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||

|

Dry

wells

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||

|

Total

|

18

|

18

|

24

|

24

|

24

|

24

|

|||||

|

Development

|

|||||||||||

|

Productive

|

|||||||||||

|

Oil

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||

|

Gas

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||

|

Dry

wells

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||

|

Total

|

-

|

-

|

-

|

-

|

-

|

-

|

|||||

|

Well

|

Single

Interval Production

Rate for the year ended March 31, 2010 |

Average

Daily Production

Rate for the quarter ended March 31, 2010 |

Diameter

Choke Size |

|||

|

Aksaz

-1

|

31

- 57 bpd

|

31

- 38 bpd

|

4

mm

|

|||

|

Aksaz

-2

|

0 -

13 bpd(1)

|

6

bpd(1)

|

3

mm

|

|||

|

Aksaz-3

|

0 -

377 bpd(1)

|

226

- 296 bpd(1)

|

7

mm

|

|||

|

Aksaz

-4

|

50

- 57 bpd

|

50

bpd

|

4

mm

|

|||

|

Aksaz

-6

|

25

- 63 bpd

|

25

bpd

|

5

mm

|

|||

|

Dolinnoe

-1

|

0 -

157 bpd

|

63

bpd

|

5

mm

|

|||

|

Dolinnoe

-2

|

0 -

189 bpd(2)

|

25

– 69 bpd(2)

|

6

mm

|

|||

|

Dolinnoe

-3

|

0 -

176 bpd

|

0 -

176 bpd

|

14

mm

|

|||

|

Dolinnoe

-5

|

0

bpd

|

0

bpd

|

0

mm

|

|||

|

Dolinnoe

-6

|

0 -

94 bpd(2)

|

0 -

19 bpd(2)

|

0

mm

|

|||

|

Dolinnoe

-7

|

0 -

371 bpd(2)

|

0 -

371 bpd(2)

|

4

mm

|

|||

|

Emir

-1

|

0

bpd

|

0

bpd(3)

|

0

mm

|

|||

|

Emir

- 2

|

0 -

38 bpd

|

0

bpd(3)

|

0

mm

|

|||

|

Emir

-6

|

0 -

94 bpd

|

0

bpd(3)

|

0

mm

|

|||

|

Kariman

-1

|

0 -

63 bpd(4)

|

0 -

63 bpd(4)

|

0

mm

|

|||

|

Kariman

-2

|

0 -

660 bpd(4)

|

0 -

660 bpd(4)

|

14

mm

|

|||

|

Kariman

-3

|

0 -

50 bpd(5)

|

0 -

38 bpd(5)

|

0

mm

|

|||

|

Kariman

-4

|

170

- 403 bpd(4)

|

170

- 315 bpd(4)

|

10

mm

|

|||

|

Kariman

-5

|

0 -

132 bpd(5)

|

0 -

75 bpd(5)

|

0

mm

|

|||

|

Kariman

-6

|

0 -

409 bpd(4)

|

0 -

302 bpd(4)

|

9

mm

|

|||

|

Kariman

-7

|

0 -

415 bpd(4)

|

0 -

415 bpd(4)

|

12

mm

|

|||

|

Kariman

-8

|

0 -

434 bpd(4)

|

201

- 384 bpd(4)

|

12

mm

|

|||

|

Kariman

-10

|

0 -

321 bpd(4)

|

0 -

189 bpd(4)

|

10

mm

|

|||

|

Kariman-11

|

0 -

346 bpd(4)

|

126

- 239 bpd(4)

|

12

mm

|

|

(1)

|

We

have performed acid treatment at these

wells.

|

|

(2)

|

We

have performed workover at these wells and moved to new

horizons.

|

|

(3)

|

Emir

wells are on temporary abandonment as the Company is planning for

submission of an application for pilot development project for this

field.

|

|

(4)

|

We

have installed centrifugal submersible pumps at these

wells. After a brief period of testing and fine tuning,

production from this well stabilized. Stabilized production

rates are included in the table

above.

|

|

(5)

|

We

have installed beam pumpcentrifugal submersible pumps at these

wells. After a brief period of testing and fine tuning,

production from this well stabilized. Stabilized production

rates are included in the table

above.

|

|

·

|

Introduce

a new definition of oil and gas producing activities. This new definition

allows companies to include in their reserve base volumes from

unconventional resources. Such unconventional resources include bitumen

extracted from oil sands and oil and gas extracted from coal beds and

shale formations.

|

|

·

|

Report

oil and gas reserves using an unweighted average price using the prior

12-month period, based on the closing prices on the first day of each

month, rather than year-end prices.

|

|

·

|

Permit

companies to disclose their probable and possible reserves on a voluntary

basis. In the past, proved reserves were the only reserves allowed in the

disclosures. We have chosen not to make disclosure under these

categories.

|

|

·

|

Requires

companies to provide additional disclosure regarding the aging of proved

undeveloped reserves.

|

|

·

|

Permit

the use of reliable technologies to determine proved reserves if those

technologies have been demonstrated empirically to lead to reliable

conclusions about reserves volumes.

|

|

·

|

Replace

the existing “certainty” test for areas beyond one offsetting drilling

unit from a productive well with a “reasonable certainty”

test.

|

|

·

|

Require

additional disclosures regarding the qualifications of the chief technical

person who oversees the company’s overall reserve estimation process.

Additionally, disclosures regarding internal controls over reserve

estimation, as well as a report addressing the independence and

qualifications of its reserves preparer or auditor will be

mandatory.

|

|

Proved

reserves to be recovered

by January 9, 2013(1) |

Proved

reserves to be recovered

after January 9, 2013(1) |

||||||||

|

Developed(2)

|

Undeveloped(3)

|

Developed(2)

|

Undeveloped(3)

|

Total

|

|||||

|

Oil

and condensate (MBbls)(4)

|

5,195

|

307

|

14,960

|

2,264

|

22,726

|

||||

|

Natural

gas (MMcf)

|

-

|

-

|

-

|

-

|

-

|

||||

|

Total

BOE (MBbls)

|

5,195

|

307

|

14,960

|

2,264

|

22,726

|

||||

|

Standardized

Measure of discounted future net cash flows(5)

(in thousands of U.S. Dollars)

|

$ 268,322

|

||||||||

|

(1)

|

Under

our exploration contract we have the right to sell the oil and natural gas

we produce while we undertake exploration stage activities within our

licensed territory. As discussed in more detail in “Risk

Factors” and “Properties” we have the right to engage in exploration stage

activities until January 9, 2013. To retain our rights to

produce and sell oil and natural gas after that date, we must apply for

and be granted commercial production rights by no later than January 2013

or obtain a further extension of our exploration contract. If

we are not granted commercial production rights or another extension by

that time, we would expect to lose our rights to the licensed territory

and would expect to be unable to produce reserves after January

2013.

|

|

(2)

|

Proved

developed reserves are proved reserves that are expected to be recovered

from existing wells with existing equipment and operating

methods.

|

|

(3)

|

Proved

undeveloped reserves are proved reserves which are expected to be

recovered from new wells on undrilled acreage or from existing wells where

a relatively major expenditure is required for

recompletion.

|

|

(4)

|

Includes

natural gas liquids.

|

|

(5)

|

The

standardized measure of discounted future net cash flows represents the

present value of future net cash flow net of all

taxes.

|

|

Oil

(Bbl)

|

Pre-Tax PV10 Value |

Standardized

Measure

of Discounted Future Net

Cash Flows

|

|||

|

Oil

and condensate (MBbls)(4)

|

22,726

|

$

422,121

|

$

268,322

|

||

|

Natural

gas (MMcf)

|

-

|

-

|

-

|

||

|

Total

BOE (MBbls)

|

22,726

|

$

422,121

|

$

268,322

|

|

Year

|

Total

BOE

|

Estimated

Development

Costs

|

||

|

2011

|

3,074,000

|

1,170,000

|

||

|

2012

|

1,175,000

|

600,000

|

||

|

2013

|

6,868,000

|

1,720,000

|

||

|

2014

|

-

|

-

|

||

|

2015

|

-

|

-

|

|

As

of March 31, 2010

|

As

of March 31, 2009

|

||

|

Developed

oil and natural gas properties

|

$

246,979,803

|

$

221,374,856

|

|

|

Unevaluated

oil and natural gas properties

|

25,924,087

|

40,580,015

|

|

|

Accumulated

depletion, depreciation and amortization

|

(34,302,048)

|

(23,226,458)

|

|

|

Net

capitalized cost

|

$

238,601,842

|

$

238,728,413

|

|

For

the year ended

March 31, 2010 |

For

the year ended

March 31, 2009 |

For

the year ended

March 31, 2008 |

|||

|

Acquisition

costs:

|

|||||

|

Unproved

properties

|

$ -

|

$ -

|

$ -

|

||

|

Proved

properties

|

-

|

-

|

-

|

||

|

Exploration

costs

|

-

|

2,275,021

|

3,024,386

|

||

|

Development

costs

|

10,949,019

|

63,727,311

|

83,950,096

|

||

|

Subtotal

|

10,949,019

|

66,002,332

|

86,974,482

|

||

|

Asset

retirement costs

|

-

|

86,438

|

1,300,576

|

||

|

Total

costs incurred

|

$

10,949,019

|

$

66,088,770

|

$

88,275,058

|

|

For

the Year Ended

March

31, 2010

|

For

the Year Ended

March

31, 2009

|

For

the Year Ended

March

31, 2008

|

|||

|

Production:

|

|||||

|

Oil

and condensate (Bbls)

|

1,016,221

|

1,080,895

|

907,823

|

||

|

Natural

gas liquids (Bbls)

|

-

|

-

|

-

|

||

|

Natural

gas (Mcf)

|

-

|

-

|

-

|

||

|

Barrels

of oil equivalent (BOE)

|

1,016,221

|

1,080,895

|

907,823

|

||

|

Sales(1)(3):

|

|||||

|

Oil

and condensate (Bbls)

|

1,036,070

|

1,073,754

|

896,256

|

||

|

Natural

gas liquids (Bbls)

|

-

|

-

|

-

|

||

|

Natural

gas (Mcf)

|

-

|

-

|

-

|

||

|

Barrels

of oil equivalent (BOE)

|

1,036,070

|

1,073,754

|

896,256

|

||

|

Average Sales Price(1):

|

|||||

|

Oil

and condensate ($ per Bbl)

|

$ 55.28

|

$ 64.84

|

$ 67.16

|

||

|

Natural

gas liquids ($ per Bbl)

|

$ -

|

$ -

|

$ -

|

||

|

Natural

gas ($ per Mcf)

|

$ -

|

$ -

|

$ -

|

||

|

Barrels

of Oil equivalent ($ per BOE)

|

$ 55.28

|

$ 64.84

|

$ 67.16

|

||

|

Average

oil and natural gas operating expenses

including

production and ad valorem taxes

($

per BOE)(2)(3)

|

$ 8.27

|

$

7.01

|

$

6.15

|

|

(1)

|

During

the years ended March 31, 2010, 2009 and 2008, the Company has not engaged

in any hedging activities, including

derivatives.

|

|

(2)

|

Includes

transportation cost, production cost and ad valorem taxes (except for rent

export tax).

|

|

(3)

|

We

use sales volume rather than production volume for calculation of per unit

cost because not all volume produced is sold during the

period. The related production costs were expensed only for the

units sold, not produced based on a matching principle of

accounting. Therefore, oil and gas operating expense per BOE

was calculated by dividing oil and gas operating expenses for the year by

the volume of oil sold during the

year.

|

|

Fiscal

year ended March 31, 2010

|

High

|

Low

|

||

|

Fourth

quarter

|

$

1.45

|

$

0.94

|

||

|

Third

quarter

|

$

1.31

|

$

0.88

|

||

|

Second

quarter

|

$

1.14

|

$

0.78

|

||

|

First

quarter

|

$

1.79

|

$

0.56

|

||

|

Fiscal

year ended March 31, 2009

|

||||

|

Fourth

quarter

|

$

1.90

|

$

0.36

|

||

|

Third

quarter

|

$

3.54

|

$

0.80

|

||

|

Second

quarter

|

$

6.00

|

$

2.96

|

||

|

First

quarter

|

$

7.88

|

$

5.26

|

|

Name

|

Position

with Company

|

Restricted

Stock Granted

|

||

|

Boris

Cherdabayev

|

Chairman

of the Board of Directors

|

280,000

|

||

|

Gamal

Kulumbetov

|

Chief

Executive Officer

|

80,000

|

||

|

Askar

Tashtitov

|

President

|

230,000

|

||

|

Toleush

Tolmakov

|

Director

Emir Oil LLP

|

215,000

|

||

|

Evgeny

Ler

|

Chief

Financial Officer

|

110,000

|

||

|

Anuarbek

Baimoldin

|

Chief

Operating Officer

|

20,000

|

|

For

the year ended March 31,

|

|||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||

|

Consolidated

Statements of Operations Data:

|

|||||||||

|

Revenues

|

$

57,274,526

|

$

69,616,875

|

$

60,196,626

|

$

15,785,784

|

$ 5,956,731

|

||||

|

Oil

and gas operating expenses

|

8,568,453

|

7,530,653

|

5,515,403

|

2,272,251

|

875,319

|

||||

|

General

and administrative expenses

|

14,042,577

|

22,262,248

|

14,747,754

|

10,757,727

|

9,724,597

|

||||

|

Depletion

|

11,075,590

|

10,403,328

|

9,419,655

|

2,006,834

|

1,167,235

|

||||

|

Income/(loss)

from operations

|

7,888,299

|

11,595,582

|

30,020,087

|

404,843

|

(5,949,170)

|

||||

|

Net

income/(loss)

|

8,993,473

|

17,157,558

|

31,310,564

|

2,188,100

|

(6,192,943)

|

||||

|

Basic

income/(loss) per common share

|

$

0.18

|

$

0.37

|

$

0.70

|

$

0.05

|

$

(0.18)

|

||||

|

Diluted

income/(loss) per common share

|

$

0.18

|

$

0.37

|

$

0.70

|

$

0.05

|

$

(0.18)

|

||||

|

As

of March 31,

|

|||||||||

|

2010

|

2009

|

2008

|

2007

|

2006

|

|||||

|

Balance

Sheet Data:

|

|||||||||

|

Current

assets

|

$

16,947,713

|

$

12,891,196

|

$

26,519,810

|

$

18,276,626

|

$

57,336,327

|

||||

|

Oil

and gas properties, full cost method, net

|

238,601,842

|

238,728,413

|

183,042,971

|

104,187,568

|

67,497,230

|

||||

|

Total

assets

|

291,880,018

|

288,346,061

|

254,838,093

|

144,796,045

|

127,396,589

|

||||

|

Total

current liabilities

|

9,392,879

|

24,109,901

|

23,225,460

|

9,120,299

|

4,623,975

|

||||

|

Total

long term liabilities

|

72,224,647

|

72,111,959

|

71,808,702

|

9,814,127

|

8,992,420

|

||||

|

Total

Shareholders' equity

|

$

210,262,492

|

$

192,124,201

|

$

159,803,931

|

$

125,861,619

|

$

113,780,194

|

||||

|

For

the year ended

March

31, 2010

|

For

the year ended

March

31, 2009

|

For

the year ended

March

31, 2008

|

||||

|

Revenues:

|

||||||

|

Oil

and gas sales

|

$

57,274,526

|

$

69,616,875

|

|

$

60,196,626

|

||

|

|

||||||

|

Expenses:

|

||||||

|

Rent

export tax

|

10,032,857

|

467,359

|

-

|

|||

|

Export

duty

|

-

|

6,783,278

|

-

|

|||

|

Oil

and gas operating(1)

|

8,568,453

|

7,530,653

|

5,515,403

|

|||

|

Depletion

|

11,075,590

|

10,403,328

|

9,419,655

|

|||

|

Interest

expense

|

4,604,446

|

1,138,874

|

-

|

|||

|

Depreciation

and amortization

|

613,953

|

324,028

|

239,155

|

|||

|

Accretion

|

448,351

|

449,025

|

254,572

|

|||

|

General

and administrative

|

14,042,577

|

22,262,248

|

14,747,754

|

|||

|

Net

Production Data:

|

||||||

|

Oil

(Bbls)

|

1,016,221

|

1,080,895

|

907,823

|

|||

|

Natural

gas (Mcf)

|

-

|

-

|

-

|

|||

|

Barrels

of Oil equivalent (BOE)

|

1,016,221

|

1,080,895

|

907,823

|

|||

|

Net

Sales Data(3):

|

||||||

|

Oil

(per Bbl)

|

1,036,070

|

1,073,754

|

896,256

|

|||

|

Natural

gas (Mcf)

|

-

|

-

|

-

|

|||

|

Barrels

of Oil equivalent

|

1,036,070

|

1,073,754

|

896,256

|

|||

|

Average

Sales Price:

|

||||||

|

Oil

(per Bbl)

|

55.28

|

64.84

|

67.16

|

|||

|

Natural

gas (per Mcf)

|

-

|

-

|

-

|

|||

|

Equivalent

price (per BOE)

|

55.28

|

64.84

|

67.16

|

|||

|

Expenses

($ per BOE)

(3):

|

||||||

|

Oil

and gas operating(1)

|

8.27

|

7.01

|

6.15

|

|||

|

Depreciation,

depletion and

|

||||||

|

amortization(2)

|

10.69

|

9.69

|

10.51

|

|||

|

(1)

|

Includes

transportation cost, production cost and ad valorem taxes (excluding rent

export tax).

|

|

(2)

|

Represents

depletion of oil and gas properties

only.

|

|

(3)

|

We

use sales volume rather than production volume for calculation of per unit

cost because not all volume produced is sold during the

period. The related production costs are expensed only for the

units sold, not produced, based on a matching principle of

accounting. Oil and gas operating expense per BOE is calculated

by dividing oil and gas operating expenses for the year by the volume of

oil sold during the year.

|

|

Year

ended

March

31, 2010

to

the year ended

March

31, 2009

|

|||||||

|

For

the year

|

For

the year

|

$

|

%

|

||||

|

Ended

|

ended

|

Increase

|

Increase

|

||||

|

March

31, 2010

|

March

31, 2009

|

(Decrease)

|

(Decrease)

|

||||

|

Production

volumes:

|

|||||||

|

Natural

gas (Mcf)

|

-

|

-

|

-

|

-

|

|||

|

Natural

gas liquids (Bbls)

|

-

|

-

|

-

|

-

|

|||

|

Oil

and condensate (Bbls)

|

1,016,221

|

1,080,895

|

(64,674)

|

(6%)

|

|||

|

Barrels

of Oil equivalent (BOE)

|

1,016,221

|

1,080,895

|

(64,674)

|

(6%)

|

|||

|

Sales

volumes:

|

|||||||

|

Natural

gas (Mcf)

|

-

|

-

|

-

|

-

|

|||

|

Natural

gas liquids (Bbls)

|

-

|

-

|

-

|

-

|

|||

|

Oil

and condensate (Bbls)

|

1,036,070

|

1,073,754

|

(37,684)

|

(4%)

|

|||

|

Barrels

of Oil equivalent (BOE)

|

1,036,070

|

1,073,754

|

(37,684)

|

(4%)

|

|||

|

Average Sales Price

(1)

|

|||||||

|

Natural

gas ($ per Mcf)

|

-

|

-

|

-

|

-

|

|||

|

Natural

gas liquids ($ per Bbl)

|

-

|

-

|

-

|

-

|

|||

|

Oil

and condensate ($ per Bbl)

|

$

55.28

|

$

64.84

|

$

(9.56)

|

(15%)

|

|||

|

Barrels

of Oil equivalent ($

per BOE)

|

$

55.28

|

$

64.84

|

$

(9.56)

|

(15%)

|

|||

|

Operating

Revenue:

|

|||||||

|

Natural

gas

|

-

|

-

|

-

|

-

|

|||

|

Natural

gas liquids

|

-

|

-

|

-

|

-

|

|||

|

Oil

and condensate

|

$

57,274,526

|

$

69,616,875

|

$ (12,342,349)

|

(18%)

|

|||

|

Gain

on hedging and derivatives(2)

|

-

|

-

|

-

|

-

|

|||

|

(1)

|

At

times, we may produce more barrels than we sell in a given period. The

average sales price is calculated based on the average sales price per

barrel sold, not per barrel

produced.

|

|

(2)

|

We

did not engage in hedging transactions, including derivatives, during the

year ended March 31, 2010 or the year ended March 31,

2009.

|

|

For

the year ended

March

31, 2010

|

For

the year ended

March

31, 2009

|

||

|

Expenses:

|

|||

|

Rent

export tax

|

$ 10,032,857

|

$

467,359

|

|

|

Export

duty

|

-

|

6,783,278

|

|

|

Oil

and gas operating(1)

|

8,568,453

|

7,530,653

|

|

|

General

and administrative

|

14,042,577

|

22,262,248

|

|

|

Depletion

|

11,075,590

|

10,403,328

|

|

|

Interest

expense

|

4,604,446

|

1,138,874

|

|

|

Accretion

expenses

|

448,351

|

449,025

|

|

|

Amortization

and depreciation

|

613,953

|

324,028

|

|

|

Consulting

expenses

|

-

|

8,662,500

|

|

|

Total

|

$

49,386,227

|

$

58,021,293

|

|

|

Expenses

($ per BOE):

|

|||

|

Oil

and gas operating(1)

|

$

8.27

|

$

7.01

|

|

|

Depletion

(2)

|

$

10.69

|

$

9.69

|

|

(1)

|

Includes

transportation cost, production cost and ad valorem taxes (excluding rent

export tax).

|

|

(2)

|

Represents

depletion of oil and gas properties

only.

|

|

For

the year ended March 31,

|

|||||||

|

2010

|

2009

|

||||||

|

Total

|

Per

BOE

|

Total

|

Per

BOE

|

||||

|

Oil

and Gas Operating Expenses:

|

|||||||

|

Production

|

$

1,635,039

|

$

1.58

|

$

808,663

|

$

0.75

|

|||

|

Transportation

|

3,423,803

|

3.30

|

4,462,883

|

4.16

|

|||

|

Royalty

|

-

|

-

|

1,744,075

|

1.62

|

|||

|

Mineral

extraction tax

|

3,509,611

|

3.39

|

515,032

|

0.48

|

|||

|

Total

|

$

8,568,453

|

$

8.27

|

$

7,530,653

|

$

7.01

|

|||

|

|

•

|

a

57% decrease in non-cash compensation expense as the price for our stock

declined and the non-cash compensation expense we incurred decreased

significantly;

|

|

•

|

a

53% decrease in professional services resulting from decreased legal fees

incurred in our ongoing litigation as we changed the legal firm providing

those services and decreased audit consulting expenses;

|

|

|

•

|

a

27% decrease in business trip and related transportation

expenses;

|

|

|

•

|

an

11% decrease in payroll expenses;

|

|

|

•

|

a

68% decrease in environmental payments for flaring of unused natural gas

resulting from production, such decrease in the amount of environmental

payments totaling $208,087 and $652,026 during the year ended March 31,

2010 and 2009, respectively; and

|

|

|

|

•

|

a

27% decrease in rent expenses.

|

|

•

|

a

$353,401 foreign exchange loss resulting from the strengthening of the

Kazakh Tenge against the U.S. Dollar during the year ended March 31, 2010

compared with the foreign exchange gain in the amount $2,592,341 realized

in year ended March 31, 2009;

|

|

|

•

|

the

receipt of a one-time payment for disgorgement of funds received of

$1,650,293 during the 2009 fiscal year, earned in violation of the

short-swing profit rules of Section 16(b) of the Securities Exchange Act

of 1934;

|

|

|

•

|

a $116,087

decrease in interest income; and

|

|

|

•

|

a

$268,470 increase in other expense during the fiscal year ended March 31,

2010 compared the fiscal year ended March 31,

2009.

|

|

Year

ended

March

31, 2009

to

the year ended

March

31, 2008

|

|||||||

|

For

the year

|

For

the year

|

$

|

%

|

||||

|

Ended

|

ended

|

Increase

|

Increase

|

||||

|

March

31, 2009

|

March

31, 2008

|

(Decrease)

|

(Decrease)

|

||||

|

Production

volumes:

|

|||||||

|

Natural

gas (Mcf)

|

-

|

-

|

-

|

-

|

|||

|

Natural

gas liquids (Bbls)

|

-

|

-

|

-

|

-

|

|||

|

Oil

and condensate (Bbls)

|

1,080,895

|

907,823

|

173,072

|

19%

|

|||

|

Barrels

of Oil equivalent (BOE)

|

1,080,895

|

907,823

|

173,072

|

19%

|

|||

|

Sales

volumes:

|

|||||||

|

Natural

gas (Mcf)

|

-

|

-

|

-

|

-

|

|||

|

Natural

gas liquids (Bbls)

|

-

|

-

|

-

|

-

|

|||

|

Oil

and condensate (Bbls)

|

1,073,754

|

896,256

|

177,498

|

20%

|

|||

|

Barrels

of Oil equivalent (BOE)

|

1,073,754

|

896,256

|

177,498

|

20%

|

|||

|

Average Sales Price

(1)

|

|||||||

|

Natural

gas ($ per Mcf)

|

-

|

-

|

-

|

-

|

|||

|

Natural

gas liquids ($ per Bbl)

|

-

|

-

|

-

|

-

|

|||

|

Oil

and condensate ($ per Bbl)

|

$

64.84

|

$

67.16

|

$

(2.32)

|

(3%)

|

|||

|

Barrels

of Oil equivalent

($

per BOE)

|

$

64.84

|

$

67.16

|

$

(2.32)

|

(3%)

|

|||

|

Operating

Revenue:

|

|||||||

|

Natural

gas

|

-

|

-

|

-

|

-

|

|||

|

Natural

gas liquids

|

-

|

-

|

-

|

-

|

|||

|

Oil

and condensate

|

$

69,616,875

|

$

60,196,626

|

$

9,420,249

|

16%

|

|||

|

Gain

on hedging and derivatives(2)

|

-

|

-

|

-

|

-

|

|||

|

(1)

|

At

times, we may produce more barrels than we sell in a given period. The

average sales price is calculated based on the average sales price per

barrel sold, not per barrel

produced.

|

| (2)

|

We

did not engage in hedging transactions, including derivatives, during the

year ended March 31, 2009 or the year ended March 31,

2008.

|

|

For

the year ended

March

31, 2009

|

For

the year ended

March

31, 2008

|

||

|

Expenses:

|

|||

|

Rent

export tax

|

$

467,359

|

$ -

|

|

|

Export

duty

|

6,783,278

|

-

|

|

|

Oil

and gas operating(1)

|

7,530,653

|

5,515,403

|

|

|

General

and administrative

|

22,262,248

|

14,747,754

|

|

|

Depletion

|

10,403,328

|

9,419,655

|

|

|

Interest

expense

|

1,138,874

|

-

|

|

|

Accretion

expenses

|

449,025

|

254,572

|

|

|

Amortization

and depreciation

|

324,028

|

239,155

|

|

|

Consulting

expenses

|

8,662,500

|

-

|

|

|

Total

|

$

58,021,293

|

$

30,176,539

|

|

|

Expenses

($ per BOE):

|

|||

|

Oil

and gas operating(1)

|

7.01

|

6.15

|

|

|

Depletion

(2)

|

9.69

|

10.51

|

|

|

|

|

(1)

|

Includes

transportation cost, production cost and ad valorem taxes (excluding rent

export tax).

|

|

(2)

|

Represents

depletion of oil and gas properties

only.

|

|

|

•

|

a

35% increase in rent expense from renting special equipment, apartments

and additional vehicles;

|

|

•

|

a

32% increase in payroll and related costs as we hired additional

administrative personnel to fulfill business needs, increased employee pay

rates for existing employees;

|

|

|

|

•

|

a

30% increase in professional services resulting from legal fees incurred

in our ongoing litigation.

|

|

Year

ended

|

Year

ended

|

Year

ended

|

|||

|

March

31,

|

March

31,

|

March

31,

|

|||

|

2010

|

2009

|

2008

|

|||

|

Net

cash provided by operating activities

|

$

14,094,980

|

$

53,383,138

|

$

49,981,194

|

||

|

Net

cash used in investing activities

|

$

(11,410,131)

|

$

(63,916,431)

|

$ (101,454,730)

|

||

|

Net

cash (used in)/provided by financing activities

|

$

(3,000,000)

|

$

50,001

|

$

56,539,433

|

||

|

NET

CHANGE IN CASH AND CASH EQUIVALENTS

|

$

(315,151)

|

$

(10,483,292)

|

$

5,065,897

|

|

Payments

Due By Period

|

|||||

|

Contractual

obligations

|

Total

|

Less

than 1 year

|

2-3

years

|

4-5

years

|

After

5 years

|

|

Capital

Expenditure Commitment(1)

|

$ 54,973,000

|

$ 19,618,000

|

$ 35,355,000

|

$ -

|

$ -

|

|

Due

to the Government of

the

Republic of Kazakhstan(2)

|

17,141,956

|

250,000

|

592,924

|

3,343,391

|

12,955,641

|

|

Liquidation

Fund

|

4,712,345

|

-

|

4,712,345

|

-

|

-

|

|

Convertible

Notes with Interest(3)

|

71,823,785

|

3,000,000

|

68,823,785

|

-

|

-

|

|

Total

|

$ 148,651,086

|

$ 22,868,000

|

$ 109,484,054

|

$ 3,343,391

|

$

12,955,641

|

|

(1)

|

Under

the terms of our subsurface exploration contract we are required to spend

a total of $55 million in exploration activities on our properties,

including a minimum of $12.8 million by January 2011, $27.3 million by

January 2012 and $14.9 million by January 2013. The rules of

the MOG provide a process whereby capital expenditures in excess of the

minimum required expenditure in any period may be carried forward to meet

the minimum obligations of future periods. Our capital

expenditures in prior periods have exceeded our minimum required

expenditures by more than $200

million.

|

|

(2)

|

In

connection with our acquisition of the oil and gas contract covering the

ADE Block, the Southeast Block and the Northwest Block, we are required to

repay the ROK for historical costs incurred by it in undertaking

geological and geophysical studies and infrastructure

improvements. Our repayment obligation for the ADE Block is

$5,994,200, for the Southeast Block is $5,350,680 and our repayment

obligation for the Northwest Block is $5,372,076. The terms of

repayment of these obligations, however, will not be determined until such

time as we apply for and are granted commercial production rights by the

ROK. Should we decide not to pursue commercial production

rights, we can relinquish the ADE Block, the Southeast Block and/or the

Northwest Block to the ROK in satisfaction of their associated

obligations. The recent addenda to our exploration contract which granted

us with the extension of exploration period and the rights to the

Northwest Block also require us to:

|

|

·

|

make

additional payments to the liquidation fund, stipulated by the

Contract;

|

|

·

|

make

a one-time payment in the amount of $200,000 to the Astana Fund by the end

of 2010; and

|

|

·

|

make

annual payments to social projects of the Mangistau Oblast in the amount

of $100,000 from 2010 to 2012.

|

|

(3)

|

On

July 16, 2007 the Company completed the private placement of $60 million

in principal amount of 5.0% convertible senior notes due 2012 (“Notes”).

The Notes carry a 5% coupon and have a yield to maturity of

6.25%. Interest will be paid at a rate of 5.0% per annum on the

principal amount, payable semiannually. The Notes are callable

and subject to early redemption in July 2010. Unless previously

redeemed, converted or purchased and cancelled, the Notes will be redeemed

by the Company at a price equal to 107.2% of the principal amount thereof

on July 13, 2012. The Notes constitute direct, unsubordinated and

unsecured, interest bearing obligations of the Company. For

additional details regarding the terms of the Notes, see Note 11 – Convertible Notes

Payable to the notes to our consolidated financial

statements.

|

|

|

a)

|

the

present value of estimated future net revenues computed by applying

current prices of oil and gas reserves to estimated future production of

proved oil and gas reserves, less estimated future expenditures (based on

current costs) to be incurred in developing and producing the proved

reserves computed using a discount factor of ten percent and assuming

continuation of existing economic

conditions;

|

|

|

b)

|

plus

the cost of properties not being

amortized;

|

|

|

c)

|

plus

the lower of cost or estimated fair value of unproven properties included

in the costs being amortized;

|

|

|

d)

|

less

income tax effects related to differences between the book and tax basis

of the properties.

|

|

Average

Price

Per

Barrel

|

Barrels

of Oil Sold

|

Approximate

Revenue from Oil Sold

(in

thousands)

|

Reduction

in

Revenue

(in

thousands)

|

|||||

|

Actual

sales for the year ended March 31, 2010

|

$55.281

|

1,036,070

|

$57,275

|

|||||

|

Assuming

a $5.00 per barrel reduction in average price per barrel

|

$50.281

|

1,036,070

|

$52,094

|

$

5,181

|

||||

|

Assuming

a $10.00 per barrel reduction in average price per barrel

|

$45.281

|

1,036,070

|

$46,914

|

$10,361

|

|

•

|

pertain

to the maintenance of records that, in reasonable detail, accurately and

fairly reflect the transactions and dispositions of the assets of the

Company;

|

|

•

|

provide

reasonable assurance that transactions are recorded as necessary to permit

preparation of financial statements in accordance with generally accepted

accounting principles, and that receipts and expenditures of the Company

are being made only in accordance with authorizations of management and

directors of the Company; and

|

|

•

|

provide

reasonable assurance regarding prevention or timely detection of

unauthorized acquisition, use or disposition of the Company’s assets that

could have a material effect on the financial

statements.

|

|

HANSEN, BARNETT & MAXWELL,

P.C.

|

|

|

A

Professional Corporation

|

|

|

CERTIFIED

PUBLIC ACCOUNTANTS

|

|

|

5

Triad Center, Suite 750

|

|

|

Salt

Lake City, UT 84180-1128

|

|

|

Phone:

(801) 532-2200

|

|

|

Fax:

(801) 532-7944

|

|

|

www.hbmcpas.com

|

|

Name

of Director or

Executive

Officer

|

Age

|

Positions

with

the

Company

|

Director

Since

|

Officer

Since

|

||||

|

Gamal

Kulumbetov

|

34

|

Chief

Executive Officer

|

August

2007

|

|||||

|

Askar

Tashtitov

|

31

|

President

and Director

|

May

2008

|

May

2006

|

||||

|

Evgeniy

Ler

|

27

|

Chief

Financial Officer

|

April

2009

|

|||||

|

Anuarbek

Baimoldin

|

32

|

Chief

Operating Officer

|

April

2009

|

|||||

|

Boris

Cherdabayev

|

56

|

Chairman

of the Board of Directors

|

November

2003

|

|||||

|

Jason

Kerr

|

39

|

Independent

Director

|

May

2008

|

|||||

|

Troy

Nilson

|

44

|

Independent

Director

|

December

2004

|

|||||

|

Daymon

Smith

|

32

|

Independent

Director

|

September

2009

|

|||||

|

Leonard

Stillman

|

67

|

Independent

Director

|

October

2006

|

|||||

|

Valery

Tolkachev

|

44

|

Independent

Director

|

December

2003

|

|

(i) Acting

as a futures commission merchant, introducing broker, commodity trading

advisor, commodity poll operator, floor broker, leverage transaction

merchant, and other person regulated by the Commodity Futures Trading

Commission (“CFTC”), or an

associated person of any of the foregoing, or as an investment adviser,

underwriter, broker or dealer in securities, or as an affiliate person,

director or employee of any investment company, bank savings and loan

association or insurance company, or engaging in or continuing any conduct

or practice in connection with such activity;

|

|

|

(ii) Engaging

in any type of business practice; or

|

|

|

(iii)

Engaging in any activity in connection with the purchase or sale of any

security or commodity or in connection with any violation of Federal or

State securities laws or Federal commodities

laws.

|

|

(i) Any

Federal or State securities or commodities law or regulations;

or

|

|

|

(ii)

Any law or regulation prohibiting mail or wire fraud or fraud in

connection with any business entity;

or

|

|

●

|

assist

the board in the selection, review and oversight of our independent

registered public accounting firm;

|

|

|

|

●

|

approve

all audit, review and attest services provided by the independent

registered public accounting firm;

|

|

|

●

|

assess

the integrity of our reporting practices and evaluate of our internal

controls and accounting procedures; and

|

|

|

●

|

resolve

disagreements between management and the independent registered public

accountants regarding financial

reporting.

|

|

●

|

attract,

retain and motivate skilled and knowledgeable executive

talent;

|

||

|

●

|

ensure

that executive compensation is aligned with our corporate strategies and

business objectives;

|

||

|

●

|

promote

the achievement of key strategic and financial performance measures by

linking short-term and long-term cash and equity incentives to the

achievement of measurable corporate and individual performance goals;

and

|

||

|

●

|

align

executives’ incentives with the creation of stockholder

value.

|

|

●

|

base

salaries;

|

||

|

●

|

nonequity

incentive compensation;

|

||

|

●

|

bonuses;

|

||

|

●

|

equity

incentive awards; and

|

||

|

●

|

benefits

and other compensation.

|

|

Name

and

Principal

Position

|

Year

|

Salary

($)

|

Bonus

($)

|

Stock

Awards(4)

($)

|

All

Other

Compen-

sation ($)

|

Total

($)

|

|

Boris Cherdabayev

|

2010

|

192,000

|

-0-

|

319,200

|

59,309

|

570,509

|

|

Chairman

|

2009

|

228,000

|

20,000

|

1,659,000

|

67,054

|

1,974,054

|

|

2008

|

263,184

|

20,000

|

-0-

|

73,123

|

356,307

|

|

|

Gamal

Kulumbetov

|

2010

|

96,873

|

-0-

|

91,200

|

31,448

|

219,521

|

|

CEO

|

2009

|

147,581

|

13,000

|

553,000

|

48,705

|

762,286

|

|

2008

|

148,066

|

10,000

|

-0-

|

48,162

|

206,228

|

|

|

Evgeny

Ler

|

2010

|

89,309

|

-0-

|

125,400

|

29,927

|

244,636

|

|

CFO(1)

|

2009

|

73,117

|

5,000

|

442,400

|

30,762

|

551,279

|

|

2008

|

59,773

|

5,000

|

-0-

|

28,145

|

92,918

|

|

|

Leonard

Stillman

|

2010

|

4,500

|

-0-

|

-0-

|

38,351

|

42,851

|

|

Former

Interim

|

2009

|

138,290

|

-0-

|

-0-

|

9,547

|

147,837

|

|

CFO(2)

|

2008

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

|

Askar

Tashtitov

|

2010

|

115,200

|

-0-

|

262,200

|

37,417

|

414,817

|

|

President

|

2009

|

130,255

|

10,000

|

774,200

|

44,570

|

959,025

|

|

2008

|

138,153

|

10,000

|

-0-

|

44,292

|

192,445

|

|

|

Toleush

Tolmakov

|

2010

|

108,473

|

-0-

|

245,100

|

27,608

|

381,181

|

|

General

Director of

|

2009

|

127,841

|

-0-

|

829,500

|

32,550

|

989,891

|

|

Emir

Oil LLP

|

2008

|

137,508

|

-0-

|

-0-

|

27,580

|

165,088

|

|

Anuarbek

Baimoldin

|

2010

|

84,731

|

-0-

|

22,800

|

29,869

|

137,400

|

|

COO(3)

|

2009

|

60,000

|

5,000

|

-0-

|

21,081

|

86,081

|

|

2008

|

27,273

|

5,000

|

-0-

|

10,519

|

42,792

|

|

(1)

|

In